For many people, an expenses receipt is a piece of paper that gets crumpled up in your pocket. But in the business world it’s an important proof of purchase that can save companies, freelancers and employees lots of money. We’ve compiled a comprehensive guide with all the information surrounding expenses receipts to show you why it pays to keep track of your daily expenses.

What is an expenses receipt?

An expenses receipt, which you can also get emailed to you as a digital receipt, is a proof of purchase that customers and clients receive when paying for a product or service. It’s different from an invoice, as it not only contains information on the company that provides a service or product for sale and its price.

It also includes details on the completed payment. This includes how much was paid, and whether the transaction was made using card or cash. On top of this, it’s also important when it comes to calculating tax liabilities.

Good to know: Self-employed people like freelancers must keep receipts for five years. Limited companies are obliged to store them for six years. During that time, they may be required for an audit by HMRC (Her Majesty’s Revenue and Customs). The national tax office can check all books to rule out discrepancies and fraud. If so, companies have to provide all relevant documentation. If something is missing or seems irrelevant or false, it could possibly lead to additional tax payments, fines or prosecution for severe cases of fraud.

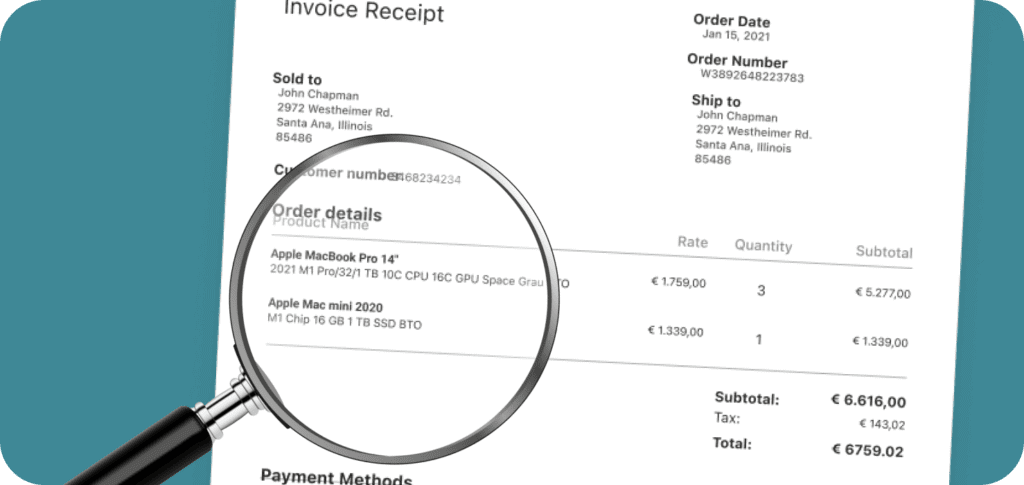

Which information does an expenses receipt contain?

The information provided on expenses receipts can vary depending on the product or service. However, it is safe to say that some information is crucial for meal expenses, gifts, travel costs, accommodation, and other typical business expenses.

When collecting expenses receipts, make sure that they include all the following information:

- the date and time of purchase

- the company name and address

- a detailed description of the product or service

- the payment amount

- VAT information

In some cases, a tax number is stated as well. Companies can also ask for the employee’s name to be added to the proof of purchase. For payments with business cards, additional card information can be useful to prove that the card has been used for a specific transaction.

What to do when you lose an expenses receipt

Losing an expenses receipt — it happens to the best of us, especially when travelling at busy times. Paper receipts can accidentally slip out of your bag or pocket, be thrown away with the rubbish, or maybe blown out of the window. Receipts are printed on thermopaper, so it’s easy to destroy them by leaving them in a hot car or spilling your morning coffee. Unfortunately, the number of different ways your expenses receipts can meet an untimely demise is practically endless.

So, many people find themselves asking the same question — can I claim expenses without a receipt? Fear not. If you can’t find the original proof of purchase, or you never received one in the first place, there still is a chance to claim your expenses.

Purchases under £25

Second-hand purchases or spontaneous transactions at food locations usually do not come with a receipt. However, it’s useful to keep track of these expenses. For purchases under £25, it’s possible to claim VAT without a receipt.

Road tolls or car parking fees are sometimes paid without being handed proof of payment. Writing down these expenses whenever they occur can save money with the upcoming tax return.

Purchases over £25

Unfortunately, it’s not possible to claim VAT when purchases cost more than £25. But it is still possible to show proof of payment via a bank statement when a card was used to pay for the expense. This can be useful for employees who have paid for business purchases and wish to be reimbursed.

In the end, it’s up to accounting and management if they will accept a bank statement without being handed a proper receipt. Using a business card to pay for the purchase definitely helps here, especially when the purchase can be backed up with further internal information.

Can I claim business expenses without a receipt?

When searching the internet for answers, it’s common to find websites that offer expenses receipt generators. Those tools let users write their own receipts by adding a company’s information, the paid amount, tax information and more. However, this service can be risky when used carelessly. In some cases it could even be used for fraud. This is the case when users claim fictitious amounts for purchases that have never been made. Of course, this is not the case when receipts are lost or damaged, but it might still become a problem for accounting when there is no original receipt to work with.

Tip: To be on the safe side, it’s best to consult the company’s accounting team or talk to a tax advisor before going forward with writing your own expenses receipts. This also applies to lost or destroyed receipts, especially when it would mean that business expenses without a receipt might cause problems with bookkeeping.

How automated processes help with expense management

There is a common rule in accounting: The simpler it is for employees to submit their receipts, the better. This is because expense claims can be a time-consuming task. Most colleagues are packed with work and lean towards more interesting tasks than inserting receipt data into spreadsheets—how could you blame them?

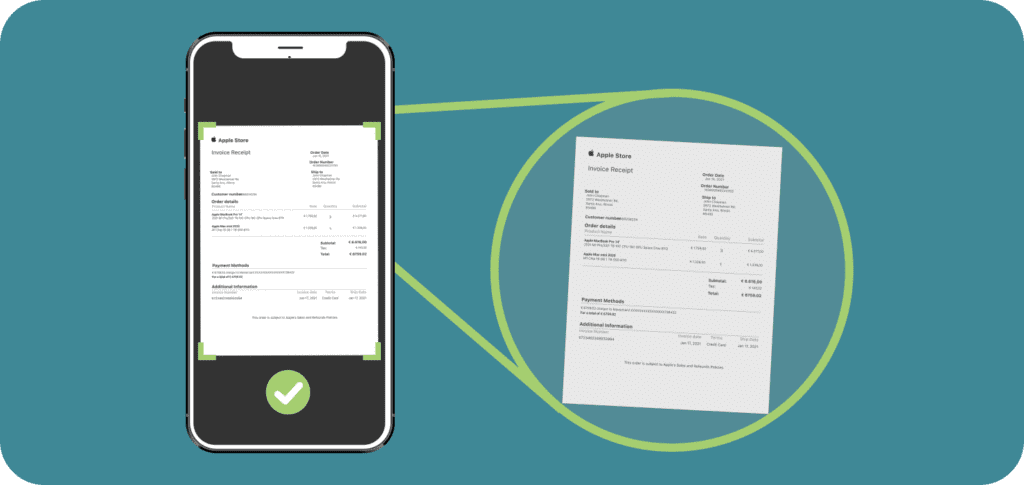

That is why OCR scanning can fix a common issue. Employees simply take a picture of their expenses receipt with their smartphone and let an app do the rest of the work. These are the main benefits for staff and accounting:

- avoids errors caused by manual data entry

- saves plenty of time for more important tasks

- losing a physical expenses receipt is not a problem anymore as there is a digital copy

- employees tend to claim more expenses in time and not forget about it

- workers can get promptly reimbursed for out-of-pocket expenses

- better company experience for employees

- real-time overview of expenses costs and better insights for managers and accounting

OCR scanning can go hand in hand with other digitisation processes and even speed up the approval of reimbursement for employees. With the help of a clever interface, the collected data can also be used with smart accounting software such as Xero.

Organising expenses receipts with Moss

We have good news: Keeping receipts in boxes and folders is a thing of the past. Nowadays, every business should switch to digital solutions. They help avoid typical problems that sooner or later occur when handling old-fashioned paper receipts. With Moss, every proof of purchase can be digitised within seconds by employees.

Whether they are on a business trip, buying supplies for the company or having lunch with a client. They can add their expenses receipts by simply scanning them with their mobile phone. Time-consuming expense reports? There’s no more hassle at the end of the month when colleagues can submit expenses directly after purchases. Out-of-pocket payments get reimbursed quicker, too, as managers can approve payment with just a few clicks.

But wait, there’s more: Moss also offers an unlimited amount of corporate cards for businesses, so that every employee can use their own physical or virtual card. Management can easily set limits or restrict use to a specific purchase. This way, even freelancers can pay for subscriptions with a company card.

The benefit of all this: Avoiding out-of-pocket expenses and dealing with expenses receipts from employees. Instead, every payment and purchase shows up neatly and transparently in your system. This is useful for checking funds in real-time, keeping an overview of departmental expenses and gaining further insights into the company’s financial status.

Which businesses can benefit from Moss?

Medium-sized companies in particular can work more efficiently when digitising their processes with Moss. Businesses with tight budgets can profit too. Automated processes can free accountants and coworkers from tedious tasks, giving them more time for evaluation, improvement and creative thinking. Reducing pressure in the workplace always pays off. Companies can see a spike in motivation and team spirit, which also has a positive effect on overall health and work availability.

Tip: We also highly recommend checking out our invoice management solutions and budget control tools. The modular approach supports start-ups and established businesses from tech, consulting, e-commerce and plenty of other business types.

FAQs

A VAT receipt for expenses is proof of purchase. Customers and clients can prove that they have paid for a specific product or service. It includes information on the VAT that has been paid so it can be considered in the upcoming tax return.

The piece of paper you receive in a supermarket, a drug store or at the petrol station is an expenses receipt. Individuals who receive them for personal purchases do not always need them, but businesses heavily rely on them as proof of purchase.

A valid expenses receipt should contain the date and time of the purchase, the business the purchase was made at and specific details on the product or service. Moreover, the paid amount has to be stated. The receipt can be on paper or come as a digital receipt.

It is always best to consult the company’s accountant or a tax advisor when an expenses receipt is missing or got destroyed. For purchases under £25, a receipt is not necessary, so there is some leverage for businesses and self-employed individuals.

Office expenses under £25 usually do not require a receipt. This is a helpful exception as many smaller purchases do not even come with a printed or digital receipt. If the issue is more complex, we recommend checking with accounting or a tax advisor.

If an employee and the company they are working for have agreed on necessary purchases or services and expenses made out of pocket, these should be reimbursed after submitting an expense report. To avoid disagreement and payment delays, it is always best to use a company card for obvious business expenses.