Variance analysis is a common tool that businesses use to compare actual versus planned performance of different business metrics. While variance analysis can be used to compare different types of variance, it’s most commonly used to assess budget performance in the form of cost variance analysis. This takes place as part of the wider financial planning and analysis and cost control processes where businesses evaluate how much money they spend on producing products and services.

The insights gained from variance analysis can save businesses significant amounts of money if carried out properly. However, variance analysis can be a complex and time consuming process.

In this guide, we’ll explain variance analysis in more detail, with examples of different types of variance analysis in action.

What is variance analysis?

The purpose of variance analysis is to help businesses improve their budget management by comparing how much they have spent in relation to how much they expected to spend in their budget. Variance analysis is usually carried out by the financial controller or other experienced members of the finance team.

As its name suggests, variance analysis aims to identify ‘variances’ and then explain why they exist through further analysis. ‘Variances’ are discrepancies in actual costs versus planned costs, and they can be either positive or negative.

For example, a business may have a budgeted production cost of £5.00 per unit of a product. If the actual production cost turns out to be £4.50 per unit, the business has a positive (or favourable) variance and is actually making a higher profit than expected.

If the production cost is £5.50, the business has a negative (or unfavourable) variance and will want to investigate further to understand why that variance exists and how to reduce it.

Different types of variance analysis

Finance professionals use four main types of variance analysis to identify variances in their budgeting.

Materials variance

Materials variance looks at the variance in the amount of materials businesses used versus the amount of materials that have been accounted for in a budget. Alongside overall variance, materials variance analysis looks at the variance in the quantity and the price of materials used. These are calculated as follows:

- Materials quantity variance:

Materials quantity variance = (Actual quantity x Standard price) − (Standard quantity x Standard price)

- Materials price variance:

Materials price variance = (Actual quantity x Standard price) − (Actual quantity x Actual price)

- Total materials variance:

Total materials variance = Price variance + Quantity variance

Materials variance analysis is essential for businesses that deal with regular price fluctuations in the core materials used to make their products. If they identify a significant price variance in one material in particular, they can attempt to bring the price back in line by finding a new supplier, ordering in higher quantities, etc.

Labour variance

Another common variance that can be identified through variance analysis is labour cost. Just like materials variance analysis, labour variance analysis looks at two different variables, labour rate/cost and labour efficiency. They are calculated as follows:

- Labour rate variance:

Labour rate variance = (Actual hours x Actual rate) − (Actual hours x Standard rate)

- Labour efficiency variance:

Labour efficiency variance = (Actual hours x Standard rate) − (Standard hours x Standard rate)

- Overall labour variance:

Overall labour variance = Labour rate variance + Labour efficiency variance

Carrying out full labour variance analysis should allow businesses to identify whether they’re paying too much for the labour that they accounted for in their budget. But, more importantly, it reveals whether or not the labour they’re paying for is efficient enough, i.e. getting the right amount of work done within a short enough time.

Overhead variance

Variance analysis is also used to look at the real versus budgeted cost of overheads. Overhead costs are costs that are not directly related to the production of products or services. They can fit into three general categories — fixed, variable, and semi-variable.

Examples include utilities (electricity, heating, etc.), legal fees, rent, any fees that are related to the general running and upkeep of the business. While overhead costs generally do not change in relation to production they offer important cost saving opportunities for businesses.

Overhead variance analysis can be separated into a number of different calculations depending on the type of overhead variance you want to measure. However, these are primarily aimed at fixed overheads:

- Fixed overhead spending variance:

Fixed overhead spending variance = Actual fixed overhead spending – Budgeted overhead spending

- Fixed overhead volume variance:

Fixed overhead volume variance = Applied fixed overheads – Budgeted fixed overhead

- Fixed overhead efficiency variance:

Fixed overhead efficiency variance = (Standard hours for production – Actual hours) x Standard fixed overhead rate

- Fixed overhead capacity variance:

Fixed overhead capacity variance = Standard cost for actual input – Standard cost for actual periods

Sales volume variance

Finally there’s sales volume variance, which businesses use to assess budget variance by looking specifically at how much of their products they have sold in relation to their budget.

There are a few different ways to calculate sales volume variance, which we’ll look at below. Each one aims to calculate the revenue brought in by products sold, and then compare that value between actual and budgeted sales volume.

Sales volume variance is important because it can help businesses refine their pricing strategy, improve distribution and marketing, and reduce costs in the production process. The most common sales volume variance calculations are as follows:

- Sales volume variance based upon marginal costing:

Sales volume variance = (Actual units sold – Budgeted units sold) x (Standard contribution per unit)

- Sales volume variance based upon absoption costing:

Sales volume variance = (Actual units sold – Budgeted units sold) x (Standard profit per unit)

- Sales volume variance based upon revenue:

Sales volume variance = (Actual units sold – Budgeted units sold) x (Price per unit sold)

Why do variances occur?

Businesses may uncover variances in their budgeting for many different reasons. These can be due to factors that are within or outside of the company’s control, i.e. controllable and uncontrollable variances. The most common causes for budget variation are:

Faulty or inaccurate budgeting

Inaccurate budgeting or poor budget management is one of the main causes of budget variation. It is classed as a controllable variance because it is a result of shortcomings in the business’s planning. However, because budgeting is a complex process that differs from business to business, there are many potential ways for budgeting to go wrong. This is one reason many businesses choose to use flexible budgeting, as budgets are continuously adjusted to account for price fluctuations or discrepancies.

Inaccurate spend data or poor spend visibility can have a severe negative impact on budgets and forecasting. Forecasts or financial models are only as good as the data that is fed into them.

Failure to meet performance expectations

Another common cause of budget variation is failing to meet performance expectations. This may be due to a variety of factors, some controllable and some uncontrollable. One example is a key hires falling through. This will negatively affect team performance and may result in a hire having to be made via an external agency for a higher cost to the business.

Alternatively, poor performance may be due to reduced employee morale following a layoff, cuts to employee welfare budgets, poor management, etc. The list of potential reasons for missing performance expectations is long, and often hard to pin down. However, they can have a tangible impact on budget performance.

Changes in business or market conditions

The final common cause of budget variance is uncontrollable changes in the wider market or business conditions a company faces. This may be a new competitor or new product that steals market share from a business, or changes in labour or materials prices.

The latter of these has been especially relevant over the past year and a half following the Russian invasion of Ukraine. The war has had a severe inflationary effect on food and energy prices, as well as a general negative effect on worldwide financial markets.

Budgeting processes usually try to account for unexpected situations or market forces as much as possible but it’s unfortunately never possible to do so with complete accuracy.

The benefits of variance analysis for your business

As we’ve discussed above, variance analysis can play an important role in helping businesses to identify overspending or underspending in relation to budgeted costs. Using specific types of variance analysis, it can even help them understand why they are overspending, and on what, i.e. labour, materials, or overhead costs.

However, it’s by no means a perfect solution. It doesn’t provide context to explain the root cause of overspending, and it requires accurate, timely spend data. In this sense, variance analysis is most effective when used together with other spend management processes and technology.

| Compare your company’s spend with industry averages: Try our comparison calculator to see how your costs compare to the industry average. >>Benchmark your SaaS spending now!<< |

Managing budgets with Moss

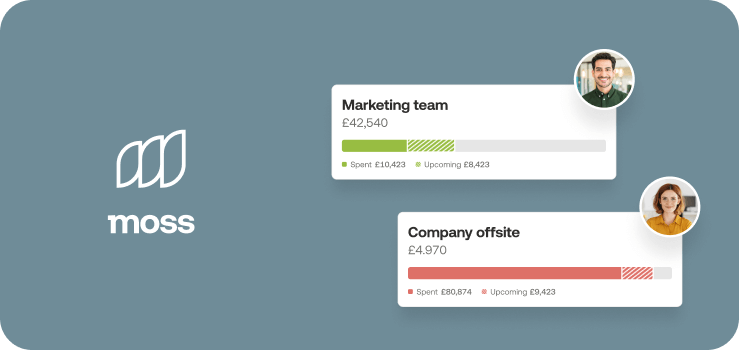

At Moss we help businesses gain control over their spending with a range of smart spend management tools. With our smart corporate credit cards, businesses can give each team or individual employee their own budget for business expenses. Each Moss card can be fully controlled via the Moss app, meaning you don’t have to worry about unauthorised or over budget spending.

Spend data from every Moss credit card is updated in real time, giving our customers unrivaled spend visibility. With a readily available reservoir of all spending that is made through Moss, businesses have what they need to carry out accurate variance analysis and budget planning. Moss also integrates with accounting platforms, including Xero, Exact Globe, and DATEV to save time and money on pre-accounting and admin.

FAQs

Variance analysis is an analytical technique that helps businesses identify and understand under or overspending in relation to a budget. Discrepancies between budgeted spend and actual spend are known variances.

The primary forms of variance analysis are aimed at identifying variances in labour, materials, overhead costs and sales. Each type of variance analysis uses different formulae and metrics to measure spending against a budget.

Identifying budget variations as quickly as possible helps businesses reduce overspending and manage project expectations. The longer a project or budget is allowed to continue off track, the more potential there is for it to seriously harm a business, both from a financial perspective and a reputational perspective.

Overhead costs are costs that businesses pay which are not directly linked to creating a product or service. This includes things like rent and legal fees, etc. Excess spending on overhead costs can be identified using overhead variance analysis.