Cash flow is a fundamental financial KPI that businesses use to gauge their financial health. Like other financial KPIs, cash flow is calculated with a formula, using raw figures for the money that’s flowing into and out of a business.

Cash flow is one of the simpler top line metrics that you can use to determine the viability of your business. But it’s possible to use it to build a number of deeper insights that can help you steer all sorts of decisions within your business.

In this guide we’ll take a look at cash flow in more detail. We’ll also explain how you can boost cash flow with a few simple changes to the way you handle money.

What is cash flow?

Cash is the fuel that powers everything you do as a business, hence why businesses strive for high revenue. But revenue doesn’t tell the whole story.

Outgoing cash is just as important. It’s how you pay suppliers and employees, bolster your marketing budget, develop your product offering, pay employee expenses, etc.

This is where cash flow comes in. It’s a summary of the cash that’s entering and leaving your business over any given time period. It tells a much clearer picture of a company’s financial performance than figures like revenue or sales growth.

In this sense, it’s possible to have sky high revenue from sales, but negative cash flow due to even higher outgoing costs. This is why cash flow figures are one of the main KPIs that investors take into account when investing in a company. It’s also an important metric that is used as part of the financial planning and analysis process.

There are a few different ways to calculate cash flow, which we’ll get into later. But in its simplest form, cash flow is calculated as follows:

Net cash flow = Total cash inflow – Total cash outflow

If you have more money coming in than going out you have positive cash flow, and vice versa.

Why is cash flow so important for businesses?

The benefits of positive cash flow are wide ranging:

- Liquidity: Having positive cash flow increases your company’s liquidity. Many assets can provide liquidity, but cash is the most liquid asset of all. Having lots of cash makes it easier for you to pay off debts, and reduces your reliance on credit and money from investors.

- Flexibility: Having positive cash flow also allows you to be a lot more flexible and reactive from a strategic perspective. With more cash in the bank, you can implement changes across your business, and react to unexpected market conditions with very short notice.

- Growth: In a similar vein to flexibility, good cash flow also allows businesses to pursue growth. Most growth initiatives, like investing in new hires, new products, or a new office space, are much easier to implement with cash up front.

Apple: A poster child for cash flow

As a quick side note, Apple is a perfect example of what high cash flow can do for a business. Over the past decade, Apple has consistently had the highest cash flow figures of any company worldwide.

The company has mainly used its huge cash reserves for stock buybacks. But this cash as also allowed the company to invest heavily in other areas to ensure it remains competitive in the long run:

- Research & development: Apple’s continued investment in R&D has allowed it to release innovative, class-leading products and new technologies. This has established Apple as a premium brand among consumers.

- Marketing and brand: Alongside its products, high cash flow has allowed Apple to build one of the strongest brands in the world with the help of advertising and other marketing initiatives.

- Strategic acquisitions: Apple has also made a number of strategic acquisitions over the years which have helped the business expand into new sectors.

Managing and forecasting cash flow

Unfortunately, there are lots of external factors that can negatively affect your cash flow. For example, prices for materials may increase, a new competitor may enter the market, or you may lose an important customer.

While it’s not possible to control these external factors, you can prepare your business for potential negative influences on cash flow with proper cash flow forecasting. This involves estimating your business’s future incoming and outgoing cash flow using forecasts for sales, expenses, payments, etc.

The better you can predict when money will enter or leave your business, and where it’s coming from or going to, the better your forecasting will be. There are various different methodologies for cash flow forecasting, but they mainly rely on analysing and extrapolating past cash flow figures from cash flow statements.

Different types of cash flow

There are three main types of cash flow, all of which have their own impact on cash flow forecasting:

- Operating cash flows

- Cash flows from financing

- Cash flows from investments

As we outlined earlier, cash flow is the amount of money coming into your business minus the amount of money going out of your business. This is what’s known as net cash flow. But there are other cash flow metrics that businesses use to gain more specific insights.

Operating cash flow

Operating cash flow is an essential metric because it shows whether or not the money being made from a business’s operations is enough to sustain and grow the company. It takes into account cash coming from sales of services or products. The formula for calculating operating cash flow is:

Operating cash flow = Net income + Non-cash expenses + Changes in working capital

Free cash flow

Free cash flow is the cash that is available to a business after accounting for costs associated with maintaining operations and assets. It is calculated using the following formula:

Free cash flow = Operating cash flow – Capital expenditures

Discounted cash flow

Discounted cash flow is used to assess the value of an investment based upon its expected future cash flow. It aims to convert the future value of an investment based upon the equivalent value it would hold at present. As a result it requires a significantly more complex formula.

How to improve cash flow

Cash flow is hard to come by for some businesses, especially if they’re growing rapidly, or experiencing a downturn in sales. But luckily, there are always steps you can take to try and improve your cash flow. These include:

- Reducing your business expenses: This is usually the go-to option for businesses looking to increase their cash flow. Cutting operating expenses can take many different forms, from negotiating better rates with suppliers, to automating business processes.

- Controlling your spend: Businesses can save significant amounts of money by controlling how they spend money day-to-day. This could be implementing a stricter expense policy, or using expense management software to track budgets for employee expenses.

- Improving accounts receivable processes: Any process changes that you can implement to get money into your business faster from customers and clients will help you improve your cash flow. With clearer payment deadlines you won’t have to worry about outstanding cash.

- Using credit cards: Credit cards come with their own risks, including credit card fees. But when used correctly, credit cards can significantly improve your cash flow by deferring outgoing cashflows to a later date. Instead of paying expenses and costs immediately, you can pay your credit card bill at the end of the month.

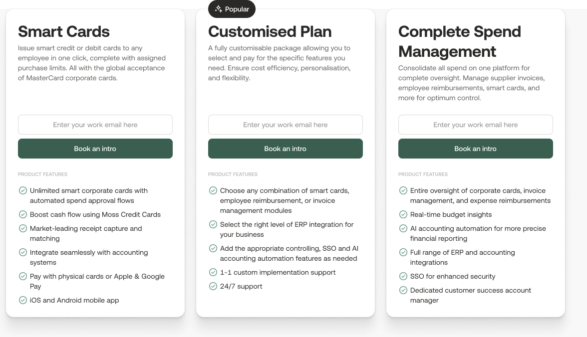

Managing cash flow with Moss

Moss offers a range of expense management solutions which help businesses improve the way they handle money. Our smart corporate credit cards allow businesses to give their employees access to company funds for expenses, while retaining complete control over how that money is spent. With budget controls, you can set individual spend limits for each Moss card in your organisation, and track how much is being spent directly from the Moss app.

FAQs

Cash flow is the total amount of money going into and coming out of a company. This includes income from sales and assets, and outgoing cash from expenses and investments, etc.

A cash flow statement is type of financial statement that outlines a business’s cash inflow and cash outflows over a specific period. It’s used to aid financial planning, forecasting and aids investors in assessing a company’s financial health.

Positive cash flow is important for businesses because it gives them more funds and flexibility. This gives them more freedom to invest in long term growth, and reduces reliance on creditors and debt.

Businesses can increase their cash flow in a number of different ways. Anything that increases the amount of money coming into the company and decreases the amount of money leaving the company, will improve cash flow.