Being able to manage budgets effectively is the key to running a successful business. Budget management takes place at all levels of an organisation, from the C-suite all the way down to individual teams, who control things like digital marketing budget or budgets for team building activities.

There are a number of different methods or ‘philosophies’ that businesses adopt when managing budgets. Each one approaches business spending slightly differently, and has its own benefits for businesses of different sizes or structures.

Being able to manage a budget is also a fundamental skill that managers need to acquire as they move up the ranks within a business. In this article we’ll cover everything you and your business needs to know about budget management:

- What effective budget management means for businesses

- The most popular budget management strategies

- What skills employees need to be effective budget managers

- How software can aid businesses in their budget management

What is budget management?

Budget management is a fundamental business process aimed at controlling spending in relation to a predefined budget. It involves a wide range of separate processes, and is carried out at various different levels of business.

Broadly speaking, budget management can be broken down into the following activities:

Budget planning

Budget planning is the first step in the budget management process. The budget planning process varies significantly depending on the budgeting strategy in place, as we’ll explain later. But budget planning sets the stage for all other budget management processes by outlining how much money can be spent, and on what.

Once the budget has been outlined, it needs to be approved by the relevant manager or department head. Top level business budgets are usually approved by the CFO/CEO and then go to the board of directors for final review and approval.

Implementation

Budget implementation is an ongoing process which takes place throughout the budgeting period. While the general guidelines for budget implementation are often outlined in the budget, many of the specific operational details are put into place on an ad hoc basis.

Budget monitoring and controlling

As budgets are spent they have to be continuously monitored and controlled to ensure that:

- Spending doesn’t exceed the budget

- The spending achieves the desired strategic and operational objectives

Budget monitoring involves tracking expenditure and incoming cash flows and comparing them to the budget. If the figures are off, corrections are made to get the budget back on track. This may mean reducing spending, or increasing spending if business has been stronger than expected.

Budget reporting

Budget reporting is an important part of the general financial reporting process. It outlines how actual spending lines up to the predetermined budget, and offers granular insights about exactly where funds have been spent. Central budget reporting is usually carried out by the financial controller or another senior member of the finance department.

Budget reports also play an important role in financial planning and analysis (FP&A), and general strategic planning by giving decision makers accurate insights about how to control spend.

Budget revision and auditing

The final stage of the budget management process is budget revision. This involves comparing your actual expenditure with your budget at the end of the budget period. The main objective is to identify and understand shortfalls in your budget so you can rectify them in the next budget planning process.

Internal and external budget auditing also happens alongside the review process. It ensures that the budgeting process was reported and carried out correctly, and plays an important role in combating financial fraud.

Different approaches to budget management

There are many different business budget strategies, each of which brings their own pros and cons. We’ll go through a few of the most well established approaches towards budget management below:

Hierarchical budget management

The most conventional approach toward budget management treats budgets with a top-down hierarchy. It outlines a clear structural relationship between all budgets in a business where higher level budgets cascade down into more specialised budgets for individual departments or business activities.

Each budget is planned and controlled at the respective departmental level, with approval coming from the level above. In general, this budgeting process takes place at three different levels:

- Corporate level budget

This is the overall budget for the entire business. It is outlined by the company’s top-level management and is structured to help the business achieve its core strategic objectives.

- Department level budgets

Within the business’s overall budget, each department is assigned its own budget to cover expenses and initiatives that have been planned for the year.

- Project level budgets

Each business department or unit will then create budgets for specific projects or activities that they carry out.

This structure is generally applicable to businesses above a certain size. However, in reality many businesses’ budget hierarchy is much more complex.

Bottom-up budgeting

Bottom-up budgeting sets budgetary requirements from the bottom of the company, and uses these requirements to outline the overall budget for the business. This budgeting strategy requires each department to evaluate their needs for the upcoming budgeting period, and outline their expected/requested budget.

Zero-based budgeting (ZBB)

Zero-based budgeting is another popular budgeting technique that requires each cost within the business to be justified before a budget is approved. It starts from the ‘zero’ point, i.e. a blank budget, and builds costs after requirements for the upcoming budgeting period have been outlined.

In this sense it is the opposite of the standard budgeting method, where budgets are outlined first, and relevant activities and expenses are altered to fit into the budget that has been allocated.

Zero-based budgeting is significantly more time consuming than normal budgeting, because it requires extensive, in-depth analysis of business needs before building a budget. However, it can result in notable savings, as the business only spends what it has already decided it needs, and its needs are calculated without any relation to the previous budgeting period.

Flexible budgeting

Flexible budgeting, as the name suggests, involves continuous adaptation and budget tuning throughout the budgeting period. This specific budgeting technique allows businesses to be more flexible and adapt to changing market conditions which can impact revenue and costs.

To make flexible budgeting work, you have to be on the ball and ready to change spending habits quickly in response to external factors. But it can be a powerful tool, especially for rapidly growing businesses and businesses in unpredictable markets.

Incremental budgeting

Incremental budgeting uses the current budget as a baseline and applies incremental increases for the new budgeting period. Increases are applied taking into account expected additional costs, including inflation, salary increases, marketing growth etc. While incremental budgeting is conservative and not very well suited to growth, it can save significant amounts of time by using previous budgets as building blocks for new budgets.

What does a budget manager do?

Rather than being a specific job position, budget management tends to be a responsibility that falls within the scope of many different jobs. Some businesses do hire budget managers whose sole purpose is to manage and monitor a specific budget or group of budgets. But the task of managing a budget can technically fall to any employee.

As we mentioned earlier, budget management takes place at all levels of a business. The higher up the budget hierarchy a specific budget lies, the more complex the processes and workflows involved in budget management are.

For example, managing the budget for an individual team’s monthly social activities would be very simple. The budget would be outlined by the department, and a budget owner would calculate what the team could afford, usually on a per-person basis.

However, the higher up the budget hierarchy you go, the more work there is involved in managing a budget. Dependencies, stakeholders, processes and the amount of money included in the budget all increase significantly.

How to manage a budget effectively

Managing a budget effectively can be tricky, especially in an uncertain economy. New or growing businesses often struggle to budget effectively because they lack experience in their specific niche or market.

However, there are some quick and easy ways to improve the way you manage budgets. The first is to understand the impact of discretionary spending on your overall budget. Discretionary spending is spending that is non-essential to the survival of your business. What is classed as discretionary varies from business to business, but common examples include things like marketing costs and employee perks. Discretionary spending should be the first target for cost cutting if you need to reduce your outgoing expenses.

Businesses also need real-time spend insights to understand exactly where their budgets are going, and the best ways to alter their spending to cut costs. Going over budget can cause your burn rate to increase, and ultimately threaten the survival of your business. Software tools can be a game changer when it comes to budget management, because they provide real-time data about budget progress, as well as immediate, granular control over budget projections and forecasts,

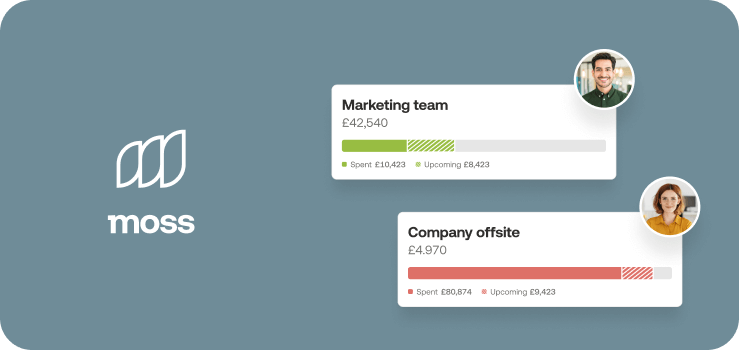

Managing your budget with Moss

As we mentioned above, to manage a budget as effectively as possible, you need to be equipped with the right tools. Nowadays budget management can be automated and improved with the help of technology, and our spend management platform was built to do just that.

Moss smart corporate credit cards give our customers unprecedented control over their spend with real time insights about how much is being spent by each person in your business. You can set individual budgets and spend rules for each card, and allocate them to individual projects or teams within your business. This way you can reduce admin time in approving funds, and limit spending in a way that aids your specific budgeting strategy.

With Moss you can access real time budget controls, which enable you to fine tune every card within your organisation and approve every item that has been bought directly from the Moss app.

FAQs

Budget management is the overseeing of a pot of funds that have been earmarked for a specific purpose, or purposes. There are many different approaches towards budget creation and budget management, each of which has pros and cons for businesses of different sizes.

The best approach towards budget management depends on:

a) The business and business structure in question

b) The purpose of the specific budget (i.e. marketing budget or office expansion budget)

c) The preferences and strengths of the person in charge of that budget

Zero based budgeting is a budgeting strategy which starts the planning process from the ‘zero point’. In other words, every budget is built from scratch and each budget item has to be justified before approval. Zero based budgeting can help keep costs down, but it’s time consuming and requires a lot of input from all corners of a business.

Generally, budget managers are responsible for planning, implementing, managing and reviewing budgets. However, these responsibilities vary significantly depending on the size and importance of the budget in question. Often, budget management is carried out by managers throughout an organisation who don’t necessarily have any formal financial training, e.g. team leads.

Budget planning is the process of building a budget that will enable a business achieve specific strategic objectives. There are many different approaches to budget planning, each of which have different pros and cons when it comes to accuracy, cost and ease of execution. Examples include flexible budgeting and zero-based budgeting.