The month-end close process: Most finance teams find this vital function taxing and time-consuming owing to its lengthy workflows and error-prone nature. Yet, ensuring the month-end close tasks are completed promptly and accurately is critical to your business’s financial health and growth prospects. That’s because timely month-end close avoids delayed financial reporting, compliance risks, poor cash flow visibility, and erosion of investor confidence. But how do you conduct the balancing act and ensure accuracy while completing month-end close on time?

The answer lies in implementing the right strategies for your month end close tasks and ensuring you follow the month-end close best practices. This guide highlights seven proven ways to introduce efficiency and save time on month-end close. Read along to close your books faster and more accurately.

What is the month-end close process?

The month-end close process includes the sum of all accounting and financial reconciliation activities that businesses need to perform at the end of each month. These activities are primarily centred around ensuring that the business’s financial transactions, such as revenues, expenses, and liabilities, are accurately recorded before they’re used in preparing the business’s financial reports.

When the month-end close is well-executed in a timely manner, it helps the business get a clear picture of its operations from a financial viewpoint at the right time. This intel helps the company’s leadership manage cash flow efficiently, comply with regulatory requirements, and make strategic decisions that drive business growth. At the same time, it helps ensure consistent audit and compliance documentation.

What are the key tasks in the month-end close process?

While different companies may have their month-end close tasks based on their business intricacies, the essential elements of the month-end close process are pretty standard and include:

- Recording voucher and journal entries and ensuring the different financial transactions are accurately categorized.

- Reconciling different accounts such as bank statements, invoices, and receipts.

- Examining inter-company trades

- Reviewing revenue and expenses and ensuring they’re accurate with no missing transactions.

- Closing sub-ledgers and finalizing the accounts for accounts payable (AP), accounts receivable (AR), and inventory.

- Generating financial reports such as the profit & loss statement, balance sheet, and cash flow reports to get a clearer business picture

- Gaining approvals and signoffs after securing final review from management.

While these tasks may seem straightforward at the onset, executing them on time with complete accuracy can be a challenge.

What are the bottlenecks that teams face while implementing month-end close tasks?

The most familiar challenges that finance teams face concerning the smooth and timely execution of month-end close tasks include:

1. Outdated manual workflows

Despite the remarkable applications of tech in finance, most companies still rely on legacy approaches. They record financial data manually to track expenses, reconcile supplier accounts, and compile financial reports. According to a research study, 66% of UK finance departments depend on Excel spreadsheets.

Reliance on manual approaches for tasks presents several challenges. Firstly, compiling financial data from various sources becomes a time-consuming affair. It involves dependency on several stakeholders (sometimes across departments) and can delay the entire close, leading to missed deadlines. Furthermore, manually recording data is also prone to human error. For example, misplacing a single decimal or an incorrect formula is common when recording a considerable number of transactions. This sometimes creates discrepancies that can take hours to track down. According to a study, accounting errors have risen by 30% over the past few years due to a shortage of expert staff.

2. Lack of real-time visibility

Finance teams also struggle dealing with the fragmentation of financial data across their organisations. Most teams’ financial data is spread across multiple platforms, such as ERP systems, banking portals, procurement tools, and spreadsheets. When these systems operate in silos, getting a real-time picture of the company’s financial position becomes tricky. Oversight gets even messier in organizations where there are thousands of transactions.

As a result, teams end up having to spend a lot of time gathering data from various sources to find specific details, making the entire process cumbersome. In case there are errors, tracking them is quite challenging in siloed systems. Without real time visibility, decision-makers cannot access up-to-date spending insights. The organization’s budget control gets derailed. In addition, ensuring timely and accurate compliance also becomes challenging.

3. Difficulties and delays in getting approvals

When managers across different departments have to review and sign off on transactions manually, expense approval processes become lengthy and delayed. Approvals become even slower in larger organizations that have multiple authorization levels. In such situations, tracking and verifying receipts and accounting cumulatively turn into a taxing nightmare during the month end closing process.

When expenses are not accounted for in a timely manner, there is the risk of inaccuracies in cash flow. Furthermore, the closing of books gets reasonably delayed as finance teams wait for their outstanding approvals. This process also becomes frustrating and stressful for those who need to chase down details.

4. Last-minute adjustments & reconciliation issues

Sometimes, account discrepancies are discovered only at the end of the month during the close process. When this happens, finance teams rush to make last-minute adjustments to fix incorrect entries, chase missing invoices, or reallocate expenses for accurate financial statements. This increases the team’s stress and pressure as they scramble to correct errors. If these adjustments are rushed, there’s a higher risk of mistakes.

The answer to all these teething troubles lies in standardizing the month end close workflows and introducing efficiency with digital transformation. Let’s look at some of the best practices you can implement in that respect.

Here are 7 month-end close best practices to follow

1. Crystallize and standardize the close process

While this may sound obvious, implementing a straightforward, standardized month-end close practice is a wonderful way to streamline it. It starts with ensuring that all finance team members clearly understand their roles, are accountable, and know precisely how to approach their schedule. In other words, they know their deadlines and responsibilities and are well-trained in carrying them out with standardised month-end closing procedures.

Creating and running through a month-end close checklist is a fantastic way to ensure consistency and accountability and minimise delays.

Here’s an example of a month-end close checklist:

- Ensure all transactions are recorded and categorized accurately.

- Reconcile bank and credit card statements.

- Approve and finalize expenses.

- Close accounts payable and receivable.

- Review and adjust financial statements.

- Submit for approval.

2. Automate tasks wherever possible

Since manual data entry is time-consuming and error-prone, automating routine accounting tasks offers an excellent way to save hours on month-end close and eliminate a mountain of tedious paperwork. According to research from the McKinsey Global Institute, 40% of finance functions, such as cash disbursement, revenue management, and general accounting and operations, can be fully automated, and another 17% can be mostly automated.

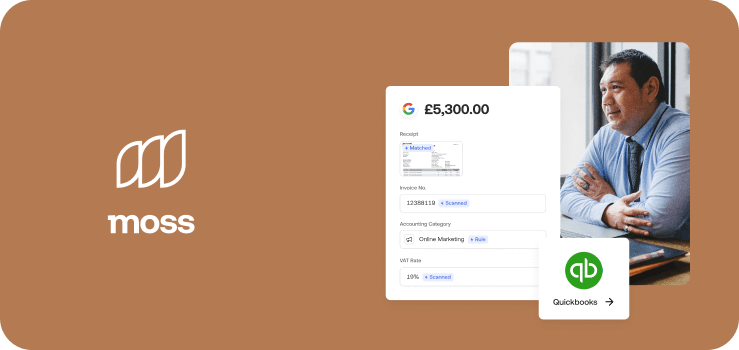

Let’s take the example of an AI-enabled tool like Moss’s accounts payable in helping simplify tracking expenses and getting approvals. It helps automate a significant part of the AP workflow. Using it, you can trim down the need to carry out approval follow-ups manually. It automates and prevents spending surprises by enabling intelligent, layered approvals and transparent audit trails. The technology also automatically pulls transaction details from invoices accurately through OCR and AI. The system further records and codes the data for card transactions, supplier invoices, and employee reimbursements. Paying these invoices (even in bulk) is also possible from within the system without making the payments manually. All of this automation speeds up the monthly close remarkably.

Interestingly, Snocks followed this approach and was able to cut its month-end close time by 70%. Previously, they took over a month to finish their month-end closing tasks, which has now come down to under eight days. Read Snocks’ success story using automation here.

3. Improve centralization with integrations

Alongside automation, integrating financial systems enables excellent collaboration across departments and helps speed up month-end closing tasks. Technology makes this centralization possible. Using the right platforms like Moss, you can integrate your existing accounting software or ERP, ensuring that your spending data is always up-to-date and accurate. The platform supports the automated sync of your expense accounts, VAT rates, and more and even categorizes spending, eliminating a large part of the manual labour. You can also export all payment and purchase data to your general ledger to further ease the effort.

This is exactly what Orderly did. With a consolidated tech stack, they’ve been saving seven admin days a month. Find out more about their story here.

4. Proactively close as you go

Another excellent approach to month-end close efficiency is adopting a continuous close approach. In other words, instead of waiting until the end of the month, make it a point to review and reconcile your transactions regularly. This will help you avoid the last-minute crunch and prevent discrepancies that can take hours to resolve. For instance, instead of reconciling bank accounts at the end of the month, you can do it every week. Similarly, you can encourage different departments to submit expenses or invoices daily to speed up the month-end close.

5. Leverage real-time financial data

Instead of relying on outdated reports, a better approach to follow is extensively using real-time financial insights around expenses and cash flow. This is possible by implementing centralized platforms that help in tracking these. Real time knowledge presents the advantage to stay on top of costs and control them, irrespective of the transaction, without waiting for monthly reports. Access to this information helps to make informed business decisions. Moreover, it aids accuracy and speeds up the monthly close.

6. Work on continuous improvement

As you conduct your routine month-end closing workflow, make notes of any roadblocks or problems you regularly encounter. For instance, let’s say you figure out there’s a problem with employee reimbursements. They’re delayed and this also delays the month-end close. A closer look tells you this is because of the missing receipts the finance team has to track and the unstructured workflows.

With clarity on the exact issues, finding a more practical solution is more manageable. This is precisely what Demodesk did, and with the right technological interventions, they could increase their spend visibility by 100% and save three days a month in pre accounting.

7. Prioritize accuracy over speed

Lastly, while you work on improving speed and save time on month end close tasks, prioritize accuracy to win the long-term race. You don’t want to rush through, make mistakes, only to find them out later.

The most common mistakes that often trip up the month-end close for most teams include misclassifying expenses or revenue, late or inaccurate revenue recognition, wrong calculations or entries, and inadequate reviews. If you end up making these mistakes, the time that would go into correcting the inaccuracies can be crippling and defeat all your initial head start. So, prioritize accuracy!

Ready to improve your month end close workflow?

Month-end closing is a critical function that finalizes and wraps up financial activities for the previous month. For most companies, reviewing, documenting, and reconciling every financial transaction from the previous month can be a cumbersome and stressful nightmare.

Thankfully, modern technology offers much respite and can significantly simplify the process. By implementing best practices, automation, and spend management solutions, you can streamline your workflows, reduce errors, and gain real-time financial visibility.

Think about your existing workflows: Are you operating with all your might and efficiency? If not, it’s time to speed up your month-end close and reduce the hassle.

Moss offers excellent automated spend tracking, expense approvals, and real-time financial insights. Our industry-leading corporate cards and expense management solutions have helped leading companies across Europe save time, control costs, and gain control over their finances, with a 47% increase in team efficiency. Contact us to book an intro.

FAQs

Yes, the exact month-end close process differs across companies. The difference primarily depends on factors such as their company size, industry, and financial processes.

While the exact tasks vary in different companies, the common elements in the month end close across all companies include recording journal entries, reconciliations of accounts, reviews of revenue and expenses, getting approvals and working on financial reporting.

An inefficient month-end close commonly leads to accounting errors, compliance risks, and cash flow visibility issues. Cumulatively, these also delay the month-end close.

Typically, the finance team performs the month-end closing tasks. They often collaborate with the accounting, procurement, and department heads responsible for approving expenses.

There’s no standard duration for a month-end close process that applies to all companies, and it varies. However, it has been seen that with automation, businesses are able to significantly reduce their month-end close duration.