Accounting for a faster month-end, every time

Complete and accurate data for every card transaction, invoice and reimbursement. Automate pre-accounting with AI-powered spend categorisation. Sync directly with your accounting software for a faster month-end.

Automate error-prone admin

AI automation collects, splits, and categorises accounting data for card transactions, supplier invoices, and employee reimbursements.

Sync accounting data

Powerful two-way integrations to sync expense data, payment entries and supplier data with your accounting system.

Keep control over spend

Monitor and manage all company expenditure, approvals, and budgets in one platform. Full visibility and control for everyone who needs it.

Trusted by finance teams at Europe's leading companies

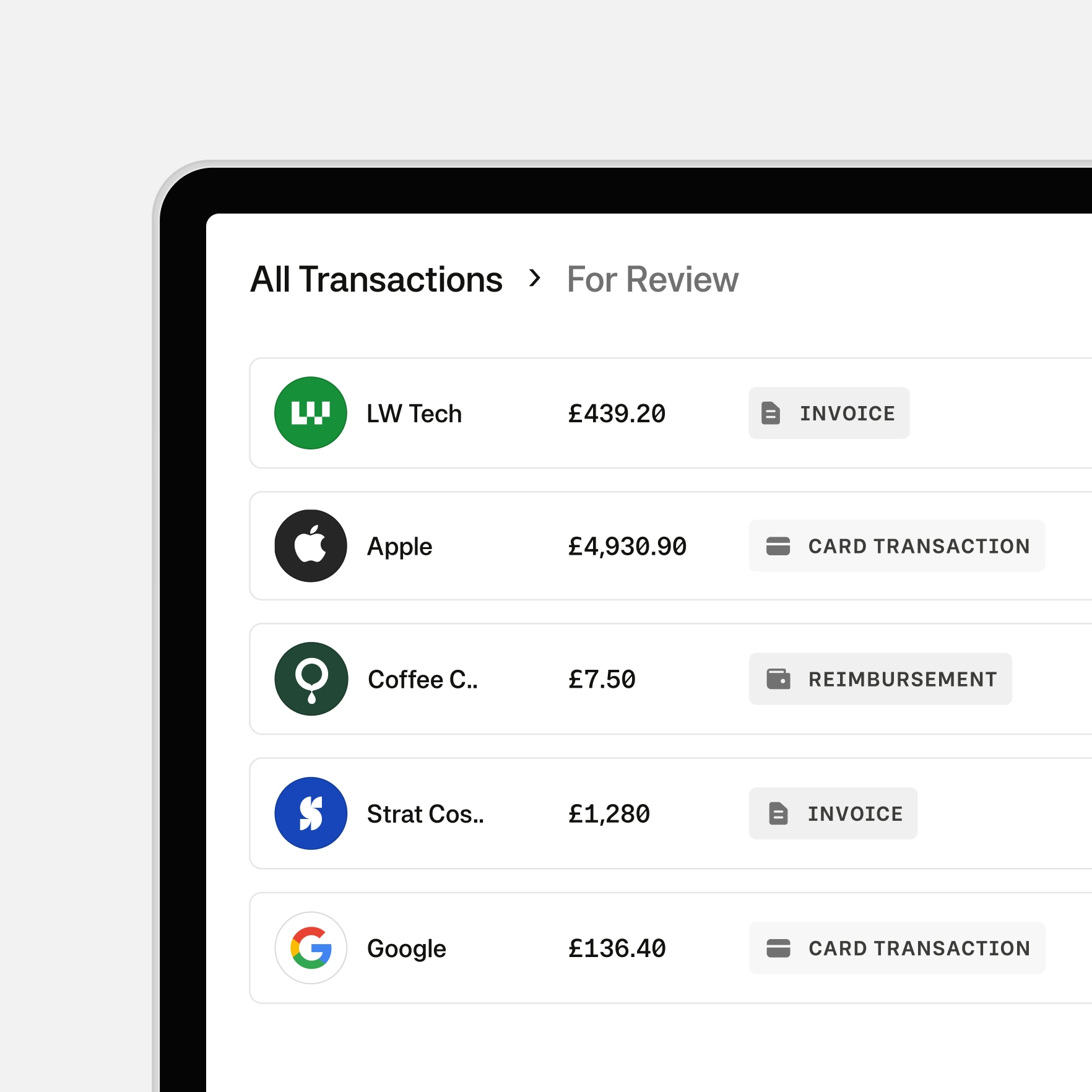

Complete, accurate spend data

Moss collects and centralises card transactions, reimbursements, suppliers invoices, and payments, all with accounting data complete and ready for review.

- Multiple ways to capture expenses, including mobile app, email, and more

- Set mandatory fields to ensure employees share required data

- Moss chases missing receipts so you don’t have to

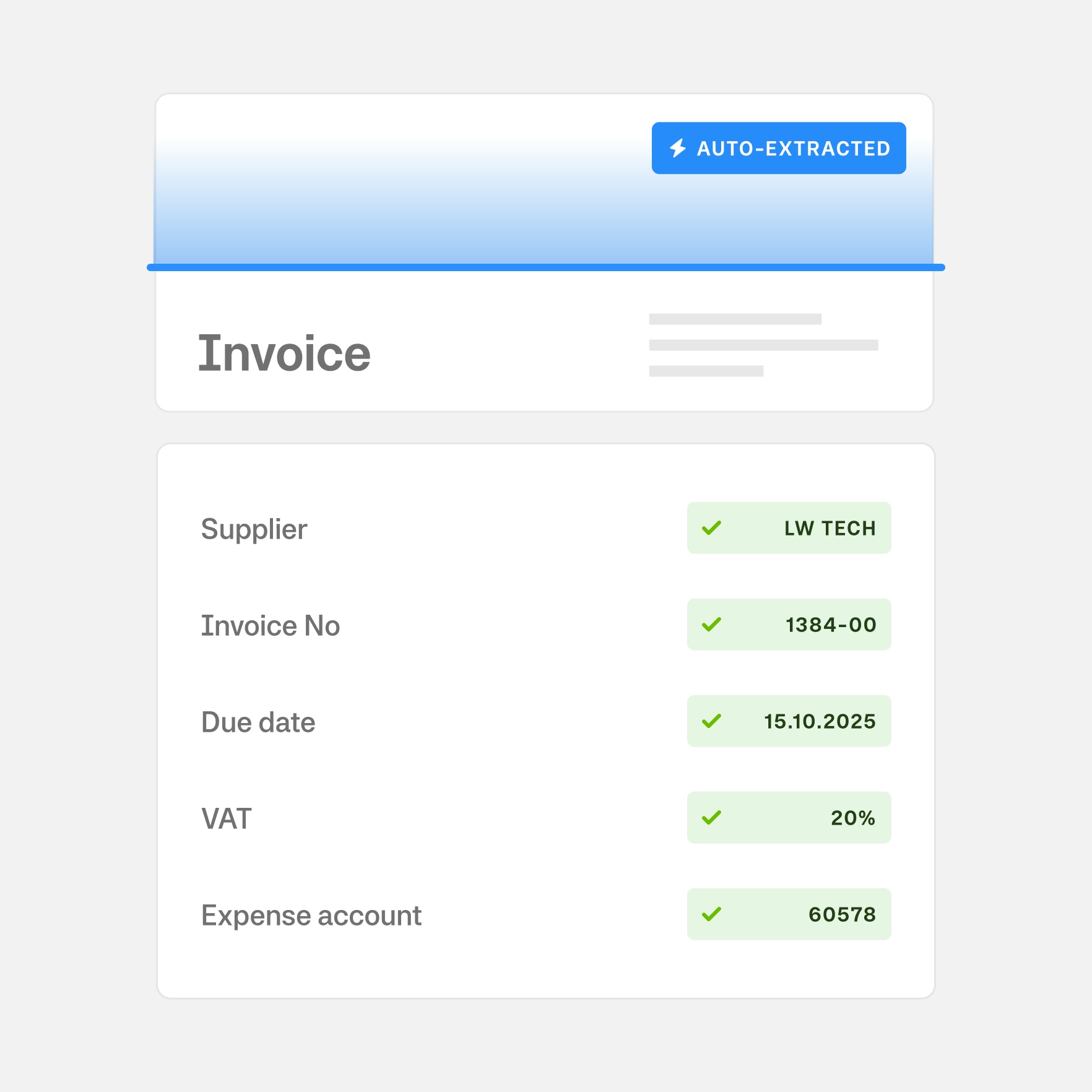

Fast transaction coding

AI-powered accounting automation completes transaction data. Reduce manual work with records automatically prepared and ready to sync with your accounting software.

- Automatically extract and split line items based on VAT rates or booking text, ensuring precise attribution to account codes, cost centres, and projects.

- Set rules and use AI automation to auto-fill account codes, suppliers, and VAT rates

- Accelerate reviews with machine learning that learns from your accounting patterns

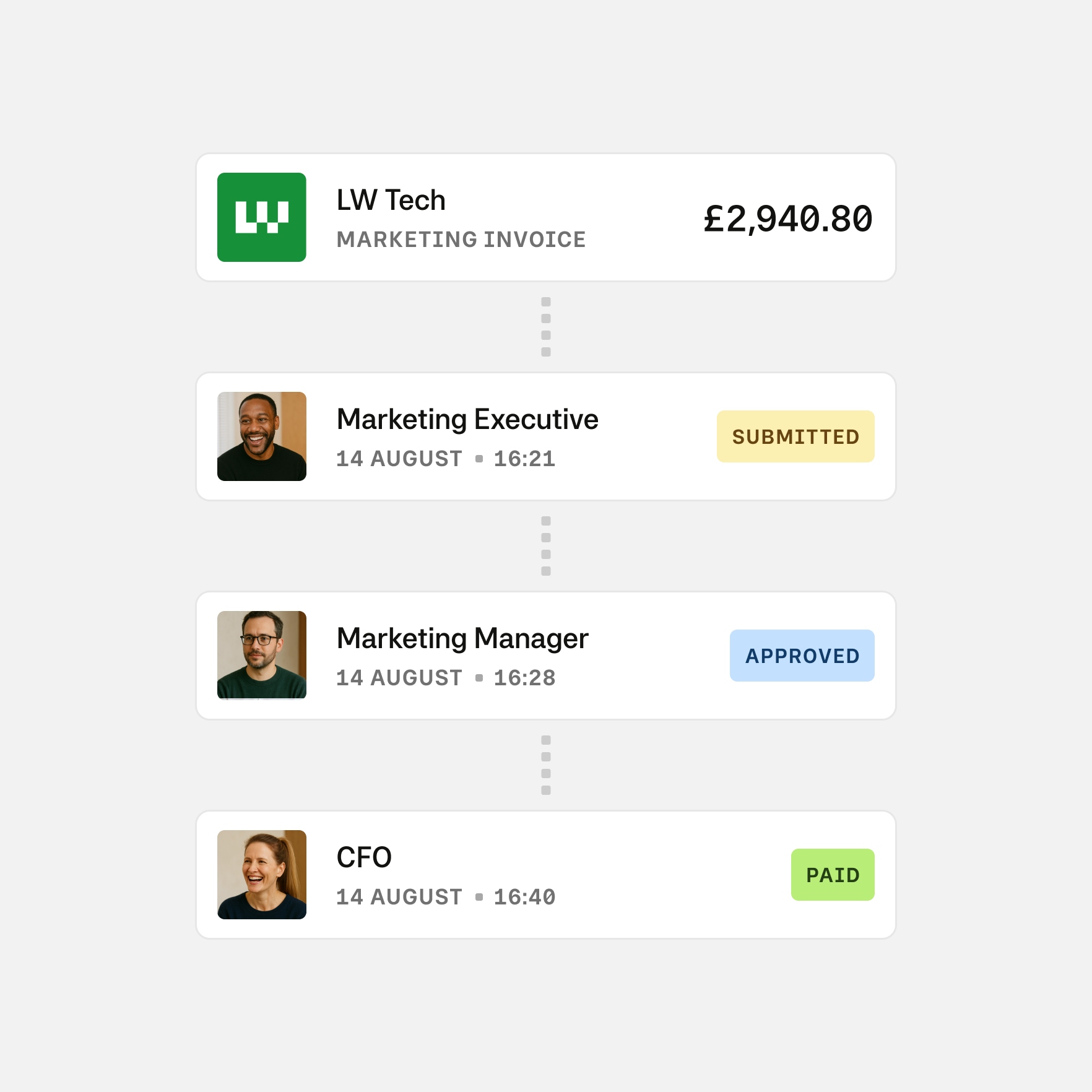

Customise to fit your accounting processes

Configure Moss to map spend data to your accounting requirements. Set mandatory fields, automate pre-paid expenses, create custom approval routing, and more.

- Add custom spend attributes and dimensions

- Set field completion rules based on user profiles

- Customisable multi-step approvals with smart routing

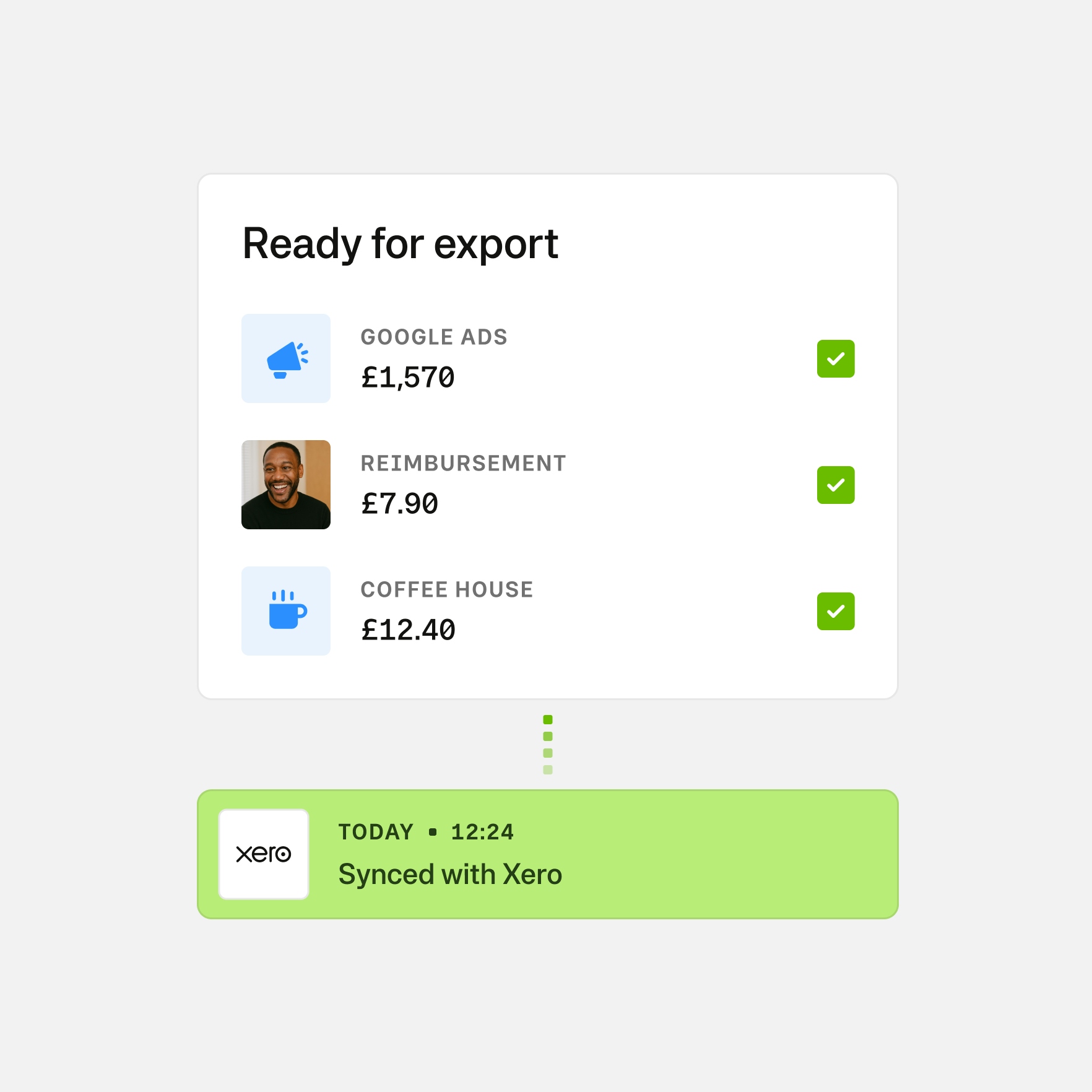

Keep your accounting records accurate and in sync

Connect Moss to your accounting software or ERP. Choose what to sync and when, with exports available via API or CSV, to supercharge your tech stack.

- Export spend and payment data on demand to fit your schedule

- Automatically reconcile paid items, reducing manual effort

- Two-way syncing keeps master data up to date

Businesses save more with Moss.

Pay as you grow

Our pricing model is unique—just like your business. Design your ideal package: start with a base like Corporate Cards, Employee Reimbursements, or Accounts Payable, enhance with add-ons like Advanced Accounting or ERP integrations, and upgrade to an integrated suite when you're ready.

Best-in-class customer service, mobile app, and all the financial integrations you need to start effectively managing your spend.

Maximise spend efficiency and control with unlimited cards, customisable limits, and automated receipt fetching.

Make submitting reimbursements quicker and easier through streamlined upload and approval, and employee payouts directly from Moss.

Streamline accounts payable flow with customisable review process, effective supplier and OCR based automation, and one-click payments.

Improve financial oversight through budget tracking, spend insights, and greater flexibility in your approval flows.

Simplify purchasing through real-time budget oversight and efficient handling of purchase requests.

Native integrations to your ERP system, including support for any controlling dimensions that your business uses.

Enhance your pre-accounting experience with AI based automation, project-specific tracking, or the setting of mandatory fields.

FAQ

Can Moss handle multiple types of financial transaction?

Absolutely! Moss is designed to handle a wide range of financial transactions, covering everything from routine business expenses to significant capital expenditures. Whether it's automating receipt collection or tracking multi-dimensional spending, Moss fully supports your financial processes within your existing framework.

How easily does Moss integrate with my existing financial software?

Moss integrations are designed to meet the specific needs of major accounting and ERP systems. The setup is secure, straightforward, and tailored to your software, ensuring accurate import of account codes, tax rates, and supplier data for a reliable workflow. Dedicated support is available as needed.

What if Moss doesn’t currently integrate with my financial software?

We’re continuously expanding our list of integrations to include more accounting and ERP systems, so your software may be added soon. In the meantime, Moss provides a robust and flexible CSV export process. Our support team will work closely with you to configure the export to suit your organisation’s needs, ensuring you can still leverage all of Moss’s features. This approach gives you complete control over what data is synced to your accounting system and when, without compromising on efficiency or functionality.

G2

4.7