Choosing the right business credit card can be a real game changer, especially for small businesses in the UK: not only does it allow them and their employees to pay anywhere in the world, but it also creates additional economic value thanks to cashback and other benefits. With modern and holistic solutions, the business credit card can do even more – and help small businesses to truly save time. Find out how in our guide.

What are business credit cards?

Anyone who runs a small business knows that it can be difficult to keep track of expenses and costs efficiently. A business credit card may help: it can be used to manage business expenses transparently – either through monthly accounting or, in the case of digital solutions, through online management in real time.

Business credit cards work in a similar way as personal credit cards. The difference is that they are not issued to an individual but to the company. This makes it easier to separate private spending from business spending, especially for small businesses and individual companies.

Depending on the credit card chosen, the company has a monthly credit line that can be used for business expenses. This increases liquidity and flexibility in everyday business. Most business credit cards also offer bonus programmes and other advantages from which small businesses in particular can benefit.

Business credit cards can only be used for business expenses. This includes not only costs for business travel, but also for equipment, stock, telephone, and internet bills. These expenses are submitted to HMRC where they can be claimed for tax. Although private and business expenses often can overlap, especially in small businesses, care should be taken to maintain a strict separation in expense management.

Advantages of business credit cards for small businesses

When we think of business credit cards, we tend to imagine larger companies that need to keep track of the expenses of several employees and teams. But small businesses can also benefit from the many advantages of a business credit card.

The advantages of a business credit card include:

- Better control over budget and finances: each transaction made with the card is recorded. At the end of the month, the accounts department receives a consolidated billing. Each credit card can be capped, so there are no unpleasant surprises at the end of the accounting period.

- Facilitate accounting: small businesses may also have several employees. In this case, a business credit card helps to account for the expenses of all employees at once instead of having to go through individual accounts of several employees. Some credit cards come with their own accounting software, which can further relieve the burden on the business.

- Separation in finances: especially in small businesses, private and business expenses can overlap. A business credit card clearly separates business and private matters. This pays off in the end, not only when it comes to tax returns.

- Liquidity and flexibility: Even if you still have to wait for customers to pay their bills, a business credit card helps your company to stay solvent. Depending on the provider, interest on the credit granted usually only accrues after 56 days when it is repaid. Thus, small businesses remain as flexible as possible even in unexpected situations.

- Increasing the credit score: small businesses often find it difficult to take out larger credits or loans because they lack a credit history. Proper and responsible use of a business credit card can raise the credit score and open up more opportunities for the business.

- No cash required: a credit card dispenses with the need to keep a cash register in the office.

- Contactless payment: business owners and their employees can make contactless payments at any checkout with an NFC-enabled credit card. Unhygienic touching of screens and keypads of ATMs is no longer necessary.

- Simplified business travel: most business credit cards are accepted internationally. It is no longer necessary to change money, as the credit card settles each expense at the current exchange rate. And depending on the provider, companies also benefit from travel discounts.

In addition, companies benefit from a number of other advantages such as cashback or bonus and membership programmes, which also depend on the respective credit card provider. However, the company should make sure to repay the granted credit in full at the scheduled time. Non-payment may lead to penalty interest or other disadvantages. In case of payment difficulties, which can affect even the best-run company, it is advisable to contact the credit institution personally.

In addition to the aforementioned benefits, the use of business credit cards can also have certain disadvantages for companies.

The disadvantages of business credit cards include:

- Misuse is not completely excluded: although each card can be capped, a company must take precautions, as in all financial matters. Theft of the credit card is also possible. In this case, the card must be blocked immediately to prevent misuse.

- The biggest advantage of credit cards can turn into a disadvantage: they are so user-friendly that a company may end up making unnecessary expensive purchases. If the credit line is not complied with on time, the company can quickly be faced with penalty interest and other measures.

- Private risks: some providers of business credit cards request a guarantee, which is often linked to the entrepreneur’s private assets. A business owner must be aware that he may be liable with his personal property if the company cannot pay the credit debt.

Every small business should thus weigh up the advantages and disadvantages of business credit cards. If the company decides on the use of a credit card, it is important to identify the most suitable card from all the providers. Small businesses have quite different needs and expenses than, for example, listed companies. The company must consider which business credit card best suits its own corporate structures.

Accepting credit cards for small businesses

If a company wants to accept credit cards as a means of payment for its services or products, it not only needs the appropriate technical equipment, but also a contract with a payment service provider – the so-called acquirer. Once the company has selected a suitable acquirer, it concludes a contract. The required hardware, such as payment terminals or devices for the tablet POS system, is then sent by post.

Companies that want to enable online payments by credit card proceed in the same way. After concluding the contract with an acquirer, the company’s online shop can accept credit card payments. Mastercard, for example, offers its own payment gateway solution for this.

Identifying the right and applying for credit cards for small businesses

Before owners of a small business enter into a partnership with a credit company and apply for a business credit card, they should answer a few questions for themselves. For example, it should be understood for what expenses or purchases the card is actually needed. This will determine the required credit line. It is equally important to determine whether and to what extent the credit card can be integrated into the existing accounting system or if an external software of the provider will be used.

The option of ordering several cards at once should be considered as well. After all, also small businesses may occupy several employees who carry out numerous individual purchases and payments. However, credit card providers are often more limited in this respect than the offer from Moss, for example. Moss grants users several business credit cards and an unlimited number of virtual credit cards without further ado.

Another question is, of course, the conditions. As a company, do you only look for the most favourable interest rate? Or is it the perks, bonus programmes and cashbacks that one wants to take advantage of? There are also big differences in the repayment terms: most providers offer interest-free loans up to 56 days, but some have other terms.

Once the company has found the right card, it must apply for it. Small businesses need to keep in mind that the turnover of a business often has an impact on the conditions. Companies in the early stages of their business or individual companies may not have the best credit score and may also be a higher risk for the banks. They must first prove their ability to repay before they can benefit from the best conditions.

Most applications nowadays can be made easily via online forms. If a company meets the bank’s requirements, it can apply. In addition to the company name and contact details, the date of establishment, turnover, and number of employees must also be provided. The countries in which the company operates must be specified as well, since the possibilities for using certain business credit cards may vary from country to country.

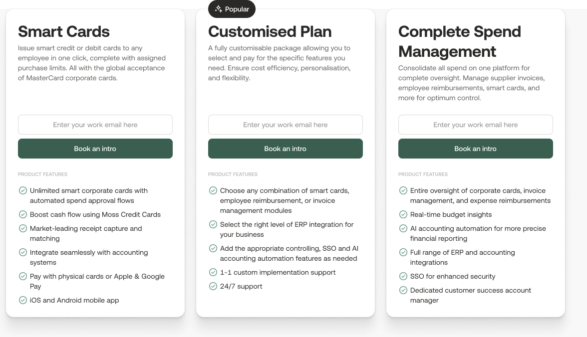

Business credit cards from Moss

For small businesses, business credit cards can be a valuable extension of their operations and make everyday business life much easier. However, it is important to be aware of the potential disadvantages. Moss business credit cards are special credit cards because they are linked to Moss digital invoice management tools. Moss offers an alternative for small businesses that want to take advantage of business credit cards without accepting disadvantages.

With classic business credit cards, it is sometimes difficult to apply for and manage various credit cards. In addition, the cost structure when applying for several cards is usually confusing: for example, do you pay per card or per account? Are there annual or monthly fees for each individual user?

Business credit cards from Moss simplify a company’s expense structure by making the issuance and management of credit cards as convenient as possible. One credit card for each employee is no problem at all. The number of virtual credit cards is even unlimited, which brings additional benefits. In this way, invoice management is streamlined and facilitated for small businesses.

Moss: expense management for small businesses

Moss business credit cards have the advantage over other corporate credit cards in that they are linked to Moss’ invoicing mangement feature. Moss offers small businesses a digital invoice management system that makes everyday business life much easier.

Small businesses focus on growth and on realizing their company vision – complicated accounting only gets in the way. For small businesses, using Moss is all about saving a huge amount of time, maximizing flexibility, and keeping a clear head for the important things. And of course, Moss can be connected to various accounting software, such as DATEV or Xero.

FAQs

Business credit cards work in the same way as regular credit cards, except that they are not issued to an individual but to a company. The business credit card is used to make business purchases and payments within a pre-determined credit line. Private expenses cannot be covered with a business credit card.

Especially for small businesses, business credit cards can offer many advantages. In addition to a better overview of expenses and simplified accounting, businesses can also benefit from bonus programmes and cashbacks. In addition, companies increase their liquidity and remain solvent even in unforeseen cases.

Besides the obvious advantages, business credit cards can also have some disadvantages. For example, the advantage of being easy to use can also turn into a disadvantage if a company makes too many purchases and cannot ensure that the credit line granted is complied with in time.

When companies want to enable the buyers of their products or services to pay by credit card, they turn to a so-called acquirer. After concluding a contract, the necessary hardware and software is made available. Whether in retail or online, companies and service providers offering credit card payments increase their turnover.

Business credit cards can also have disadvantages. The special business credit cards from Moss compensate for these disadvantages by offering a fully digital billing system in addition to the cards. This way, companies not only benefit from the advantages of business credit cards, but also from an efficient billing and accounting system.

Moss digital tools relieve the burden on administration, accounting, and staff. All expenses, whether recurring or one-off, are recorded in real time, archived, and made available for further processing. Accounting processes and financial management of small businesses are simplified and can be handled more efficiently.