Cost control is an essential part of business management. It helps companies regulate outgoing cash flow. A lack of attention towards costs, or a failure to understand how best to control costs can have serious negative consequences for businesses.

There are many different ways businesses can control costs. This could be an increased focus on process efficiency, or more active measures like reducing their headcount.

However, the best approach for a company in any given situation will only become clear after thorough cost control analysis.

In this article we’ll explain cost control in more detail. We’ll also outline some of the most common cost control methods that businesses use to tackle budget overruns.

What is cost control?

Cost control is the process of reducing business costs in order to increase profitability. Crucially, cost control aims to reduce costs while maintaining output. It involves many different processes, from analysing financial reporting, to negotiating with suppliers for better prices.

Cost control is also a highly cross functional effort, involving input from teams and team members across a business. This includes financial planning and analysis, procurement, data experts, financial controllers, all the way up to the CFO.

Once businesses have a firm understanding of how they are spending their money, and which potential avenues they have for reducing costs, they can implement cost control measures to boost profitability.

Again, these cost control measures can take many different forms. This could be changes to top level business strategy, targeting increased operational efficiency, negotiating new contracts with suppliers or partner companies, or investing in new tools like spend management software.

Why is cost control important?

Ultimately, if done properly at regular intervals throughout the planning process, cost control has the potential to significantly increase a company’s financial health and competitiveness. Unfortunately, cost control itself can be quite time consuming. But it almost always pays out in the long run by ensuring that:

- Projects do not go over budget

- Businesses and project managers are able to seize cost saving opportunities whenever possible

This can have a significant positive effect on a business’ profitability and, especially in the case of startups, its investability.

Steps in the cost control process

Cost control involves many different processes, from the planning phase, to budget analysis and execution of cost control strategies. Most large companies have their own cost control methodologies in place. But in general, the cost control process can be broken down into the following steps:

Budgeting

All cost control begins with budgeting. It’s the foundation for all business spending, and it provides the context for determining whether or not current costs are in line with forecasts.

When planning and managing a budget, businesses try to work out exactly how much money they will need to allocate to different projects and departments to achieve their core business outcomes.

Monitoring costs

The next step of the cost control process is monitoring costs as each budgeting period unfolds. This is an ongoing process that involves tracking spend data. The more detailed spend data your business has, the better you’ll be able to monitor the costs that your business faces.

Variance analysis

When businesses identify discrepancies between their budget and their actual spend, they use variance analysis to determine why that discrepancy exists. There are many potential reasons for estimated costs to differ from real costs. Variance analysis can be used to dial in on specific cost types, for example materials variance or labour variance.

Implementing and monitoring cost controls

How businesses implement cost controls depends entirely on the findings of their cost control analysis. Whichever measures they do choose need to be monitored and fine tuned to ensure that output remains on target and the performance of related departments or projects doesn’t fall.

Costs that can be targeted with cost control

Businesses face four core types of costs, each of which can be targeted as part of a cost control initiative. The amount and type of each cost can vary from business to business, so it’s important to understand how different types of cost are linked to one another.

Direct/indirect costs

Direct costs are costs that can be directly attributed to a specific cost object. Cost objects are anything that a business accumulates costs in relation to. Examples include business departments, projects, products, services, etc.

The crucial distinction between direct and indirect costs is that direct costs can be attributed wholly to one cost object.

Indirect costs, on the other hand, cannot be tied to specific cost objects. They tend to be more associated with running a business in general. A common example is electricity costs for offices or production facilities.

Fixed/variable costs

The other common cost distinction that is made for accounting and planning purposes is fixed costs vs. variable costs.

Fixed costs are costs that remain constant regardless of a company’s output. Examples include costs like rent and insurance, i.e. costs which are more related to running the business rather than output.

Variable costs are the opposite — they increase and decrease depending on the company’s output, i.e. how much the company produces or sells. Common examples include raw materials and utilities.

To help you understand the differences between these different types of costs, we’ve included a table which outlines a few hypothetical examples.

| Direct costs | Indirect costs | |

| Fixed costs | Costs that are directly related and traceable to the product, but do not change in relation to the company’s output, e.g. production facility lease | Costs that cannot be directly linked to production, but which don’t vary depending on production output, i.e. general office lease or fixed manager salary. |

| Variable costs | Costs that are directly related and traceable to the product, but change in relation to the output. Most direct costs are also variable costs, e.g. materials needed for production | Costs that cannot be directly linked to product, and which fluctuate in relation to total output. I.e. electricity costs at the production facility. |

Common cost control strategies

After completing cost control analysis, businesses will implement a strategy to get their spending back on track.

The cost control analysis may reveal overspending in one area in particular. Sometimes this may be due to errors made by the business itself, and other times it may be due to factors that are outside of the business’s control. In general, cost control measures usually target variable expenses because they are more flexible.

Outsourcing

Outsourcing is a common spend control strategy which has permeated most sectors in some form or another over the past few decades. Outsourcing can take a few different forms. For example, many businesses outsource specific departments or business operations to foreign contractors to take advantage of cheaper labour. A prime example is call centres, many of which are situated in developing countries where employees can be paid less.

Another form of outsourcing is hiring freelancers or contractors to take on temporary projects. While contractors are usually more expensive in terms of labour costs, this specific cost control measure takes advantage of shorter contract duration to save money in the long run.

Negotiating with suppliers

Contract renegotiation is another common cost control measure that businesses may use to reduce their expenditure. Variable costs are usually the easiest and most effective target for cost control because they fluctuate over time. They also tend to be supplied on less rigid, shorter term contracts than fixed costs, like rental contracts.

If profitability is the primary objective then negotiating new contract terms for raw materials with suppliers or new contracts with service suppliers can help businesses drive down costs. However, this may come at the expense of product or service quality, which will directly impact customer satisfaction. This can severely impact sales in the long run, so any product-related cost control measures should be considered carefully before implementation.

Shrinkflation

In a similar vein, businesses may reduce the size or quantity of their products in response to rising ingredients or raw materials prices. To increase profits, they will keep the new, smaller product at the same price as before. This is known as shrinkflation, and it’s a well known phenomenon among consumers which have seen average product sizes (e.g. chocolate bars) gradually decrease over the years.

Layoffs

Businesses use layoffs and redundancies to reduce their costs over the short-to-mid term. Companies and startups that have experienced quick growth often find themselves facing rising costs as their growth tails off.

For many businesses, layoffs are seen as a necessary cost control measure because they allow them to reduce outgoing cash flow while reformulating hiring strategy around a new growth plan. Whether or not layoffs should be used as anything more than a last ditch option is debated. Like cost control measures that target cheaper materials and outsourced labour, layoffs can have a similar negative effect on employee satisfaction and motivation that becomes apparent further down the line.

Process efficiencies

Finally, process efficiencies are another popular cost control method that companies pursue to save money. Process efficiencies can be pursued in all corners of a business, from operational aspects of the production process, to hiring, and everything in between.

Where process efficiencies may have involved a transition to digital technology a couple of decades ago, they’re now primarily achieved through automation. Automation allows businesses to reduce employee workloads and increase accuracy and efficiency in everyday business processes. Over time, this can save significant amounts of money. A prime example is spend management software, which simplifies common work processes for accounting teams.

| Compare your company’s spend with industry averages: Try our comparison calculator to see how your costs compare to the industry average. >>Benchmark your SaaS spending now!<< |

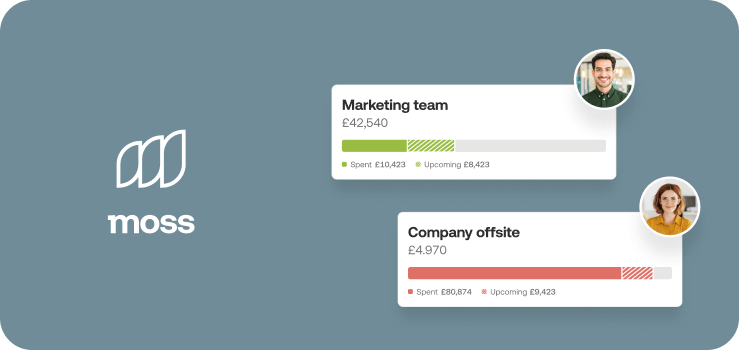

Controlling your business expenses with Moss

When it comes to being able plan and implement cost controls effectively, accurate financial data is arguably the most essential tool for your team. The more detailed your pool of spend data is, the easier it is to draw meaningful insights about your real spend in relation to your budget.

Conventional business spend processes are severely lacking in this sense. Many companies still use a handful of traditional corporate cards to manage all of their business expenses. This includes everything from employee travel expenses to software/service subscriptions. Conventional cards use paper receipts and monthly card bills, which are cumbersome and highly inaccurate if you want to gain accurate spend insights. As a result, it’s much more difficult to successfully implement cost control initiatives.

At Moss, we help businesses overcome these issues and improve their cost control capabilities with a range of smart spend management tools. Our customers can issue an unlimited number of smart, virtual corporate cards to individual departments or employees. Each card can be set with custom spend limits and monitored with real-time budget controls. All spend data from across your company is compiled digitally, including digital receipts, which drastically reduces the amount of time your team needs to spend on reporting.

This provides ultimate spend visibility and gives your team a much clearer reservoir of spend data that they can use to fine tune their cost control initiatives.

FAQs

A typical example of cost control would be a business switching suppliers for parts or raw materials in order to reduce their production costs and increase profitability.

Ongoing cost control benefits businesses because it allows them to identify potential money saving measures and minimise budget overruns.

The most effective cost control measure for businesses depends entirely on the business in question and the specific financial situation they are in at any given time. In some cases a business may be best served by outsourcing a specific project or department to save money. At other times, they may need to renegotiate specific supplier contracts to reduce costs on a specific product.

Cost control analysis allows businesses to identify the best course of action to bring spending back in line with their budget. It typically involves variance analysis which aims to understand the cause behind budget overruns.

Spend data is essential for cost control because it allows businesses to see where and why they are overspending. The more accurate and up to date spend data a business has, the better they can understand their spending in a holistic sense.