Expenses are an annoying but inescapable part of business. Most of us have experienced the hassle of claiming money back from an employer for a work-related expense at some point. Or, if you’re part of your company’s accounting team, you may have had the pleasure of dealing with expense claims from the other side.

One of the key parts of the expense reimbursement process is expense reports. They allow businesses to track and categorise expense claims made by individual employees or business departments throughout the year.

In many ways they’re essential for the smooth running of a business. With a solid expense reporting process in place, companies benefit from better spend visibility and a clearer understanding of where their funds are going. But, to maximise accounting efficiency, expense reports need to provide your accounting team with the right information.

In this article we’ll cover the topic of expense reports in more detail. We’ll explain why expense reports are so important for accounting, budgeting, and a number of other key operational processes. We’ll also explore how expense report automation can save businesses time and money.

What is an expense report?

So, let’s outline what an expense report actually is. Expense reports are an essential part of the expense reconciliation process. They help businesses ensure that their employees stick to their company expense policy by tracking, in detail, where money has been spent, and what it has been spent on. Usually, expense reports are filed with corresponding expense receipts for each item on the report.

Expense policies, expense receipts and expense reports each play their own important role in controlling and monitoring how much money a business spends on expenses:

- Expense policies outline the rules and expectations surrounding what can and can’t be charged as an expense

- Expense receipts provide a paper trail and proof of purchase for each expense employees pay for on behalf of their company

- Expense reports provide a itemised summary of expenses that have been paid over a specific period of time

Expense report definition

An expense report is an itemised, categorised list of expenses that have been paid for by employees on behalf of their employer. Expense reports are typically compiled monthly, quarterly, or yearly (i.e. at the end of each accounting period), but may also be requested to summarise travel expenses paid on a business trip, for example.

Why do businesses need expense reports?

While they serve multiple different purposes, expense reports are, first and foremost, an accounting and bookkeeping tool. They provide businesses with a clear, comprehensive record of outgoing expenses that have been accrued by employees in the course of their work or work-related activities.

Let’s drill down into the main reasons businesses need expense reports:

- Calculating tax:

Because employee expenses come with tax and National Insurance obligations for employers (and in some circumstances also employees), expense reports need to provide all the information necessary for accounting teams to calculate the tax that the business owes.

The amount of tax owed on different expense categories also varies significantly, which is why expense reports need to be itemised, categorised, and include the details of who paid what. Ultimately, clearly categorised expense reports make it easier for businesses to work out their tax liabilities.

- Improving accounting efficiency:

Expense reports are also a significant time saver when it comes to accounting process efficiency, depending on how well they’re implemented. With a summarised list of all expense claims, and the relevant information needed to process them, accounting teams have access to a reservoir of spend data for reference. The better structured your expense reports and expense reporting process, the less work your accounting team has to do to make sense of it.

First and foremost, expense reports are an accounting tool. They allow businesses to consolidate their expense records in one place, effectively saving time and effort when it comes to working out where funds are going, as well as giving them a greater ability to control spend. Expense reports tend to be compiled monthly or yearly, but can be compiled for specific events like business trips or work events.

- Auditing and compliance:

Expense reports play an important role in internal and external audits. They are used to identify and review potential cases of expenses fraud and spending that goes against company policy.

- Budgeting:

Finally, accurate expense reports allow businesses to budget and manage their costs with greater ease. With a better overall picture of which departments or activities are having the biggest impact on company budgets, it’s much easier for businesses to make adjustments that will have a positive effect on the balance book.

How to make an expense report

Expense reports are usually created using an expense report template. However, in many cases businesses choose to build their own expense reports from scratch. This allows them to add custom fields, and other pieces of information that fit the individual requirements of their company.

Common expense report templates include mileage expense reports for tracking expense claims from employees who use their car for work, or travel expense reports which are broken down into common expense categories like food, drinks, and accommodation.

To serve their purpose as a tracking tool for accounting, tax and budgeting as effectively as possible, expense reports need to contain some key pieces of information.

A typical expense report contains the following key fields to track employee expense submissions across a company:

- Employee details

The name and department of the employee making each expense claim is important for accounting and auditing processes.

- Date of purchase/claim

Each item on an expense report should have a date of purchase.

- Vendor/merchant

Where each item/expense was bought.

- Expense account details

Expenses should be assigned to a specific expense account, e.g. variable expenses or deductible expenses. Together these expense accounts form part of a company’s chart of accounts, which is the central record of all costs a business incurs.

- Client/project

Many expenses need to be assigned to a specific client or project for bookkeeping purposes.

- Expense amount

The cost of each item and total of all items on the report, including VAT.

- Notes/expense explanation

Expense reports should also include a notes section where employees can add notes and other information about specific expense items.

Expense report automation

The typical expense claim process varies from company to company — many still use the old school approach of paper receipts and expense forms. But, in the past couple of years, digital expense management has transformed the way businesses handle expenses and reimbursements.

Expense automation software allows businesses to save significant amounts of time and money on expense processing. A report by the Global Business Travel Association puts these savings into perspective:

- The average expense report takes 20 minutes to complete and costs $58 to process

- 19% of expense reports contain errors

- On average it takes 18 minutes and costs $52 to correct an expense report

Meanwhile, Goldman Sachs estimates that automation can cut accounts payable costs by 75%.

So, how do automated expense reports work? They’re actually part of a wider process of expense management automation. This includes everything from digital receipts and expense approvals, to automated reporting and budget tracking.

While expense automation is now becoming much more common, many businesses are still stuck using outdated expense reporting methods and workflows.

A physical expense report would be filled out manually, with corresponding paper receipts for every individual expense. It would then be submitted to a manager for review and approval, which may involve edits, or back and forth communication to confirm missing information. Every manual step in the expense reporting and reimbursement process adds a layer of complexity to the overall workflow.

With automated, digital expense reporting, most of the tedious, repetitive tasks are effectively outsourced to software. This has played an important part in the rise of accounts payable automation software, a market which is forecast to be worth $5.3 billion by 2028, according to recent report by KBV Research.

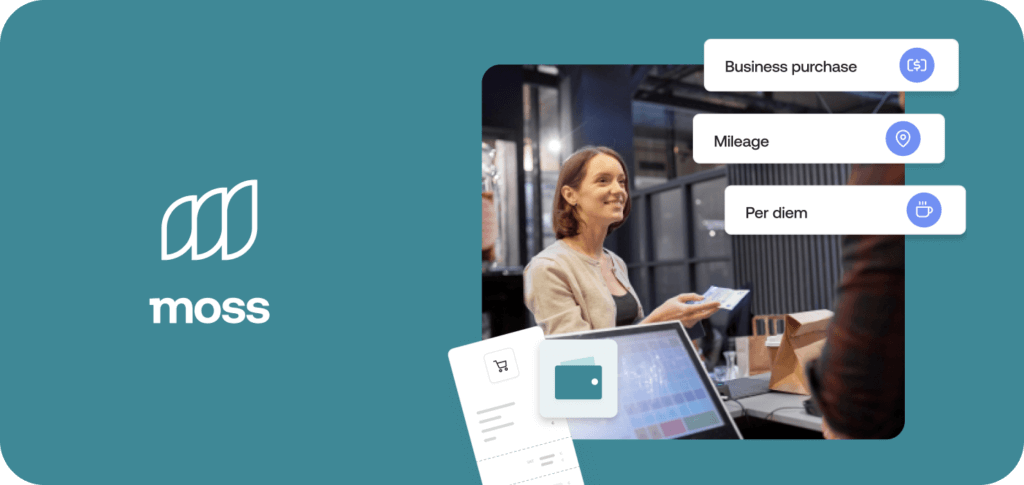

Automating expense reporting with Moss

At Moss we help businesses improve their expense management capabilities with a suite of powerful expense management tools. You can save money and team on accounting tasks with smart invoice management. Automatically extract data from invoices, and instantly send them for approval and pre-accounting in-app. Your entire paper trail is stored securely in Moss so you can review and track where your money is going in real time.

Our reimbursements module also slashes time spend on employee expenses processing. Your team can submit their receipts remotely using their smartphone camera. From there they’re automatically sent to managers for approval, and everything is added to a unified record of transactions. Alternatively, you can give your employees direct access to company funds with our high-limit, Moss corporate credit cards. You can track and control every transaction, and set up custom budget limits for individual cards.

FAQs

An expense is an itemised, categorised list of expenses that have been paid for by employees on behalf of their employer company. Expense reports are usually submitted with corresponding expense receipts which act as proof of purchase for each expense item. Expense reports are usually compiled at the end of an accounting period.

Expense reports play an important role in calculating tax, accurate accounting, and auditing. They’re also help businesses determine how and where they’re spending money on employee expenses. The more accurate and comprehensive a company’s expense records are, the better equipped they’ll be to make adjustments to their expense policy.

To calculate mileage for an expense report you need to do the following:

– Take the total mileage for the trip or trips you want to claim

– Multiply the mileage total by the mileage rate provided by your employer, or the standard mileage rate provided by HMRC

This will give you the total reimbursement figure for your car travel during your trip. It’s also good practice to separate your claim with logbook records for individual trips.

Microsoft Word has pre-defined expense report templates that you can use. Simply type ‘expense’ in the search bar and select a template. You can then edit the template to fit your individual expense report requirements.

An expense report should contain the following fields:

– Claimant details (name, department, employee ID, etc.)

– Date of purchase for each item

– Vendor information

– Expense account details

– Client/project details

– Expense amount (plus VAT)

– Notes