Millions of consumers and businesses use credit cards every day. They offer a host of benefits which make them an attractive payment option for everything from your morning coffee to a new car. But they come with one main downside in comparison to debit cards—credit card fees.

Unfortunately, fees are enough to make many consumers and businesses avoid credit cards altogether. Luckily, you can avoid most of the headache surrounding credit card fees by simply being aware of potential additional costs you’ll pay.

To help, we’ve created this guide. It outlines all of the potential fees you could run into as a credit card user (there are a lot…), and provides tips on how to avoid them. We’ll also explain the credit card fees you can expect to pay as a merchant.

Credit cards vs. debit cards

First let’s provide a little background context—specifically the differences between credit cards and debit cards.

Physically, debit cards and credit cards are virtually exactly the same. The only difference is that debit cards have the word ‘debit’ clearly printed on them somewhere, and they don’t have sort codes. Besides this, they work in exactly the same way, with a chip, PIN and 16-digit card number.

The real difference lies in the way they access funds. Debit cards take money from a bank account, while credit cards take money from a line of credit. Ultimately, this is the reason credit cards charge fees, and it’s how credit card providers make their revenue. But it’s also a big factor in debit cards being almost twice as popular as credit cards in the UK (money.co.uk).

It used to be common for retailers to charge customers extra for credit card payment. However, these fees were banned by law in 2018. Despite a downturn due to the pandemic, credit card usage in the UK is trending upwards in the long term.

Different types of credit card fees

Now that we’ve briefly explained the difference between credit cards and debit cards, let’s get into the fees. It’s important to note that not all credit cards will charge every type of fee. But we’ve covered all potential fees to make our list as exhaustive as possible.

Interest

Interest is the biggest single source of revenue for credit card companies. In 2020, interest fees accounted for $76 billion of the $176 billion total revenue across the industry. Interest is the fee you pay in exchange for using credit or taking out a loan. But there are many different types of interest fee within this general bracket.

Annual Percentage Rate (APR)

In the UK the average credit card annual percentage rate hit a new record high of 30.4% in January 2023. APR is the primary form of interest customers pay when using credit cards. It’s the headline figure that card companies display front and centre of their advertising to attract new customers.

APR is a yearly amount that is averaged across 12 monthly billing periods. But there are two main ways to calculate it:

Fixed rate APR

A fixed annual percentage rate stays the same regardless of changes in inflation or the prime lending rate. This protects the cardholder from price fluctuations. But as a trade off for increased stability, fixed APRs tend to be higher than variable APRs. Fixed rates are also not fully fixed, in the sense that the card provider can make adjustments if you miss repayments or your credit score changes.

Variable rate APR

A variable annual percentage rate will change alongside index fluctuations and other economic variables like inflation. A variable rate credit card may be more expensive than a fixed rate credit card if indexes fluctuate or rise. But, if conditions remain stable over a significant period of time they are often cheaper.

Lenders need to protect themselves from risky loans, so they use credit scores to determine the rate they’ll offer customers. This is what’s known as personal APR, and it’s calculated on a customer-by-customer basis. The higher your credit score, the lower your personal annual percentage rate will be.

However, because each customer gets a different rate, credit card companies use what’s known as representative APR in their advertising. Representative APR is the lowest rate that 51% or more of customers are offered.

This is important to bear in mind when you sign up for a credit card. Depending on your credit score, providers may offer you a significantly higher personal APR than you expect.

Minimum credit card repayments

As part of your credit card contract your credit card provider will outline a minimum card repayment that you’re expected to meet each month. This varies significantly depending on the card you sign up for and your credit score. It’s essential to pay off as much of your balance each month if you want to minimise the interest you pay. If you only meet your minimum repayment amount, the interest that’s added to your bill will quickly compound and you’ll end up paying a lot more down the line.

APR grace period

Most credit card providers will offer a grace period on APR charges. This means that, if you pay back your balance within an allotted time, you won’t be charged extra. Sticking to the grace period is also essential if you want to minimise costs.

Other types of APR

Under the general umbrella of APR, there are a number of additional APR charges that businesses and consumers pay. These vary depending on what you use your card for. Common examples include:

- Introductory APR is a lower promotional rate that is typically offered to new customers. Introductory APR is active for a limited time, and often only applied to specific purchases.

- Purchase APR is the annual percentage rate applied to purchases that you make with a credit card.

- Penalty APR is a higher rate that many credit card providers apply if you miss a payment or violate the terms of your contract in some way.

- Balance transfer APR is often applied when you transfer a balance to your credit card from another card.

Cash withdrawal fees

Card providers charge cash advance APR when you use your credit card to withdraw cash at an ATM. It can also apply when you perform other actions, like exchanging foreign currency. As far as APRs go, cash advance APR is usually only second to penalty APR in terms of cost to you as the cardholder. Card providers also apply them immediately with no grace period, so you’ll start paying interest right away.

On top of cash advance APR, you’ll also be charged a cash withdrawal fee. This is a separate charge that’s calculated as a percentage of the amount of cash you withdraw.

In terms of the amount of money you can withdraw on a credit card, you’ll usually be limited to a certain percentage of your credit limit. For example, you may have a credit limit of £10,000 and a cash withdrawal limit of 80%. This means that you’ll be limited to £8,000 cash withdrawal per month.

If you withdraw cash at an independent ATM, you will also have to pay a fee to the ATM provider for using their cash machine. However, this applies to debit card withdrawals too.

Late payment fee

Credit card providers will apply a late payment fee to your card if you’re late paying your monthly balance. Late payment fees are typically a fixed amount that’s applied to your next monthly card statement. Late fees will also accrue interest.

It’s crucial to remember that late payments will have a negative impact on your credit score, and therefore make it harder to get a good rate on loans and credit. In the UK, late payments stay on your credit file for six years, although the impact they have on your credit score diminishes over time.

It is possible to file a notice of correction to get a late payment removed in special circumstances, e.g. being made redundant. But in the vast majority of cases you’ll be stuck with the late payment and potentially suffer negative consequences.

Credit card instalment plan fee

You may have the option to pay your credit card balance in instalments. If this is the case, you’ll be charged a credit card instalment fee in the form of an additional percentage of your balance. The longer the instalment period, the more you’ll pay for the instalment fee.

Exceeding credit limit/overlimit fee

Most credit card companies will also charge you a set fee if you go over the agreed credit limit on your card. Just like late payment fees, overlimit fees will show up on your next statement, and will accrue interest if they remain unpaid.

Returned payment fee

Credit card providers will charge a returned payment fee to your card if a direct debit payment doesn’t go through. This is usually due to insufficient funds in the account you use to pay off your credit card balance.

Minimum finance charge

Credit card providers impose a minimum finance charge if the amount of interest calculated on your monthly balance falls below a certain threshold (the minimum finance charge). For example, if your monthly interest charge is £0.40 but your minimum finance threshold is £0.70, you’ll be charged £0.70 as the minimum finance charge.

Additional cardholder fee

In most cases it’s free to add an additional authorised user to your credit card account. This means they’ll get their own card which is linked to your account. However, some providers charge a fee.

If you do want to add another user, it’s essential that you understand the liability rules. In some cases additional users will take on the same level of responsibility for the credit on your account. However, in others they may get access to credit while you, as the main cardholder, are liable for repayments.

Dormancy fee

In some cases credit card providers will charge you a fixed dormancy fee if you don’t use your credit card for a certain period of time.

Trace fee

Another lesser known credit card fee to watch out for is a trace fee. Some card card companies will charge a trace fee if you forget to tell them that you’ve moved house and they consequently have to locate you themselves.

Paper statement fee

Finally, some providers will charge you a paper statement fee if you request a paper statement or copy of a transaction. In the era of digital receipts and statements you shouldn’t have to worry about paper statement fees as you can access all the information you need in your online credit account.

Schumer box

In the US, credit card companies are obliged by federal law to include a summary of their rates and fees in all credit card statements and offers. They come in a standardised, easy to read table known as a Schumer Box. While there is currently no equivalent in the UK, parliament has debated introducing similar legislation regarding credit card charges.

Using a credit card abroad

Using a credit card abroad comes with another set of fees which can quickly stack up if you’re not careful. Many providers offer credit cards specifically for use abroad. They come with more attractive fees for paying and withdrawing cash.

Foreign transaction fee

A foreign transaction fee is charged when you use your credit card abroad and the currency on your card needs to be converted to a foreign currency. This usually falls in the range of between 1% and 3% of the total transaction amount. In some cases it may be charged once by the card provider and another time by the card issuer (e.g. Master Card).

ATM withdrawal fee

Just like using an ATM at home, you’ll also be charged a flat ATM withdrawal fee if you withdraw cash with your credit card abroad.

Credit card payment protection insurance

Some credit card users opt to pay for credit card insurance. While it’s not a must have, it can offer peace of mind and security in certain circumstances. Payment protection insurance allows credit card users to cover payments in case of a serious issue which stops them from being able to pay. This includes circumstances like sickness or redundancy.

Credit card fees for merchants

As a merchant, you’ll also face fees if you want to accept credit card payments. This includes one-off fees for devices and other fees which you will pay for each card transaction.

Device/terminal cost

The first thing you need to accept card payments is a card terminal. There are many different options with features designed specifically for businesses of different sizes.

Smaller businesses can buy a wireless bluetooth card reader for as little as £20. These card readers are a cost-effective way for small-volume merchants to accept both debit card and credit card payments in-store. But they need to be connected to a merchant account via app on a smartphone or tablet. As a result, they typically come with higher per-transaction fees.

Apple recently released ‘Tap to Pay’ capabilities on Apple Pay. This will allow small businesses to use their iPhone as a card reader, removing the need for a separate card reader.

Larger businesses tend to need more complex, robust point of sale terminals. They can handle higher transaction volumes, and come with a built-in SIM card to ensure internet connectivity at all times. As a result they are significantly more expensive than bluetooth card readers, and tend to be rented from suppliers for a monthly fee. However, they come with lower transaction fees from the card processing merchant.

Merchant service charge

The main cost associated with credit card payments is the merchant service charge, sometimes called a transaction fee or processing charge. This is a percentage amount that’s taken from each credit card payment you accept as a merchant, and typically ranges from 1.4% to 1.75%. Some card processing merchants will lower their transaction fees depending on the volume of transactions you make in order to encourage higher sales volumes.

Merchant service charges are usually calculated in three different ways:

- Flat rate — You are charged a standard rate on every card transaction you take, regardless of whether its a debit card, credit card, or rewards card. The benefits of flat rate pricing are simplicity and cost effectiveness for small volume merchants.

- Tiered — Tiered pricing includes different fees for qualified, mid-qualified and non-qualified payments, at increasing rates respectively. The qualified rate is usually applied to the safest payments, including debit cards and swiped transactions. Standard credit cards usually fall under the bracket of mid-qualified payments, while business credit cards, rewards cards, and payments which don’t take a CVC number are usually classed as non-qualified.

- Interchange — Interchange pricing includes the interchange fee charged by the card network provider (e.g. Mastercard) and a service fee from the card processor. While interchange pricing is a fair representation of real costs for the merchant, it can vary significantly depending on the type of card a customer uses.

Authorisation fee

Credit card processing merchants also charge a card processing fee on every transaction. This is a flat rate fee that typically ranges from 1p to 6p.

PCI compliance/non-compliance fee

All merchants who handle card payments need to adhere to the Payment Card Industry Data Security Standard. This is a mandatory regulatory standard that’s meant to protect cardholder data and reduce credit card fraud. To be PCI compliant, merchants need to meet 12 individual requirements:

- Install and maintain a firewall configuration to protect cardholder data

- Do not use vendor-supplied defaults for system passwords and other security parameters

- Protect stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Use and regularly update anti-virus software or programs

- Develop and maintain secure systems and applications

- Restrict access to cardholder data by business need to know

- Assign a unique ID to each person with computer access

- Restrict physical access to cardholder data

- Track and monitor all access to network resources and cardholder data

- Regularly test security systems and processes

- Maintain a policy that addresses information security for all personnel

Businesses that don’t comply with these requirements will be charged a PCI non-compliance fee by their acquiring bank, which typically around £30 per month. The requirements for compliance and compliance testing vary depending on the number of transactions your business makes per year. However, many card processing providers will cover compliance for you in return for a monthly PCI compliance fee of around £5. Considering the cost of non-compliance, it’s usually much cheaper to get your provider to handle PCI compliance for you.

Chargebacks

The final fee merchants should be aware of relates to chargebacks. Chargebacks are a customer-initiated action where the cardholder’s bank reverses a disputed card transaction. They’re designed to protect consumers from unauthorised or fraudulent transactions, and are supposed to be a last resort option to reclaim funds in the event of a dispute.

Once a customer’s bank initiates a chargeback, it’s on you as the merchant to prove that the chargeback was invalid. If you fail to prove this then you’ll have to pay a hefty fee to the customer’s bank or credit issuer. Chargebacks are also recorded and, if your merchant chargeback ratio reaches a certain limit, you’ll face higher fees from card networks. In extreme cases you may even have your merchant account terminated.

How to withdraw cash from a credit card without fees

As mentioned above, credit card companies charge significant fees for withdrawing cash. If you want to withdraw cash on a credit card without paying fees, you’ll need to find a credit card provider that offers zero cash advance fees. Although there are providers that offer this benefit, it’s not common.

Generally, credit cards are not intended to be used for cash withdrawals. So, if you need cash in a pinch but only have a credit card at hand, your best bet is to withdraw cash and pay off your balance as quickly as possible. This way you can minimise interest charges on the withdrawal fee.

While it may be tempting to withdraw cash on your credit card, it’s also important to note that doing so can negatively impact your credit score, even if you settle the balance quickly. This is because some credit card companies view cash withdrawals as a sign that you have limited options for accessing cash, and could be a risky borrower.

Paying your tax bill by corporate credit card

If you’re a business owner or self-employed individual in the UK, it’s not possible to pay your corporate tax bill using a personal credit card. However, you can use a corporate credit card if you pay HMRC an additional fee. To avoid this fee you can pay with a debit card instead. You can find out more about the different payment options on the gov.uk website.

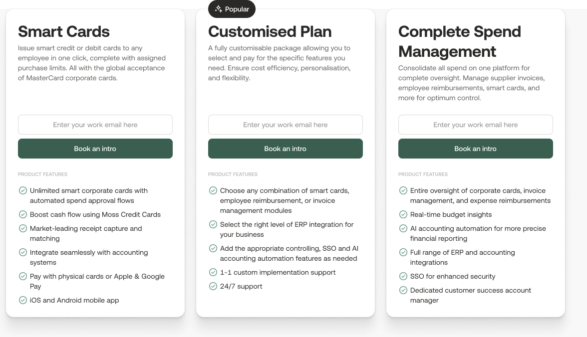

Moss corporate credit cards

Moss helps businesses manage their corporate spend more effectively with a range of intuitive spend management tools. Get full control over every aspect of your spend so that you can make more effective budgeting decisions, and save money in the process.

Corporate credit cards lie at the heart of our vision for more effective spend management. Moss customers can issue corporate credit cards for individual departments, cost centres, and even employees, for unrivalled spend visibility. Your employees can use their Moss card like any other card, all you have to do is approve their purchases in the Moss app.

We offer up to £2.5 million credit per month with flexible payment terms and a competitive 2% FX fee, so you can cover business expenses abroad hassle-free. Moss also integrates with a range of third-party software integrations, including accounting and HR platforms, so that you can streamline your workflows and automate pre-accounting processes.

FAQs

Debit cards withdraw funds directly from a customer’s bank account, whereas credit cards take funds from a line of credit that the customer pays back at a later date.

No, not necessarily. You’ll pay the same amount using a credit card as you would using a debit card. However, credit card providers will charge you interest in the form of APR on the money you spend. This will be applied to your monthly credit card bill, and will accrue interest if you don’t pay off your bill in full each month.

In most cases, the main cost you pay as a credit card user is interest/APR on the purchases you make on your card. However, this is largely dependent on how quickly you pay back charges on your card.

Yes, you can withdraw cash on most credit cards. However, you’ll pay a significant premium in the form of cash withdrawal fees which will apply the moment you withdraw money.

Yes, credit card providers will add charges to your credit card balance when you use your credit card to pay abroad.

Yes, credit card providers and card networks charge merchants a number of different fees every time they accept card payments.