If you’ve spent any time working at a startup, you’ve probably heard the term ‘burn rate’ at some point.

Burn rate is an important financial KPI that shows how quickly businesses are spending their cash. It’s mainly used by startups and other small businesses to gauge how long they can rely on their remaining cash reserves.

But it serves a purpose for businesses of all sizes and structures. In this article we’ll take a closer look at burn rate, explain how it works, and give some tips on how to decrease your burn rate if you’re struggling to keep costs down.

What is burn rate?

Let’s start off with the burn rate definition:

In business, burn rate is the rate at which a company spends its cash reserves. Burn rate is usually calculated on a monthly basis, and it’s primarily used by companies that haven’t achieved profitability yet, or have negative cash flow.

Businesses use burn rate calculations to build projections for their cash runway, which is the amount of time they have until they deplete their cash reserves. The end of the runway is also sometimes referred to as the ‘zero cash date’, i.e. the point at which the business’s cash reserves will be completely depleted.

How do you calculate burn rate?

So, how do you work out your company’s burn rate? As far as business metrics go, burn rate is pretty easy to calculate. It doesn’t require a complex formula, like customer lifetime value (CLV) or return on investment (ROI). You just need a firm grasp on how you spend your money and you’re good to go.

There are actually two different types of burn rate that businesses look at when assessing their financial viability. Each one provides a slightly different insight into the state of a business’s finances.

Gross burn rate

First let’s cover gross burn rate, which is the more basic of these two measurements.

Gross burn rate = Total expenses leaving your company each month

Here, your expenses are all of the operating costs and other outgoing cash flows from your business, including salaries, rent, supplier payments, etc. Gross burn rate is calculated by gathering together data from all sorts of different financial reports.

Net burn rate

Net burn rate gives a more realistic picture of how much money your business is actually using by accounting for the revenue it’s bringing in. The formula for net burn rate is as follows:

Net burn rate = Operating costs – Income

The higher your revenue, the slower you’ll drain the funds in your bank, and the longer your cash runway will be. It’s important to remember that expenses can fluctuate significantly from month to month — some months you’ll have big additional items in your cash flow statement. Because net burn rate calculations use accrual accouting, i.e. they take costs into account when they’re incurred, they provide a more accurate long term picture of outgoing costs over a longer period of time.

Average burn rate

As we mentioned before, you can calculate your burn rate over different time periods. It depends on your preferences for financial reporting, and the degree of accuracy you need for financial planning and analysis.

Burn rates are typically calculated on a monthly basis because it gives a more accurate picture of the current drains on your budget.

But, over longer reporting periods, businesses will often average out their burn rate to make their data more digestible. For example:

| Month | Gross Burn Rate |

| January | £30,000 |

| February | £25,000 |

| March | £40,000 |

| April | £40,000 |

| May | £50,000 |

| June | £55,000 |

| Six month average | £40,000 |

Why is burn rate so important?

Burn rate is an essential business metric, especially for startups and businesses with venture capital funding, for a few different reasons.

Firstly, it’s a crucial tool for internal leadership. Cash in the bank is effectively the lifeblood of business which hasn’t achieved profitability yet. Burn rate tells these businesses how much money they’re using and how much money is left at hand to pursue different strategic objectives.

Targeting growth with a tight budget is a delicate balancing act. It involves channelling money into different parts of the business, and any insights about where too much money is being spent, or unnecessary costs are being incurred, are vital for increasing efficiency.

Secondly, cash burn rate is one of the primary metrics that investors look at when assessing how investable a business is, and how well it’s progressing towards profitability.

Investors want to see how their money is being spent, and whether it’s being spent on the right things to achieve long term success. Burn rate is a big part of this, because it shows how much a company is gearing themselves towards growth, as opposed to balancing the books.

Burn rate benchmarks

So, if you’re a startup or VC-backed company, you’re probably eager to understand how your burn rate relates to other businesses in your field or industry. Unfortunately, there’s no golden ratio for burn rate vs. cash runway or the amount of money you have in the bank.

This mainly depends on the specifics of your business, and how aggressively your business strategy has prioritised growth over the short to medium term.

As a safe minimum, startups are usually recommended to have at least 12 months of cash in the bank to cover operating expenses. This means that, with a monthly net burn rate of £100,000, you should have at least £1,200,000 cash reserve.

As cash in the bank is usually more difficult to obtain than burn rate is to alter, it’s important for businesses to adapt their burn rate to fit their cash reserves. Obtaining more funding usually takes around 6 months, and healthy burn rates are a key financial indicator that investors will look out for when assessing whether your business is worthy of investment or not.

American venture capitalist Fred Wilson recommends the following burn rate benchmarks specifically for software startups. He differentiates them depending on the stage of growth the company currently sits in:

- Stage 1: Building the product — below $50k per month

- Stage 2: Building usage — below $100k per month

- Stage 3: Building the business — below $250k per month

However, this benchmark only fits a very specific type of startup and a growth model based upon the minimum feasible number of employees. Alternatively, Wilson suggests multiplying the number of people in your business by $10k. This covers the ‘fully burdened’ cost of each employee, including salary, rent and all other standard business expenses.

Is low burn rate always a good thing?

Given that your burn rate is the speed at which your business is spending the money in your bank, you’d assume that it’s best to minimise it as much as possible. After all, if you’ve reached a nice equilibrium between spend and revenue, your reserves should be able to last indefinitely.

While this is mostly true, it’s unfortunately not always that simple. Often, a high burn rate is actually a good business strategy if your company is targeting high growth, and investors will want to see reasonably high burn rates because they’re expecting a return on their investment.

How to reduce your burn rate

Since the pandemic there has been a sharp increase in inflation and a big decrease in the availability of capital for businesses. VC funding and other forms of business capital is much harder to get than it was a few years ago. This means that many businesses have had to find ways to minimise their cash burn and increase their runway in an attempt to weather the storm.

The most effective way to decrease burn rate varies from business to business. Some companies have expenses that are much easier to reduce at short notice than others. It mostly comes down to discretionary spending, i.e. expenses that are non-essential to the survival of the business. What counts as discretionary spending varies from business to business. However, in general, there are some common discretionary expenses that all business can target for reducing costs:

- Business travel

- Staff perks and entertainment

- Non-essential maintenance

- Research and development

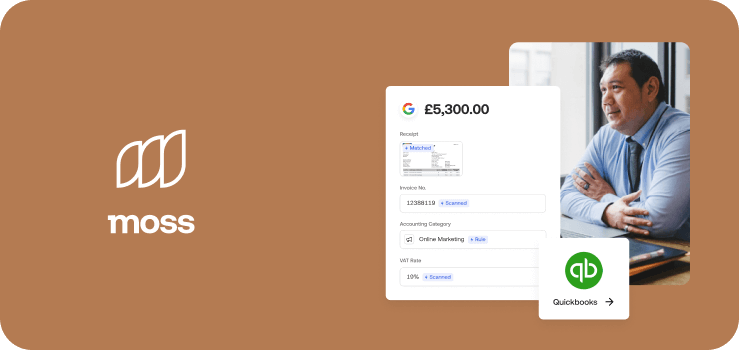

Managing your business’s finances with Moss

Moss’s spend management platform offers a variety of different tools that can help businesses manage their spend more effectively. It’s all about giving you better spend visibility and more ways to control how your money is being spent.

Our smart corporate credit cards allow businesses to give each of their employees their own fully functional payment card that’s linked to the company. There’s no need to worry about reimbursements, because each card can be set up with custom budget controls and monitored directly via the Moss app. You’ll be able to reduce your burn rate with tighter control over discretionary spending, and more detailed insights into where your money is actually being spent.

Our spend management solutions can also save you significant amounts of admin time in the month end closing process and general accounting preparation. You can export your spend data directly to Xero, and use our Personio integration to automatically set up new Moss users whenever a new team member joins your company.

FAQs

Burn rate is the amount of money your business loses per month. Burn rate is an essential metric for startups and other business that haven’t achieved profitability yet because it tells you how long you can continue using cash at current rates before you run out of money.

There are two different ways to calculate burn rate:

– Gross burn rate. This is simply the total of your monthly outgoing costs as a business.

– Net burn rate: This is your total outgoing costs, minus your monthly revenue

There is no specific figure for a good burn rate because spend and revenue vary drastically from business to business. However, in general, it’s good to have at least 12 months of cash in the bank at your current burn rate. This ensures that your business has enough money to survive in the mid-term, and gives you enough wiggle room to grow or pursue another round of funding if needed.

There are many different ways that businesses can reduce their burn rate. It’s all about cutting costs (and preferably increasing revenue at the same time), which should specifically target discretionary spending first.

Cash runway is the projected amount of time a business has left before it runs out of money. To calculate your cash runway you need to divide the total amount of money your business has left in the bank by you monthly burn rate/projected monthly burn rate going forward.