As we’ve embraced a mobile-first, digital way of shopping, a host of technologies have sprung up to help make our online shopping experience as easy and seamless as possible. One of these is virtual card payments. In just a few years there’s been a huge increase in adoption among consumers and businesses. In fact, by 2026, the total value of virtual card payments is expected to hit a staggering $6.8 trillion worldwide (Juniper Research).

But what are virtual card payments? How do they work? And what benefits do they offer compared to conventional card payments?

In this guide we’ll explain all there is to know about virtual card payments, and provide some context that will help you decide if they’re right for you, whether you’re a consumer or a business.

What are virtual card payments?

First, we need to understand the difference between physical cards, digital cards and virtual cards. They all use the same underlying tech, but there are some important distinctions.

Normal cards provide a physical copy of the information you need to complete a transaction. This includes your card number, CVC or security code, card expiry date and cardholder name. Most modern cards use chip and PIN to verify your identity when you pay in-person.

Digital cards are simply a digital copy of your physical card. The card number, CVC, etc. are all exactly the same, but they’re stored on your phone in a digital wallet, like Apple Wallet. Instead of chip and PIN, you use NFC and a passcode, fingerprint or your face to verify a payment through a digital payment app, e.g. Apple Pay.

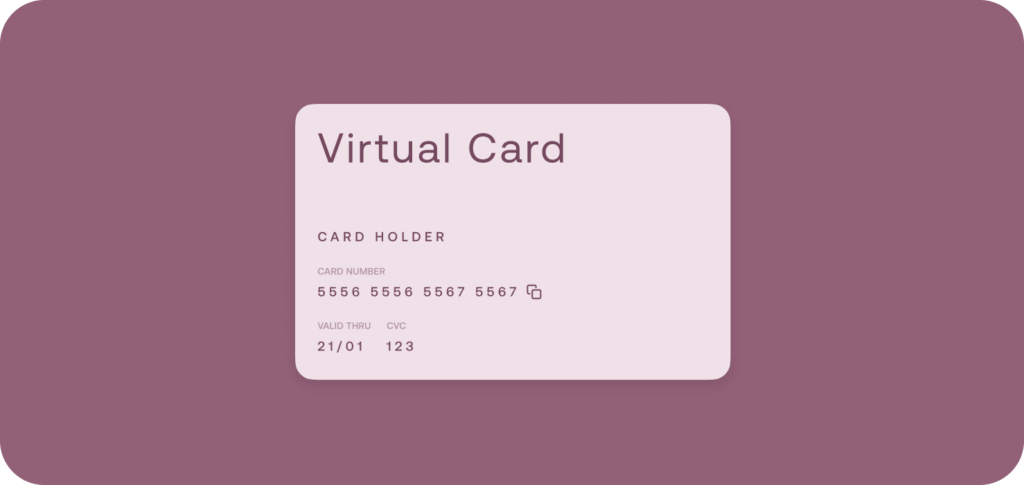

Virtual cards are slightly different. They’re also stored in a digital wallet, but they have no corresponding physical copy like digital cards do. Instead they’re issued digitally with a unique random card number that’s linked to software.

Virtual cards are intended, by design, to be temporary. Your normal debit or credit card will usually be valid for three or four years. But virtual cards can be set with custom expiry dates. This helps increase security and reduce the risk of losing money to theft or a data breach. Even if a hacker does manage to obtain your card details, you can simply block the card on your phone.

How do virtual card payments work?

Virtual card payments work in exactly the same way as normal digital card payments. You don’t need to worry about learning new processes as a user. Simply add your virtual card details to your digital wallet and you’re ready to pay online or in-store via NFC.

It’s important to remember that you can only use virtual cards in-store if you’re paying somewhere that accepts contactless payments. Card machines that don’t accept NFC rely on chip and PIN, which obviously won’t work if you’re using a virtual card in a digital wallet.

When it comes to virtual credit cards and virtual debit cards, the same distinctions apply as their physical counterparts.

Debit cards draw funds directly from your bank account. This means you only have access to the balance at the time of payment. If the cost of the transaction is greater than your balance, the payment will be denied.

Credit cards, on the other hand, take funds from a line of credit that has been approved by your creditor. As the credit card holder, you pay back the credited amount at a later date. This can be monthly, yearly, or sometimes even longer.

What are the benefits of virtual card payments?

Virtual cards payments provide a number of benefits that make them an attractive option for consumers and businesses. These are mostly related to convenience and security. For example:

- Virtual cards come with a much smaller risk of theft, fraud or data loss because they’re stored in encrypted digital wallets.

- They’re easy to use both online and in-store with digital wallets. You can automatically fill card details online or tap and pay with NFC.

- It’s possible to create and customise virtual cards for different purposes. You can create a one-time-use card if you’re making a purchase in a foreign country. Or create a card with a specific budget limit and expiry date to limit spending. This effectively acts like a prepaid card. If you’re a business, you can even allocate specific cards to individual people within your organisation. This makes it much easier to track budgets, spending and approvals.

- Creating new cards is quick and easy. Simply set some parameters and you’re ready to make virtual card payments as soon as you’ve issued a new card.

- They also allow businesses to streamline workflows, and save money on administrative processes. Software unifies all of your spend data to make accounting and reconciliation easier, and you can even automate outgoing subscriptions.

The backend software that powers virtual cards can bring huge value for business users. The old way of managing expenses, with a couple of company cards and physical receipts is unfit for purpose unless you’re a tiny business with a handful of employees.

Businesses any larger than this will immediately save money through streamlined processes and freed up in-house resources. On top of this, virtual card payments are much easier to monitor, giving businesses full control over their outgoing costs.

What are the drawbacks of virtual cards?

Virtual credit cards have a couple of minor drawbacks that you don’t get with conventional cards:

- They can’t be used to withdraw cash. This may be an annoyance for some but, in many cases, it acts as an additional security feature to limit misuse.

- Using a single-use or disposable card may cause issues if you’re asked to present it as proof of booking.

Despite the many security benefits offered by virtual cards, typical precautions should still apply. This includes not sharing passwords for digital wallets, using two-factor authentication (2FA) on related apps and accounts, etc.

How to accept virtual card payments

If you’re a business owner and you’re wondering whether you’re eligible to accept virtual card payments, fear not. As long as your card machine or POS can accept contactless payments, customers will be able to pay with virtual cards.

The only thing you should consider is which card networks you use to accept payments. The three major card networks (Visa, Mastercard and American Express) all offer virtual cards. But some businesses do not accept payments from one or more of these networks.

For example, certain vendors may be able to accept payments using a virtual Mastercard but not a virtual Amex card. This isn’t related to the card being virtual, it’s simply a result of that vendor not accepting American Express.

Virtual card payments in the UK

Luckily for UK customers and businesses, the UK has a well developed virtual payments market. A number of UK banks and credit providers offer virtual cards. This includes digital banks like Revolut and Monzo, as well as traditional banks like HSBC and NatWest.

Virtual cards are especially popular for B2B payments. They allow businesses to automate and isolate subscriptions for services and software licences on individual cards. Virtual card suppliers for business payments are less common, but there are plenty of options if you know what your requirements are as a business.

Moss virtual credit and debit cards

At Moss we offer corporate cards for businesses and a range of payment solutions that help our customers in the UK manage their expenses. When you open a Moss account you gain access to unlimited virtual credit cards that you can distribute among your team.

You can add your Moss corporate cards to Apple Wallet and use Apple Pay for simple, easy in-store purchases. Create single-purchase cards to limit spending, subscription cards to automate recurring payments, and even get physical Moss cards for individual employees.

You can track all transactions and virtual card payments across your account using the Moss Portal and iOS app. See exactly how much is being spent, where your money is going, and control budgets for individual employees or departments as you need. Our cards are supported by the Mastercard network, so you can pay at millions of vendors worldwide.

FAQs

Virtual card payments use temporary card information stored in a digital wallet to complete transactions. Temporary card information provides an additional layer of security to help protect your money.

Virtual card payments work in the same way as normal card payments. The only difference is the way your card information is supplied. Your virtual card number, expiry date, CVC, etc. is stored on your phone in a digital wallet.

Both forms of virtual card use temporary card information, but they fund your transactions differently. Virtual debit cards take funds directly from your bank account, while credit cards are linked to a line of credit from your credit provider.

Virtual credit cards are issued and managed using software. As soon as you’ve set your desired parameters, like spend limit, expiration date and usage permissions, your virtual card is ready to be added to your virtual wallet.

In the UK you can use a virtual Mastercard anywhere that accepts Mastercard transactions. If you want to use a virtual card in-store, the point-of-sale must also accept contactless payments.

This depends on the type of virtual card you’re using. Virtual credit cards are linked to a line of credit, so there’s no need to transfer money. Virtual debit cards are different. You choose how much money you want to add when you create the card, and you can add more money as and when you choose via your virtual card software.