Accounting is often described as both an art and a science. It combines rigorous scientific process with human creativity when interpreting tax regulations.

But in both aspects of accounting, efficiency is key for maximising business returns. As accounting has evolved, so too have the potential avenues for businesses to unlock efficiencies.

What do we mean when we talk about efficiency in accounting? There are a number of different aspects to efficiency as a whole, but it essentially boils down to minimising input (employee hours, money, etc.) and maximising output (speed and amount of work processed). This is a desirable objective for any business because it means they have to spend less money for better results.

In this article we’ll explore five ways businesses can increase efficiency in their accounting operations. Implementing just one of them could make a big difference to the effectiveness of your accounting team, and even your business as a whole.

1. Automate and digitalise wherever possible

As is the case in most industries, automation and digitalisation are arguably the two main forces of change in accounting right now. Together they have the potential to save your business amounts of time and money. While they do require investment in new technology to replace legacy systems, they offer fantastic ROI in the long run.

Even though automation and digitalisation are changing the way businesses handle their accounting workflows in terms of day-to-day tasks, accounting work itself remains effectively the same as it was 50 years ago. Conventional accounting is heavily reliant on paper records and manual book keeping. But it’s now possible to eliminate most of the workload associated with these processes.

For example many businesses are turning to digital receipts and smart invoice management systems to slash workloads. So called ‘digital accounting’ is proving its value for businesses of all sizes by replacing outdated processes with easy-to-use software alternatives.

The savings are tangible, both in monetary terms and man hours. At a time when budgets are tight and teams are looking to increase efficiency while keeping costs down, automation and digitalisation have proven to be a valuable investment. Spend management software plays a pivotal role in this digitalisation of accounting processes by integrating a number of different finance functions, including invoice management, reimbursements, payments and insights, into one system. When all of these functions can be controlled and automated from one place, businesses will quickly see the benefits of digitalisation in comparison to conventional accounting.

2. Integrate your tools

According to Statista, the average number of SaaS platforms used by worldwide increased from 16 per organisation in 2017 to 110 in 2021. Companies with 1,000 or more employees use even more, with an average of 177 (BetterCloud 2020). This huge increase is representative of the sheer number of applications for SaaS across all different sectors of a business.

This figure represents apps used by all teams, from sales to marketing. Finance teams use a small portion of this total, for example in accounting and financial planning and analysis. But data from other departments and functions within an organisation are essential for both of these processes to work as effectively as possible.

As a result, finance teams need to be able to seamlessly draw upon data from a host of software platforms with their organisation. This can be done semi-manually with custom build code and APIs to share data when needed. But, with teams now using such a high number of software platforms on average, the real answer to this problem is integrations.

What are integrations? Without getting too technical, integrations are simply established connections between separate software platforms which allow them to communicate and share data. This is facilitated by APIs, but rather than having to build a connection in-house, the connection is build, tested and approved by the software platforms themselves.

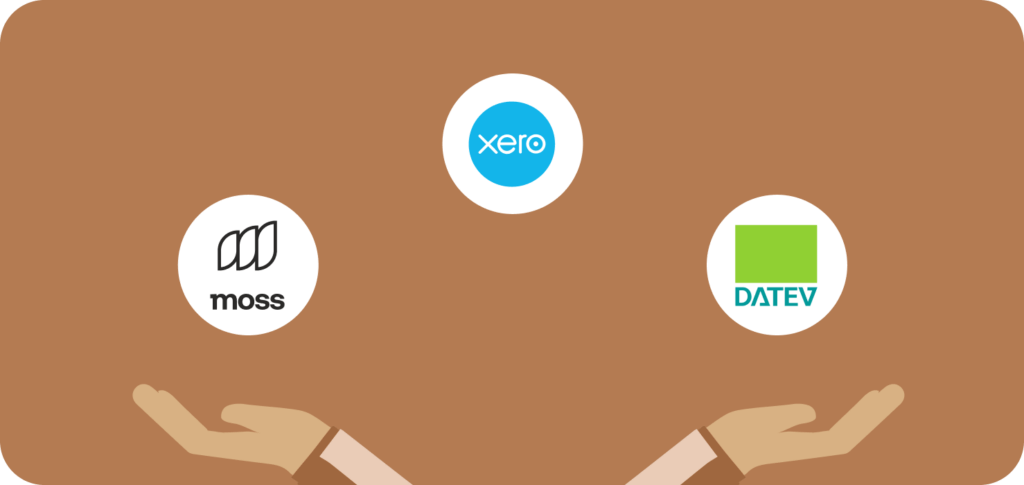

Cross-functionality is essential for efficiency in modern finance teams, as they use many different software platforms to carry out daily tasks. All accounting teams use some form of accounting software, like Xero in the UK and DATEV in Germany. For maximum efficiency, it’s essential that any other finance-related software that they use also integrates easily with their accounting software.

3. Unify spend data

Building upon the idea of integrations and sharing data between platforms, it’s also important for accounting and finance teams to have a single repository for all of their financial data. This includes spend data segregated by team, spend type, etc. as well as accounts payable commitments, budgets, operating cash flow and more.

This unified spend data makes finance teams’ jobs easier by giving them better spend visibility. Spend visibility and spend data allow businesses to develop better, more effective insights. These are important for top level executives, like the CFO, who can use them to guide strategy at the highest levels of the business.

Again, achieving this level of centralisation in your finance software stack does require some investment. You’ll need to choose the right tools for your team, and invest in a platform that allows you to make sense of your data. But the investment will pay off when it comes to allowing your teams to work effectively and save money on outdated, inefficient processes in the long run.

4. Batch processing

Batch processing is an established workflow method that is used by finance and accounting teams. It helps save time and money, particularly in accounts payable, by processing multiple transactions at once.

Transactions are grouped together in batches, with the same batch number and batch date. They are transferred from journal, to ledger, to financial statement in a linear order. Batch processing offers a number of benefits over real-time financial data entry, including:

- The ability to review and edit data before processing a batch

- Reduced workload for accounting teams because large numbers of transactions can be automated and processed together

- Greater accountability through more stringent review and peer review requirements

Batch processing is particularly popular for the closing process at the end of an accounting cycle. Because transactions are approved periodically, batch processing ensures that records and balances are always kept up to date.

Most software platforms used in accounting and finance functions offer batch processing. But some accounting teams still process invoices and transactions individually as and when they arrive. This is an inefficient way to work, so you should aim to make use of batch processing whenever possible.

5. Refine workflows

Refining strategies and processes is a fundamental part of sustainable business growth. Without adaptation, you can’t expect to stay ahead of the competition in a constantly changing environment.

This applies to practically every aspect of business, including hiring, product development, branding and lots more. Accounting, of course, is no exception. Accounting workflows can be complex and resource intensive. Even small workarounds and process refinements can save accounting teams a significant amount of time and money.

Larger businesses enlist the help of management consultants to identify and implement workflow refinements and other changes that can aid efficiency. But it’s perfectly possible, and far cheaper to use software to achieve many of the same results. Make sure each team member is aware of their responsibilities and aid them wherever possible with technology, whether that’s software, hardware or data.

Accounting efficiency ratios

Accounting ratios, also known as financial ratios, are a set of simple calculations which help determine the health of a business. While they’re not necessarily concerned with accounting efficiency, they are useful to show how well a business is generating revenue and managing its assets.

The most common accounting ratios include:

- Asset turnover ratio = total revenues / total assets

- Accounts payable turnover ratio = total purchases / average accounts payable

- Accounts receivable turnover ratio = net credit sales / average accounts receivable

How Moss helps accounting teams

Moss helps accounting teams reduce their workloads and increase their output with a range of spend management tools. Our digital invoice management module allows businesses to automate the invoicing process, with OCR invoice scanning, remote approvals and spend data updates across all accounts.

We also have accounting integrations with all major accounting software providers, including Xero and Datev, so that you can transfer all of your data directly into your company ledgers. Our software helps businesses save thousands of pounds per year in workflow reductions and additional man hours, while our corporate credit cards give them access to unlimited virtual cards and a high-limit credit line.

FAQs

There are a number of software platforms that allow businesses to automate different aspects of their daily accounting workflow. These include digital invoice management tools to smart payment cards.

Manual accounting is inefficient when it comes to using up employee hours, which also makes it more expensive. Also, as with any manual work, manual accounting is prone to human error.

Accounting efficiency ratios are a handful of simple ratios/calculations which allow businesses to assess their performance in terms of revenue and asset management.

Spend management software is software that allows businesses to control how they spend their money with greater accuracy, efficiency or level of insight.

Batch processing is a semi-automated process which processes multiple different transactions or invoices at the same time. It offers greater efficiency in a number of financial applications.