Automate your Accounts Payable with Moss

Process vendor invoices in minutes with AP automation and workflows that reduce data entry, manage money owed, and ensure timely payments to suppliers.

Faster approval workflows and more control over payment terms

Reduce follow-ups and prevent spend surprises through intelligent, layered approvals and transparent audit trails across your AP system.

Accurate accounting data for stronger financial reporting

OCR, supplier-rule and AI based AP automation to deliver reliable, structured accounting data you can trust.

Efficient payment runs to simplify transactions

Handle domestic and global supplier payments in bulk and with multi-user authorisation—eliminating overdue payments and manual data transfers.

Trusted by Europe’s leading finance teams. Independently certified for full GoBD compliance.

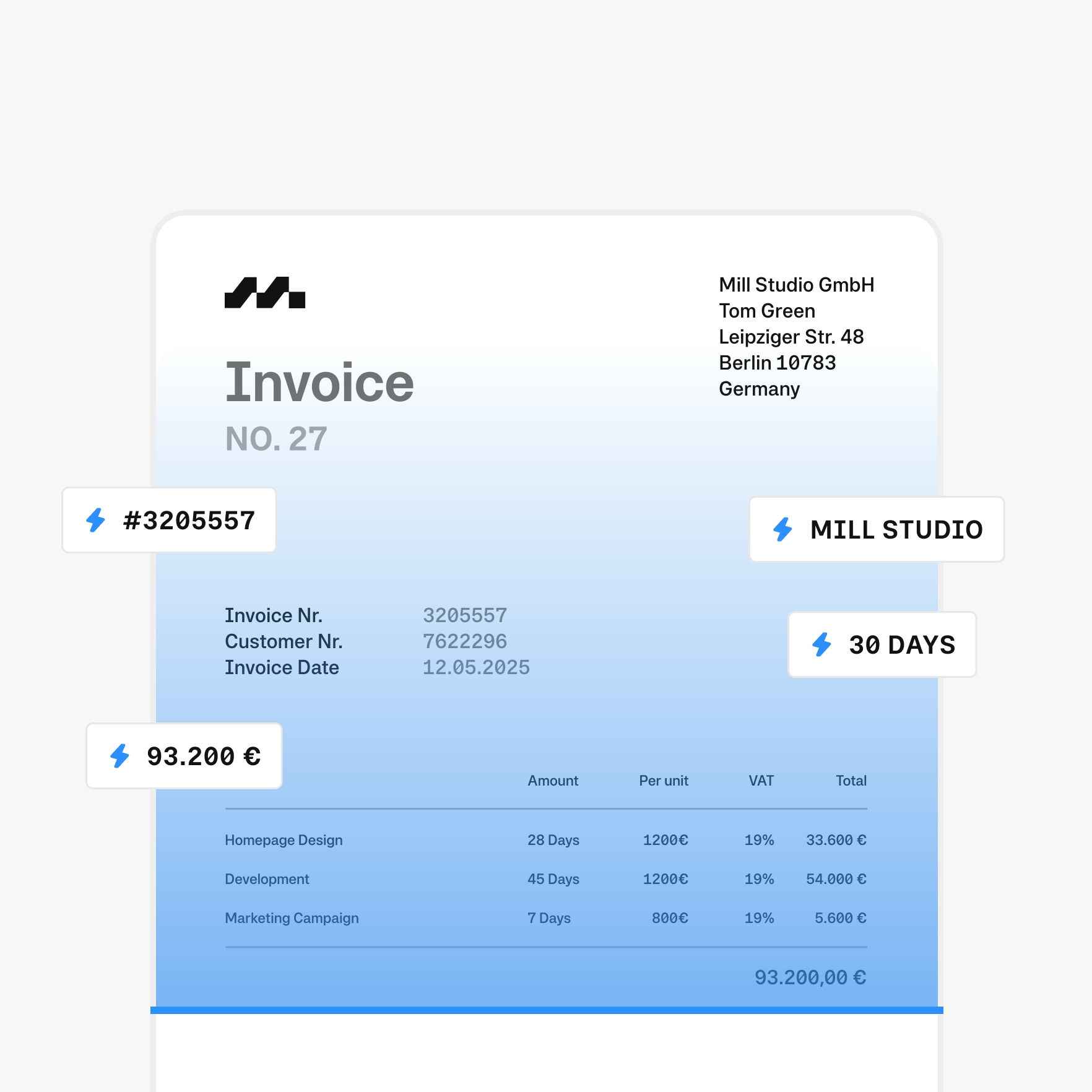

Automated data extraction and invoice processing

Automate the most time-consuming parts of your accounts payable workflow with invoice capture, invoice matching, and precise invoice data extraction.

- AP automation powered by artificial intelligence matches 49 in 50 invoices automatically to suppliers

- 99 in 100 invoices have accounting details pre-filled by machine learning-powered OCR technology

- Automatically categorise spend items, from nominal codes and VAT rates to line item splits, payment terms, and more

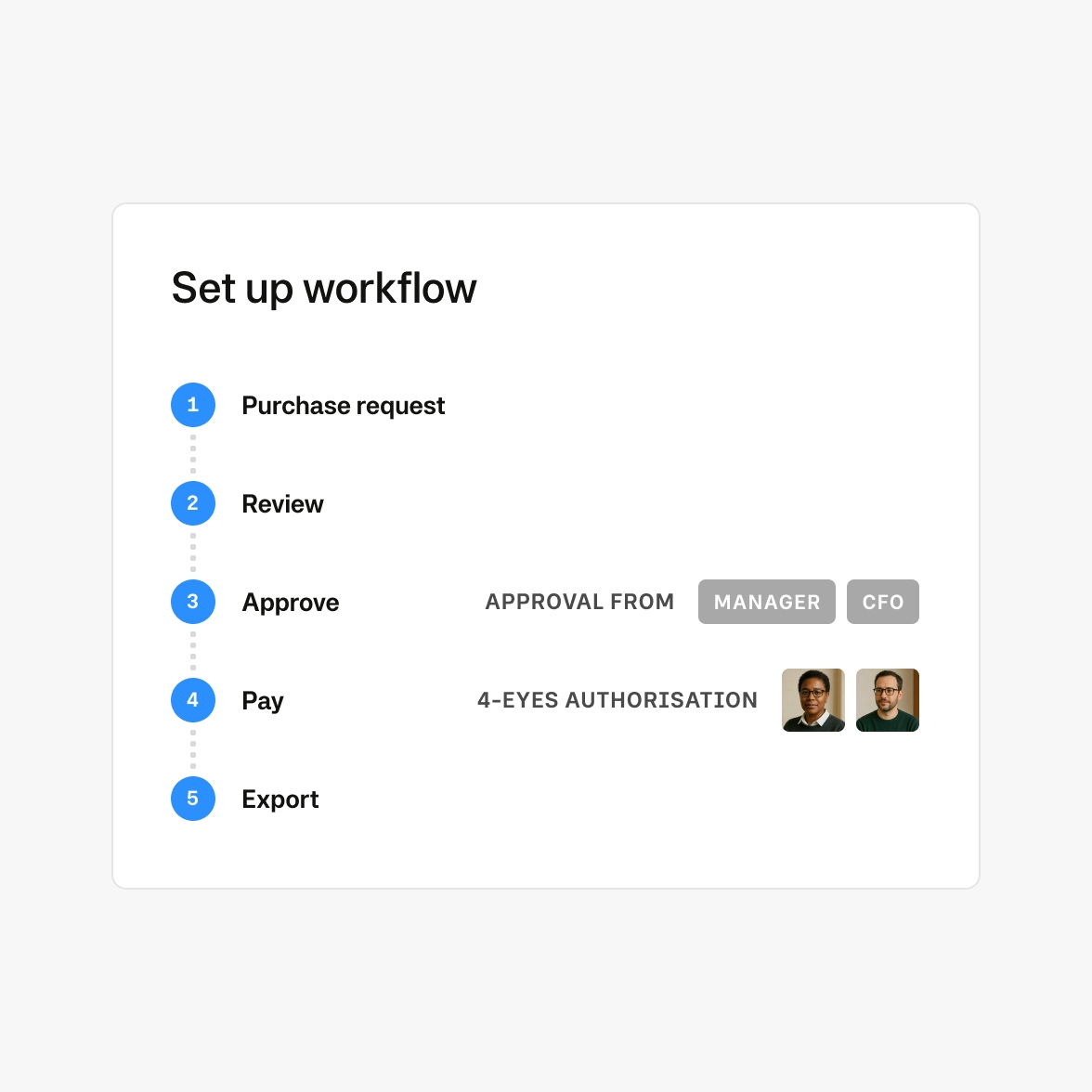

Regain control over your spending system

Strengthen your AP automation and approval workflows with clearer oversight of financial records and obligations. Tailor invoice processing workflows so that review, verification, and approval steps align with your organisation’s needs.

- Two-way matching to purchase requests

- Automated multi-step approval flows

- Role-based controls with audit trails for each review step

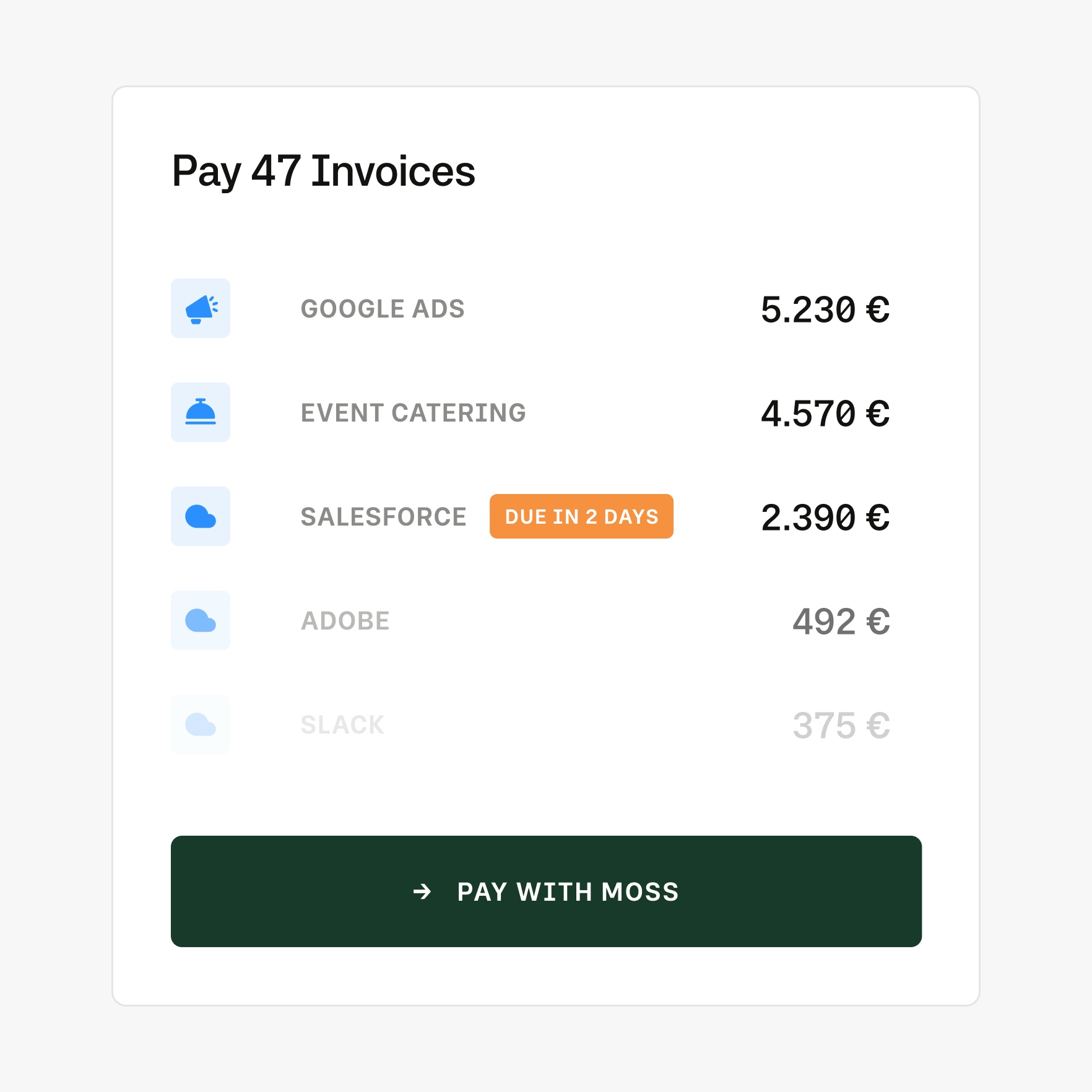

Simple and secure payment runs

Pay domestic and global suppliers for goods and services directly from Moss.

- Pay international suppliers using SEPA Instant and in 70+ global currencies

- Multi-user payment authorisation and two-factor-authentication

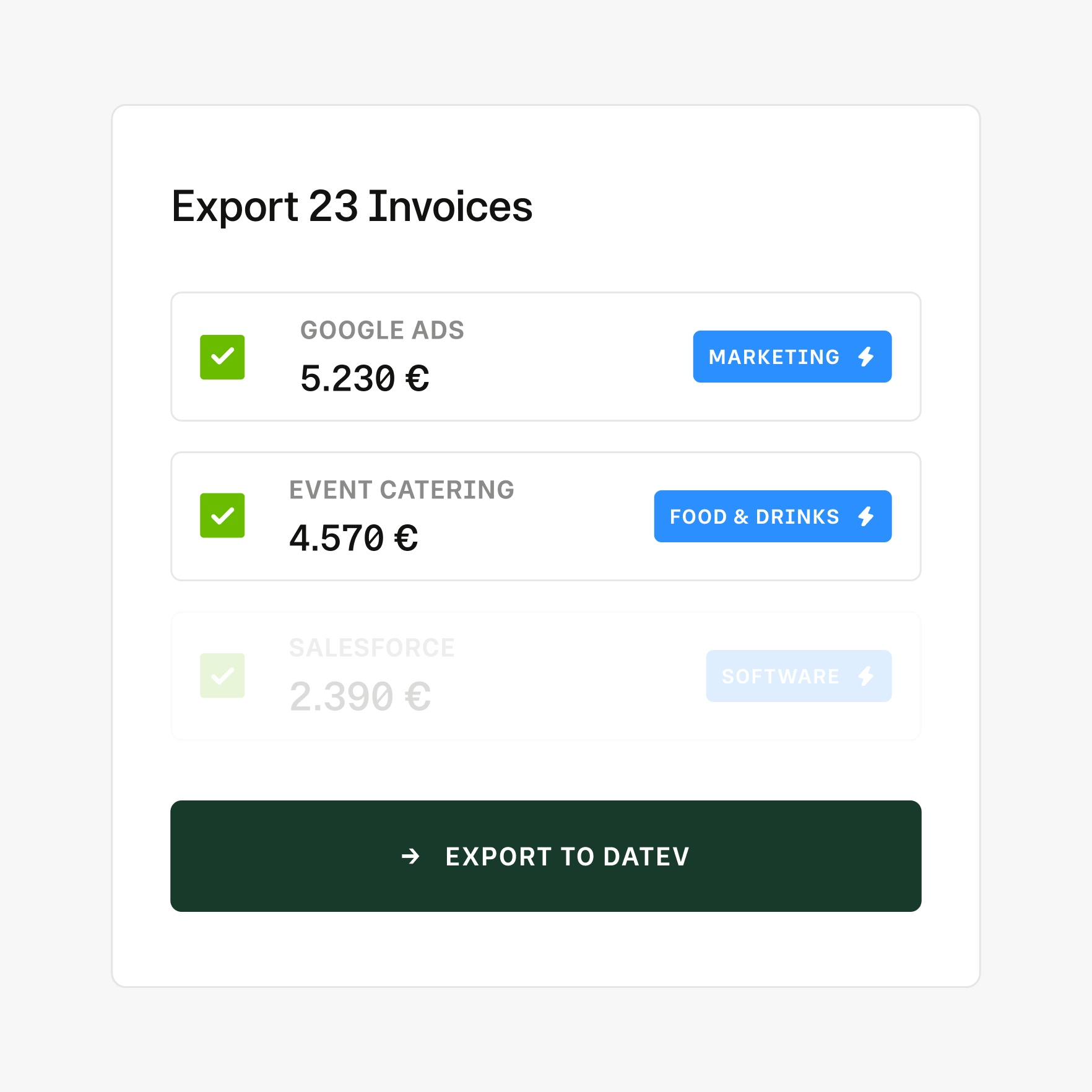

Never fear month-end again

Always keep your expense accounts data in sync with Moss' accounts payable automation software. Efficiently export invoice details and payment entries into your accounting workflow for easy end of month reconciliation and improved cash flow management.

- Two-way data sync with your accounting system

- API or CSV based exports from Moss to your accounting system

- Integrations with all popular ERP systems

Businesses save more with Moss' Accounts Payable Software.

Pay as you grow

Our pricing model is unique—just like your business. Design your ideal package: start with a base like Corporate Cards, Employee Reimbursements, or Accounts Payable, enhance with add-ons like Advanced Accounting or ERP integrations, and upgrade to an integrated suite when you're ready.

Best-in-class customer service, mobile app, and all the financial integrations you need to start effectively managing your spend.

Maximise spend efficiency and control with unlimited cards, customisable limits, and automated receipt fetching.

Make submitting reimbursements quicker and easier through streamlined upload and approval, and employee payouts directly from Moss.

Streamline your accounts payable workflows with Moss AP automation. Set up a customisable review process, effective supplier & OCR based automation, and one-click payments.

Improve financial oversight through budget tracking, spend insights, and greater flexibility in your approval flows.

Simplify purchasing through real-time budget oversight and efficient handling of purchase requests.

Native integrations to your ERP system, including support for any controlling dimensions that your business uses.

Enhance your pre-accounting experience with AI based automation, project-specific tracking, or the setting of mandatory fields.

Accounts Payable Frequently Asked Questions:

What is the Accounts Payable Cycle?

The Accounts Payable Cycle is a systematic process that includes several key steps: receiving an invoice, matching purchase orders, approving the invoice for payment, processing the payment, and reconciling accounts. This cycle ensures that all payments are made accurately and on time, avoiding duplicate payments and supporting efficient financial operations.

With AP automation, it's possible to save time and increase accuracy across the entire accounts payable cycle.

How does Moss automate the accounts payable process?

Moss' AP automation software leverages cutting-edge Optical Character Recognition (OCR) and Artificial Intelligence (AI) technologies to automatically capture, categorize, and process invoice data. This automation streamlines the entire workflow, expediting approvals and simplifying payment processing.

What kind of payment controls does Moss offer?

Moss' AP solution provides robust payment control mechanisms, allowing for customizable approval workflows and spending limits. This ensures that every transaction is subjected to thorough review and meets internal compliance requirements, safeguarding financial integrity.

How does Moss integrate with existing financial systems?

Moss offers seamless integration with leading accounting and ERP (Enterprise Resource Planning) systems. These ERP integrations enhance data accuracy, streamline information flow, and facilitate real-time financial updates, ensuring that your financial management practices are efficient and up to date.

How does Moss enhance visibility into payables?

Moss' accounts payable automation software provides real-time dashboards that give complete visibility over outstanding invoices and payment statuses. This feature allows finance teams to monitor their cash flow effectively, manage due dates, and prioritize payments to optimize financial health.

What security measures does Moss implement to protect sensitive financial data?

Moss prioritizes data security with advanced encryption protocols, multi-factor authentication, and regular security audits. These measures ensure that sensitive financial information is protected against unauthorised access and breaches, while also complying with industry regulations.

How does Moss enhance visibility into payables?

Moss provides real-time dashboards that give complete visibility over outstanding invoices and payment statuses. This feature allows finance teams to monitor their cash flow effectively, manage due dates, and prioritize payments to optimize financial health.

What is AP automation?

Accounts payable automation (AP automation) uses software to streamline accounts payable tasks end to end—from invoice capture and invoice processing to approval workflows and other digital workflows. For small businesses, it reduces manual data entry and errors, speeds up approvals, and improves control with features like purchase orders matching, audit trails, and real-time visibility into what’s been received, approved, and paid.

G2

4.7

Experience modern spend management with Moss.