In today’s corporate context, CFOs often go beyond conventional finance tasks and become guardians of their company’s digital transformation. In their role, CFOs usually use a variety of SaaS tools, any increasingly make use of artificial intelligence (AI) and machine learning (ML) day-to-day.

In 2023, the average number of SaaS apps used SMBs reached 253, and this number is only increasing year-over-year. These CFO tools boost productivity, generate team value, and enable a more effective financial plan. The ultimate goal is not simply financial management but also optimal business performance and long-term growth.

CFOs can master this balancing act by leveraging the best finance technologies. Getting the most out of these technologies is critical for staying ahead, but choosing the correct tools is difficult.

We prepared this guide to help you learn more about the best tools for CFOs and how to select one that meets your organisation’s requirements.

What are software tools for CFOs?

Software tools for CFOs refer to the financial tool stack that CFOs employ to streamline and manage various company processes.

Here’s a short list of areas these tools can help with:

- Payment processing – these technologies enable companies to accept customer payments through payment channels.

- Enterprise Resource Planning (ERP) – ERP systems provide visibility into essential business operations.

- Spend management – such tools simplify employee-initiated expense reimbursements.

- Human resources – the right tooling opens the door to managing and automating tasks relating to human resources.

- Payroll administration – these tools control employee salaries and financial data.

- Accounting – tools in this area are all about automating accounting-related operations to improve data quality and insights.

4 key benefits of tools for CFOs

Choosing the correct tools for finance teams is vital for tracking business-critical financial planning operations, adhering to ever-changing rules, and establishing a single source of truth (SSOT) for finance stakeholders.

Here are some of the benefits finance teams get from implementing tools for CFOs:

Streamlined processes

Fragmented financial activities reduce efficiency and jeopardise the integrity of cash management procedures. Finance technologies can help you communicate with other departments and streamline operations for more visibility.

Improved planning and productivity

The top finance solutions also help you automate common procedures, resulting in fewer mistakes and tedious processes. This increases your team’s productivity, enables data-driven decision-making, and allows you to appraise business conditions better.

Improved compliance

Organisations with worldwide operations are responsible for maintaining compliance with national and international accounting standards. CFOs can readily use financial solutions to comply with these requirements without missing any important changes.

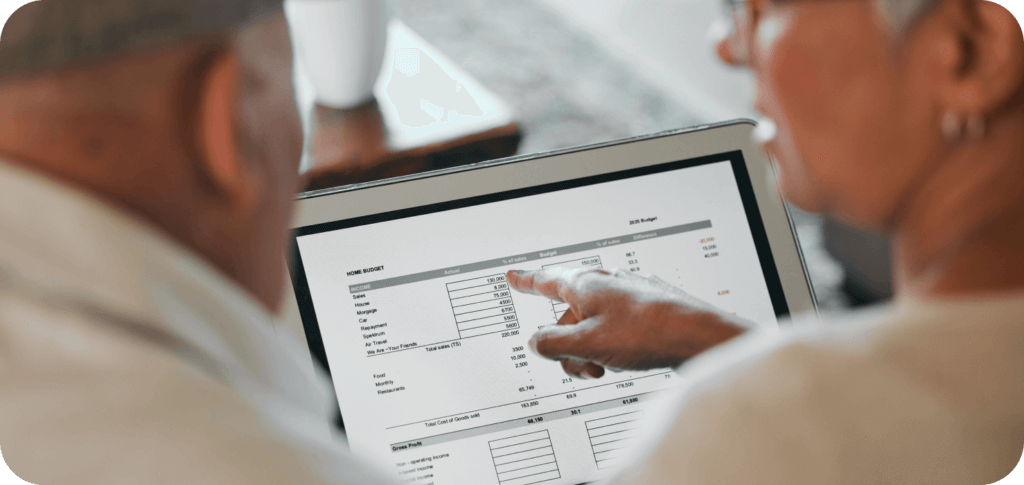

Financial transparency

Financial openness is critical for assessing your firm’s financial health. Personalised dashboards can help CFOs and corporate executives gain accurate knowledge of financial reporting, including cash flow and financial predictions.

Now that you see how beneficial CFO tools can be to various areas of business operations, let’s take a look at the best software tools for CFOs on the market.

Reporting and intelligence tools

BI software converts data from finance, CRM, marketing, and other applications into easy-to-read visual representations such as charts and graphs. Teams can then study and evaluate this data, making strategic choices based on the BI tool’s findings.

1. Tableau

Tableau is a comprehensive data visualisation tool that Salesforce acquired in 2019. Known for its exceptional user experience, most users don’t require advanced technical expertise to generate stunning charts and draw insights. However, people with Python knowledge and further training may best utilise its capabilities.

Popular features include nested sorting, a mobile version, and real-time analytics. The tool is a good match for companies eager to try new things and push the boundaries. Moreover, teams can easily integrate Tableau with other tools used on the data engineering side of the organisation to build a solid foundation for reporting.

Cloud accounting platforms

Dusty ledgers and invoice-filled file cabinets should be a thing of the past. Cloud accounting software works online and is available to team members located all around the world.

Cloud accounting technologies are extremely useful and simple to use. They also ensure compliance, data security, accuracy, and efficiency, offering everything teams need with a fraction of the trouble bookkeepers have endured for generations.

2. Xero

Xero is designed for tiny enterprises with minimal complexity and basic requirements. You can use it to pay bills, submit costs, manage purchase orders, save files, and connect to your bank.

Additionally, Xero provides fantastic integration options for businesses wishing to simplify their toolkit. Some of the most popular features of this tool include limitless users, multi-currency compatibility, and ease of use. It’s a good pick for small and medium-sized businesses with little in-house accounting help.

3. NetSuite

NetSuite’s cloud accounting capabilities allow finance teams to swiftly close their books while maintaining a consistent view of cash flow and corporate finances. The tool is considered the industry leader for rapidly expanding companies, providing more advanced features than any other small company accounting platform.

NetSuite is an end-to-end accounting system with configurable dashboards and real-time insight. Although organisations of all sizes can use it, medium-sized businesses and enterprises stand to benefit most from it.

Payment processing tools

A business needs payment gateways to process consumer payments. Such technologies are critical for providing a seamless customer experience, creating month-end closing statements, and achieving profitability. Here are some of the best payment processing solutions that can help you get the job done smoothly.

4. Stripe

Stripe’s payment processing technology is a good choice for businesses of any size. It not only has simple APIs but also a variety of features that allow you to send invoices, track spending, combat fraudulent activity, and collect payments in many currencies. Stripe’s pay-per-go model charges 2.9% + 30¢ for each successful card charge.

5. PayPal

PayPal allows you to accept consumer payments from anywhere. Whether you need a checkout solution, a payment solution for recurring payments, or a purchase now, pay later option, PayPal has you covered. PayPal charges various prices for commercial transactions, so verify the details before signing on.

Enterprise Resource Planning (ERP) tools

Enterprise Resource Planning software is critical for streamlining normal business procedures and providing a bird’s-eye view of overall corporate operations. Here are some of the most effective ERP tools that CFOs can choose from.

5. SAP ERP (S/4HANA Cloud)

SAP S/4HANA Cloud is primarily focused on enterprise-level businesses, with worldwide clients like the NBA and PwC. While this might make it more difficult and time-consuming to set up, the tool has been praised for its resilience and the variety of tools and procedures accessible. SAP S/4HANA Cloud includes payment processing systems, API connectors, and configurable processes.

6. Acumatica

Acumatica is a cloud-based ERP system with a unified data model and connections to enable smooth cross-team processes. Its automated solutions enable you to operate your whole organisation with ease. Manufacturing, retail, distribution, and e-commerce are among the industries that use it most frequently. Acumatica offers a pay-only-for-what-you-use approach, which means you pay for computer resources rather than each user you add.

7. Odoo

Odoo is an open-source ERP that helps you optimise operations by connecting services. Integrating several business areas, such as inventory, sales, marketing, and finance, gives you a 360-degree picture of corporate operations. Odoo costs vary depending on the number of apps and users, so consider which package suits you.

8. Microsoft Dynamics 365

Microsoft Dynamics 365 is one of the most popular ERP systems. It enables organisations to achieve operational excellence by connecting numerous business apps. The platform includes pre-built applications, AI-powered insights, sophisticated analytics, an integrated cloud, and more.

Microsoft Dynamics 365 provides a general ledger, AP automation and purchase orders, bespoke reporting, and data import/export. Users find it simple to use. You can use the platform to build process notes and procedures into the system to help other users.

It’s a good choice for businesses that are already familiar with the Microsoft suite. The platform unifies your accounting, procurement, and reporting operations and works seamlessly with other popular Microsoft software.

Spend management tools

Spend management or expense management tools are critical in helping companies process, pay, and audit employee costs and reimbursements.

With these solutions, you can erase the paper trail, allow cloud accounting, and improve how employees use firm financial resources. Here are some of the top cost management solutions that CFOs may pick from.

9. Moss

Moss helps increase the finance team’s efficiency by 47% through simpler receipt gathering, automatic spending classification, and one-click export to accounting software.

Employees may be issued cards with completely customisable limitations in only one click. Custom approval procedures and optional transaction evaluations ensure real-time monitoring and control over all card expenditures.

You won’t have to worry about losing receipts. Spenders can easily capture receipts with our app, and Moss can retrieve them automatically via Gmail and Outlook. For financial and administrative teams, one-click reminders and optional card-barring tools make compliance enforcement easier.

Users can view card spending in real time, automatically classified and pre-coded for easy inspection. Moss’s two-way connections with top accounting software keep your chart of accounts in line with Moss and enable dependable exports.

Accounting tools

If your accounting staff still uses spreadsheets, it may be time to transition to cloud-based accounting systems for increased visibility and automation. Here are some of the best accounting software programs with major features.

10. FreshBooks

Freshbooks is one of the best accounting software options for businesses of any size. It has several functions, such as invoicing, spending, time tracking, reporting, accounting, etc. It also supports connections with over 100 apps for easy company bookkeeping. Prices range from $6 to $20 per month.

11. Wave Accounting

Wave Accounting is another popular accounting program among small firms. Its features include invoicing, billing, payment monitoring, finance management, and more, which help improve accounting efficiency and expedite bank reconciliation. Wave’s accounting software is completely free of charge, with no setup fees or hidden costs.

12. Zoho Books

Zoho Books is an online accounting software that provides comprehensive accounting solutions. The software’s key features include accounts receivable, payables, inventories, banking, time tracking, and 1099 reports. It also enables connections with over 40 apps, making it easy to be tax-compliant.

The best news is that Zoho Books is free for firms that generate less than $50,000 in revenue. The base pricing plan is $15 per month.

Payroll & HR Tools

You need tools that match the expertise and skill sets of finance and human resource professionals. Payroll affects every employee, so HR technologies must be user-friendly.

Payroll software and management solutions guarantee that employees are paid on time and properly. These technologies also assist you in calculating taxes and complying with federal tax requirements.

The following tools ensure that employees are paid on time, payroll operations comply with legal requirements, and privacy is protected.

13. Workday

Workday is a prominent human capital management application that includes advanced analytics, self-service capabilities, time tracking, payroll, and benefits administration, among other features. Workday is also equipped with clever automation, which lowers human operations across the attract-to-pay cycle.

Workday doesn’t provide detailed pricing on its website. The tool’s pricing starts at $100 per month per user.

14. Breezy HR

Breezy HR is a comprehensive recruitment software that helps your team optimise the hiring process. It includes features such as talent sourcing, a career portal, candidate management, job posting, reporting, and much more.

It offers many price choices, including bootstrap (free), startup ($143/month), growth ($249/month), and business ($399/month).

15. Paychex

Paychex is a popular payroll administration software with an easy-to-use interface and the ability to handle payroll on the move. Other features include enhanced analytics, improved general ledger service, tax deposit notices, payroll journals, and more.

Pricing is not published online, however, you may get a free quotation via the Paychex website.

16. Patriot

Patriot is well-known for providing speedy and accurate payroll management in three easy stages that take less than three minutes. You can enter hours, authorise payroll, and print checks; the tool will handle everything for you.

The basic payroll starts at $10 per month, while the advanced payroll costs $30.

How do you find the best tools for finance teams?

Every company seeking to increase efficiency and economic success may benefit from leveraging digital technology, but selecting the best one necessitates comparison and evaluation. Here are some factors to consider that help CFOs select the optimum financial technology stack for their organisations.

Budget

If you work for a small or medium-sized company that wants to implement financial systems, your budget is likely the most important consideration.

If you already have certain tools, search for finance software that can be incorporated into them. Smaller businesses may continue to use Excel or Google Sheets until they see the necessity for a financial solution.

Scalability

You don’t want to adopt a financial tech stack that will no longer serve you as your company grows – or will require extensive and costly updates. Finance solutions that can grow with your organisation are unquestionably the best option.

Before proceeding, discuss your current and prospective requirements with the team behind your selected tool to verify that it is something that can develop with you.

Automation

Finance teams are in charge of various manual duties, including data input, data analysis, and the execution of critical financial procedures such as bank reconciliation.

Intelligent automation enables your staff to do more valuable work and make strategic decisions. Many cloud-based solutions now provide automation features, allowing you to drive business success.

Data security

Every day, businesses of all sizes handle sensitive financial information. A financial management application that protects your data while providing granular access restrictions to users is critical to its success.

How Moss can help your business

Given the abundance of options, CFOs often struggle to select the best finance management solutions. The key to finding the proper match is knowing the technology stack that will allow you to automate time-consuming operations, handle high-volume jobs, reduce manual mistakes, and provide complete financial insight.

Moss’ smart spend management software allows businesses to save time and money with automated accounts payable workflows. Our customers can create purchase requests in Moss and automate approval chains to ensure each request goes to the right person for sign off.

Moss also allows you to automatically extract data from invoices using OCR scanning directly from your smartphone. Using the invoice management module, this data can be stored and passed on via direct integration to popular accounting software platforms, including Xero and DATEV.