Accounting automation has been making a lot of noise lately—for all the right reasons. Traditionally, accounting tasks and processes have been time-consuming and error prone. Accounting and finance leaders estimate that their teams waste 53% of their time on manual, repetitive tasks while trying to meet increased business demands.

Enter accounting automation. It offers an excellent approach to streamline traditional accounting workflows, minimize human intervention, reduce errors, and boost efficiency. Research suggests that 80% of accounting executives believe applying accounting automation tools in their workflows can lead to a competitive advantage. Seventy-nine percent believe accounting automation software has the potential to increase productivity significantly.

What exactly is accounting automation? What are the benefits of accounting automation for businesses when compared to traditional workflows? How can you implement accounting automation tools successfully in your organization? This blog explores all these details.

What is accounting automation?

Accounting automation involves introducing software and technology into accounting functions to streamline and automate their varied aspects. This can cover a wide range of functions, right from basic accounting tasks such as data entry and payment processing to more complex accounting activities like bank or credit card statement reconciliation, conducting financial analysis and so on.

How do accounting automation tools work?

Most accounting automation tools work on the principle of auto-capturing accounting data from various sources, such as images or PDFs. These tools then use technology to import the relevant data into the accounting software. For example, optical character recognition (OCR) can read invoices snapped and fetch data for accounting automation.

The accounting automation software then sorts these entries into their respective categories. Finally, the categorized data gets integrated with the company’s accounting software in real-time and helps to keep up-to-date financial records. In addition, the accounting automation software is inbuilt with capabilities to analyse the data, furnish relevant reports and hasten processes.

What are the benefits of accounting automation for businesses?

Introducing accounting automation reshapes the ease and finances for organizations. Some key benefits of accounting automation for businesses of all sizes include:

- Timesaving

Traditional accounting involves accountants spending countless hours on routine tasks. For example, manually entering data, categorizing the different expenses into their respect categories, mapping invoices to those who placed the order to verify and process, and so on,

Introducing accounting automation software streamlines these lengthy tasks into a matter of minutes with a few clicks. Over 90% of small businesses agree that implementing accounting automation software has saved their team time and boosted their productivity levels.

- Improved accuracy

Manual accounting processes are prone to human errors. Something as small as a misplaced decimal or overlooked transaction can cause significant discrepancies and lead to wrong accounting submissions or business decisions.

According to a survey, 55% of respondents, including C-suite and finance executives, share they aren’t entirely confident about identifying financial errors before they report results. Accounting workflow automation steps in here as an actionable way to elevate the accuracy of accounting processes by minimizing the risk of human errors.

- Resource efficiency

Saving time on manual accounting tasks and minimizing errors saves costs significantly. —both in terms of time and resource costs. When routine tasks are automated, efficiency increases. A leaner finance team can get the same amount of work done, directly slashing staff costs. The reduction of human errors and time required to be spent on its rectification also reduces. All of this lets members of the finance team reallocate time to higher-value areas that drive growth.

- Real-time information availability

Due to their time-consuming nature, manual compilation and analysis of accounts often result in long cycle times to close books. This commonly delays important decisions across organizations. With accounting automation, real-time financial tracking becomes possible. As transactions get recorded instantly with accounting workflow automation, and there is also the choice to generate financial reports on demand, key information is always at the fingertips.

- Enhanced compliance and audit readiness

Manual accounting processes make keeping comprehensive and accurate records challenging. However, maintaining them well in a timely manner is necessary for meeting compliances and auditory requirements. With accounting workflow automation, maintaining detailed, precise, and easily accessible financial records becomes easy, enabling being audit and compliance ready.

Examples of accounting workflow automation implementation

There are many ways in which you can implement accounting workflow automation in your organization. Some promising examples include:

- Automating invoice management

With automated invoice management, you can enable your team members to scan or email their purchase receipts so that they are recorded directly into the automated system. No chasing people to share invoices and matching them with transactions. In fact, automating invoice integrations into the accounting automation software directly are also possible from popular eCommerce portals. For invoice picture or PDF uploads, technology like optical character recognition (OCR) can swiftly capture vital details such as invoice numbers, amounts, and due dates, dropping the need for manual entry.

This has worked brilliantly for Snocks. As its business grew, their team started incurring increased expenses. Their number of receipts started growing enormously. Over time, their accounting responsibilities started passing through many hands in the company. It became super unclear as to who placed which orders. Tracking and organizing the different receipts was becoming too challenging, and their year-end closing was delayed.

They intervened by providing all team members their own Moss corporate credit cards to ensure autonomy. Each employee can now scan and email their receipts directly from their smartphone. With this, they were able to store all of their spend data digitally, and pass it on to their accounting platform Xero. From there, it was sent directly to the tax accountant during month end, without anyone needing to do anything extra. Thus, with the implementation of accounting automation tools, their team is now able to work much more easily.

“We really only have one person for accounting, even though we now have up to 6,000 transactions a month,”

Rehan Choudhry, Team Lead Finance

- Simplifying Expense management

Accounting automation has excellent applications in simplifying expense management. Using it, you can gain a solid overview of your spending without doing extra work. Modern accounting automation tools come with inbuilt algorithms that can auto-analyse spend data and assign transaction categories based on predefined rules you set. For example, a transaction from a restaurant can automatically go under ‘Meals and Entertainment. This way, with a robust accounting workflow automation setup, you can get quick visibility on your organizational spending, improve it and make the right business decisions.

This is the approach Napo took. Managing finances in a fast-growing company was not coming easy. Napo’s team intervened by automating spend management with Moss. They introduced significant amount of autonomy across the team to work with agility and introduce control simultaneously. For this, they issued individual credit cards for their team members. This helped everyone effectively do their jobs, and easily pay for whatever they needed. For example, they could pay for whatever needed like hotels during conferences, PPC ads from their digital marketing budget, and more easily manage subscriptions for new tools etc.

At the same time, they’ve set up their accounting workflow automation in a way that also regulated spend limits. They also introduced easy requests procedures to keep control wherever necessary.

With this approach in using accounting automation tools, their finance team’s efficiency has skyrocketed. They are now saving 4.5 days of admin per year and reaping a 4x ROI on their accounting automation software subscription fee.

- Streamlining payroll processing

Traditionally, payroll processing involves meticulous calculations of hours worked, deductions, and benefits across departments and locations. This manual process for completing this is labour-intensive and prone to discrepancies. Payroll automation unfolds a fantastic way to streamlinesuch situations. Using it, you can integrate your employee time-tracking systems with your automated payroll software. Once employees log in their hours electronically, the system can automatically calculate their exact wages, extra payment overtime, and any deductions according to company policies and regulatory requirements.

How to implement accounting automation in your organization?

- Start with assessing your existing accounting workflows to find gaps and areas of improvement. Observe your accounting processes. Talk to employees to understand which areas they would prefer getting help on with accounting automation.

- Based on the potential areas you identify for accounting workflow automation, start looking for the best accounting automation software options out there. Assess their features and benefits and shortlist the ones that look good.

- For the shortlisted accounting automation tools, conduct a thorough cost-benefit analysis and narrow down your options. When you do this, make sure you do not just compare for the accounting automation software fees. It is also important to measure the potential ROI of using every accounting automation tool basis the tangible and intangible benefits it brings. These benefits may range from cost savings from reduced manual labour to improved accuracy in financial reporting.

- Once you decide and pick the best accounting automation software for your business, set up an implementation team. It is good to have people from finance, operations, and IT in that team to ensure seamless data migration, system compatibility, and security. Let this team build the deployment plan depending on your organization’s unique needs,

- It is always good to approach accounting automation software with pilot testing approach. Go for iterative rollout instead of all at once as this will help you to identify any potential issues at the right time. With that intel, you will be better positioned to refine processes before full-scale deployment.

- Before you deploy the accounting automation tools, make sure the team receives adequate training. They must have enough time to familiarize themselves with the software usage and its security protocol. During this phase, make sure you communicate the benefits of the change. This will ensure they are more inclined to use the technology and overcome the initial resistance to a new change. At the same time, reassure employees about job security. This is a common apprehension when organizations switch to accounting workflow automation.

- Once your training in using accounting automation tools is complete, schedule a transition period. Make sure all the stakeholders are well-informed about this timeline in advance to ensure a smooth shift.

- Finally, remember that your task does not end once your accounting automation software is implemented. You also need to regularly track how well the system is being used, and if there are any gaps. This way you can ensure you are making best use of the accounting automation tools. In addition, it is a good practice to keep revisiting your security measures and updating employees with training on data protection practices.

What are must-consider factors before choosing accounting automation software?

- Intuitive interfaces: Make sure the accounting automation software’s user interface and dashboard are intuitive and easy to use. If your finance team cannot access comprehensive financial data with just a few clicks, they will be less inclined to use it.

- Customization and scalability: Rigid, off-the-shelf solutions may not meet your business’s unique needs. Select accounting automation tools with customizable features and scalability to adapt to your business needs. For instance, you need flexibility to define the approval hierarchies that work for your team structure. So, work closely with your accounting automation software vendor to tailor solutions and ensure they can grow with your business.

- Integration with existing systems: Introducing too many new and additional automation tools may create chaos, digital fatigue, and disruptions. Therefore, it is best to integrate the tool with your existing systems like ERP, CRM, HRMS, and so on. This will ensure smooth data flow and consistency across platforms. So, look for a compatible accounting automation tool that offers robust integration capabilities. When implementing it, do not forget to engage IT to ensure seamless data migration and system compatibility.

- Data security: Automating accounting processes may create risks of data breaches and compromise the security of sensitive financial information. Make sure the accounting automation tool you choose has solid encryption capabilities and complies with the highest industry security standards.

- Cost of implementation: Deeply assess the different costs involved with switching to accounting workflow automation. These can range from initial setup costs, subscription fees, support costs, and other additional expenses. It is best to pick something whose inclusions can be scaled up or down depending on your changing business needs.

- Availability of support: Make sure the accounting automation tool offers robust support training and support services. This must include aspects like user guides, tutorials, and responsive customer support to any queries.

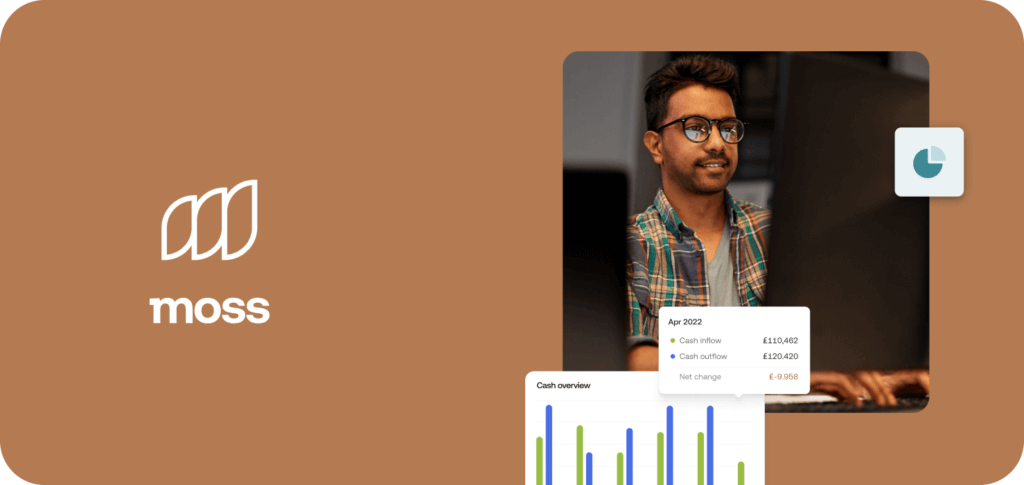

Looking to enhance your accounting function with the best accounting automation software?

Meet Moss, a proven solution for finance professionals to manage and automate end to end workflows for corporate cards, expenses and accounts payable in one place. It is designed to help you streamline and automate lengthy accounting workflows, ensure your books are always in shape and you close the month on time. Moss integrates with other systems and tools that you already use, including accounting and HR software, and helps save time and money through more efficient, controlled business spending.

FAQs

Process automation in accounting involves using technology to streamline data entry, invoice processing, and financial reporting. It aims to reduce manual effort and improve financial transactions and reporting efficiency.

Robotic Process Automation (RPA) in accounting is ideal for repetitive and rule-based accounting tasks. Examples include data entry, reconciliation processes, generating reports from multiple systems, and routine compliance checks.

Automation in accounting is not about replacing accountants but rather augmenting their capabilities. Routine tasks can be automated, allowing accountants to conduct higher-value activities such as analysis, strategy development, and advising clients.

Yes, financial data is secure with accounting automation. However, ensuring that requires implementing robust security measures and choosing accounting automation software that complies with advanced safety protocols. For example, the system you employ must have encryption for both data at rest and in transit to protect access. Similarly, features like multi-factor authentication and role-based access controls are also essential to prevent unauthorized access.