They may be a nuisance, but receipts are essential for smooth transactions between vendors and buyers. They’ve been around in one form or another since people first started trading goods. And they still serve a vital purpose in business today.

Receipts act as proof of a financial transaction and, without them, businesses and customers would find it a lot more difficult to track what they’ve bought and sold. For customers, receipts are most important when it comes to returning goods, as most businesses require one to provide a refund. But receipts are also essential for accurately calculating and proving various tax liabilities, like VAT.

As you probably know, paper receipts have a nasty habit of getting lost or damaged when you need them most, or appearing out of thin air when you least expect them to. The various negatives of paper receipts have encouraged many businesses to go digital instead.

In this article we’ll explain more about digital receipts, and why they’re favoured in a range of different applications.

What are digital receipts and how do they work?

Digital receipts originated in the world of ecommerce with companies like Amazon and Apple. But they’ve become a common replacement for paper receipts in-store too. An increasing number of businesses now offer customers the option of digital receipts instead of paper receipts, while some have even gone fully digital.

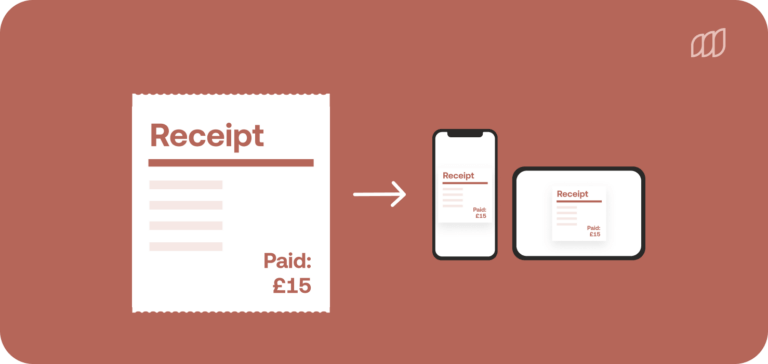

Digital receipts, also known as electronic receipts or e-receipts, contain all the information you’d typically find on a normal receipt, but in a digital format. When a customer completes a transaction the vendor generates a digital receipt. This is sent to the customer via email and a copy is stored on the business’s system as part of their digital record of transactions.

The customer can view the receipt on their phone, and the business on their computer system if it’s needed for future reference. In this sense, the receipt is only ever there when someone needs to look at it. The rest of the time it’s stored as a collection of 1s and 0s in the cloud or on your phone.

Digital receipts have also become the standard in B2B settings too, thanks to their convenience. When businesses complete a transaction they will send a digital receipt to the other party to confirm that they’ve received payment. These are known as confirmation receipts, and they’re different from invoices and the standard receipts that customers receive after paying for goods in a shop. You can learn more about the difference between invoices and receipts here.

The problem with paper receipts

Unfortunately the trusty old paper receipt has many drawbacks. Firstly, paper receipts are bad for the environment. On top of millions of trees, the receipt production process uses millions of gallons of oil and billions of gallons of water.

In the UK we use an estimated 11.2 billion paper receipts each year, or 26,000 miles of receipt paper per week. That’s a lot of wasted paper, considering most receipts are thrown straight in the bin.

Believe it or not, thermal receipt paper is also bad for our health. It’s coated with BPA and BPS, chemicals which react and change colour when exposed to heat. This paper offers quick, cheap printing in a number of everyday applications, like sales receipts. But BPA and BPS are harmful to our reproductive systems and have been linked to other conditions like obesity and ADHD.

Because these chemicals can be absorbed through the skin, handling receipts over long periods of time can have serious negative health effects. This is particularly concerning for cashiers who handle receipts every day, but it also impacts anyone who shops and touches shopping receipts regularly.

Besides their environmental and health impacts, receipts simply aren’t very practical. Thermal paper is prone to fading or discolouration over time, as anyone who’s found an old shopping receipt in their pocket knows. And they’re difficult to keep track of or handle in any kind of volume.

Why digital receipts are a much better alternative

The digital receipt has proven to be a popular alternative for shoppers. According to a survey by Green America, 89% of US shoppers would like businesses to offer them as an option at checkout. But why?

Benefits of digital receipts for customers

- They’re much easier to store and access when needed.

- They can be uploaded directly into accounting software to make tax returns quicker.

- They’re more secure as they’re protected by a password, and can’t be lost or stolen like paper receipts.

- Accepting digital receipts is faster as they’re emailed straight to you.

- They can be enhanced with personalised offers, loyalty points, media and more.

- They can be sorted and searched by category.

When it comes to the shopping experience, convenience is one of the primary factors that determines customer satisfaction. Some businesses are notorious for their excessive use of printed receipts. Take US pharmacy chain CVS for example. Their receipts are many times longer than the ones you get from other stores, unless you buy a literal boat-load of items.

Back in 2013, CVS agreed to cut the average length of its receipts by 25%, after facing criticism for unnecessary waste. Since 2016, CVS has gone one step further and offered its ExtraCare loyalty program members the option of electronic receipts instead.

Drawbacks of digital receipts

While electronic receipts have a lot of things going for them, there are still a couple of downsides that may turn customers and businesses away.

- Some businesses use them as a way to get customers’ email addresses and then bombard them with marketing emails.

- Many customers will never interact with their digital receipts unless they’re returning an item for a refund. Depending on their email settings, receipts may even go straight to their junk mail folder.

It may be tempting to use email addresses submitted for electronic receipts for email marketing campaigns instead. After all, getting mailing list sign ups can be difficult without an incentive. But it’s a big no when it comes to customer data privacy. Not to mention the fact that it can have a serious negative impact on your image and trust in your brand.

Luckily personal data is protected by the Data Protection Act (2018) in the UK and GDPR in the EU. This means you must have personal consent from the customer to send them marketing emails.

Processing digital receipts

Electronic receipts make accounting processes much quicker and more transparent for businesses. A big part of this is reimbursing expenses for employees. Many items are tax deductible, either for the employer or the employee. With a unified record of transactions and VAT via expenses receipts and invoices, it’s much easier to calculate taxes and refundable costs.

But you need software to automate most of this process. And you need to be able to generate digital receipts at the point of sale. Without a capable platform to handle your digital receipts, you’ll still have to do much of the work manually. Digital receipts allow you to gain insights into trends and flows of money into and out of your business.

It’s possible to convert your paper receipts into electronic receipts using receipt scanning software. This is especially useful for processing employee reimbursements for expenses like car mileage. Being able to scan and convert receipts into a digital format saves lots of administrative effort and makes it much easier for employees to reclaim their money.

Unlock the full potential of digital receipts with Moss

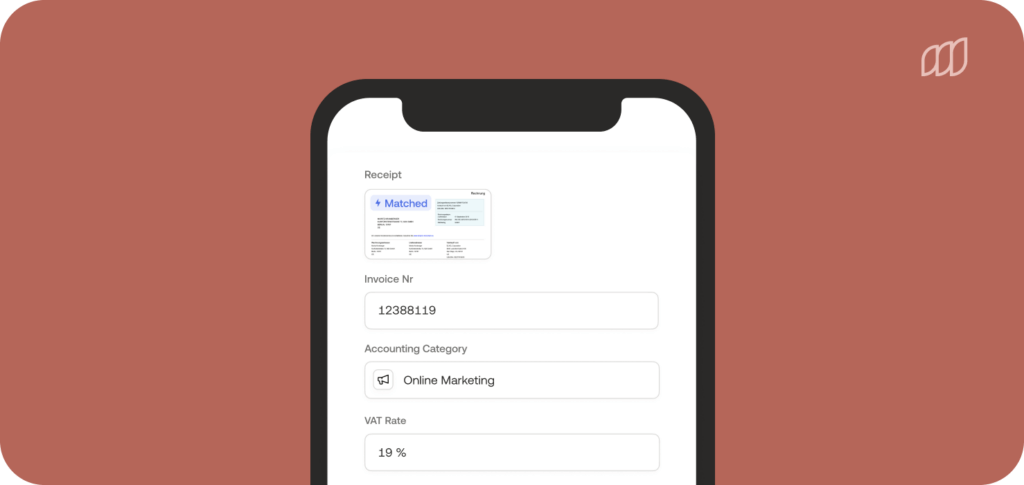

Moss’s invoice management software allows businesses to gather and process digital receipts and invoices with ease. It acts as a single repository of outgoing business expenses across all business departments when you use a Moss account. This makes it easy to gain valuable financial insights and a holistic view of where your money is being spent.

Employees can reclaim expenses with ease by scanning their receipts directly into Moss using their smartphone camera. Moss automatically extracts the relevant data from these receipts using OCR, regardless of their format. You can then review and approve each claim as needed. Set up different permissions for different roles within your organisation and track every step of the process without having to deal with a single paper receipt. Our platform also handles invoices, so you can streamline payments to suppliers and partners.

We have ready integrations with all major accounting software platforms which allow you to export receipts and expense information directly to your tax advisor. When combined with our high credit limit virtual credit cards, we offer the most powerful corporate spend solution for mid-sized businesses on the market.

FAQs

A digital receipt is an electronic version of the conventional paper receipts you receive when you buy something or make a transaction. They’re sent to customers via email and can be viewed quickly and easily on a smartphone or other device.

Digital receipts are cheaper than paper receipts, they provide a better customer experience, and they’re more effective for post-purchase marketing.

Digital receipts are much more convenient than paper receipts. They’re easier to store and retrieve when needed, and they don’t fade over time.

How businesses process digital receipts depends on whether they offer them to customers or use them in internal processes, i.e. reimbursing employee expenses. Digital receipts are created whenever a transaction is completed, and they’re processed using software.

There are many free apps that allow you to scan receipts and save them digitally. These are great for individual customers who simply want to get rid of their paper receipts. But they don’t offer much in the way of analytics. To really make the most of digital receipts, you need more advanced software that offers additional features.

If you’re a customer, many businesses now offer the option of digital receipts when you check out in-store. In many cases they’re offered on an opt-in basis, meaning customers have to choose to receive electronic receipts. If you’re a business, you can use digital receipt software or find templates online.