The benefits of flexible budgeting in an uncertain economy

Our latest white paper — Indirect costs: Optimising ad budgets in a downturn — uses real digital ad spend data to assess how digital advertising spending has changed over the past 18 months.

One of the main trends we identified during our research was a shift towards performance-related ad channels, particularly since the start of 2023. There are a few different reasons for this, but ultimately it’s a symptom of businesses adapting to the ongoing economic downturn.

Finance teams are having to be more careful with budgets and, at the same time, digital advertising channels and their engagement levels are changing. This rapid change isn’t just limited to advertising. It’s happening in many different sectors.

As a result, businesses are having to adapt with new budgeting methods and improved processes to manage how they spend their money.

White paper

Indirect costs: Optimising ad budgets in a downturn

In this article we’ll explain how conventional budgeting processes are holding many businesses back in the current economic climate. Instead, we see flexible budgeting as a powerful alternative that can help businesses remain agile. But they need to be equipped to do so. Read on to find out more.

The drawbacks of conventional budgeting

Businesses use many different budgeting techniques to estimate and allocate resources in order to drive growth.

One of the most popular and widely used budgeting techniques is incremental budgeting. It primarily uses historical spend and cash flow data to estimate how much money a business will need to cover its costs going forward.

Building a budget in this way does have advantages — it’s reasonably straightforward, not too resource intensive, and it's effective (if the economy and business in question is behaving predictably).

“Although organisations need to be as adaptive to change as possible, budget rigidity serves only to stifle innovation and responsiveness to change.” - Association of Chartered Certified Accountants

However, incremental budgeting is fundamentally rigid in the way it allocates funds for spending. Once the budget has been set, it's difficult and time consuming to revise. Additionally, because incremental budgeting is built primarily upon retrospective data, it’s often highly inaccurate when a business, market or industry is undergoing rapid change.

Rigid budgets also tend to go hand in hand with long planning cycles. The longer a budget cycle is in effect without being updated, the more likely it is to be inaccurate.

This is precisely why incremental budgeting is inadequate for many businesses in times of economic uncertainty.

The benefits of flexible budgeting

Taking a more flexible approach towards budgeting, from the corporate level, all the way down to individual projects, offers many potential benefits.

First and foremost, flexible budgeting allows businesses to adapt, and even capitalise upon unexpected change far more easily. This may be in response to shifting market conditions, emerging technology, changing consumer behaviour, organisational growth, etc.

“A flexible budgeting process can give product teams the creativity and accountability needed to deliver business value” - Deloitte

The less restricted by rigid budget limits and lengthy planning cycles teams are, the more able they are to make quick, proactive decisions that will benefit their company. Financial resources can be reallocated as needed to seize upon unexpected opportunities, or prevent bad situations from getting out of hand as early as possible.

That being said, flexible budgeting still requires certain limits and controls to ensure that spending doesn’t spiral out of control. There needs to be a clear budget approval process, with hierarchical oversight to approve spending as it happens. There also needs to be a clear paper trail that links specific spending decisions to specific individuals within the company.

Facilitating flexible budgeting with flexible payment

To enable real flexible budgeting, businesses need to be equipped with flexible payment capabilities. Following flexible budgets with conventional business payment solutions (like old school business credit cards) can make it very difficult to accurately attribute costs and maintain financial records.

Conventional business credit cards typically provide monthly statements, with little or no separation of bill items by category, payment type, payee, etc. This adds huge amounts of admin time to finance teams' plates, and wastes financial resources.

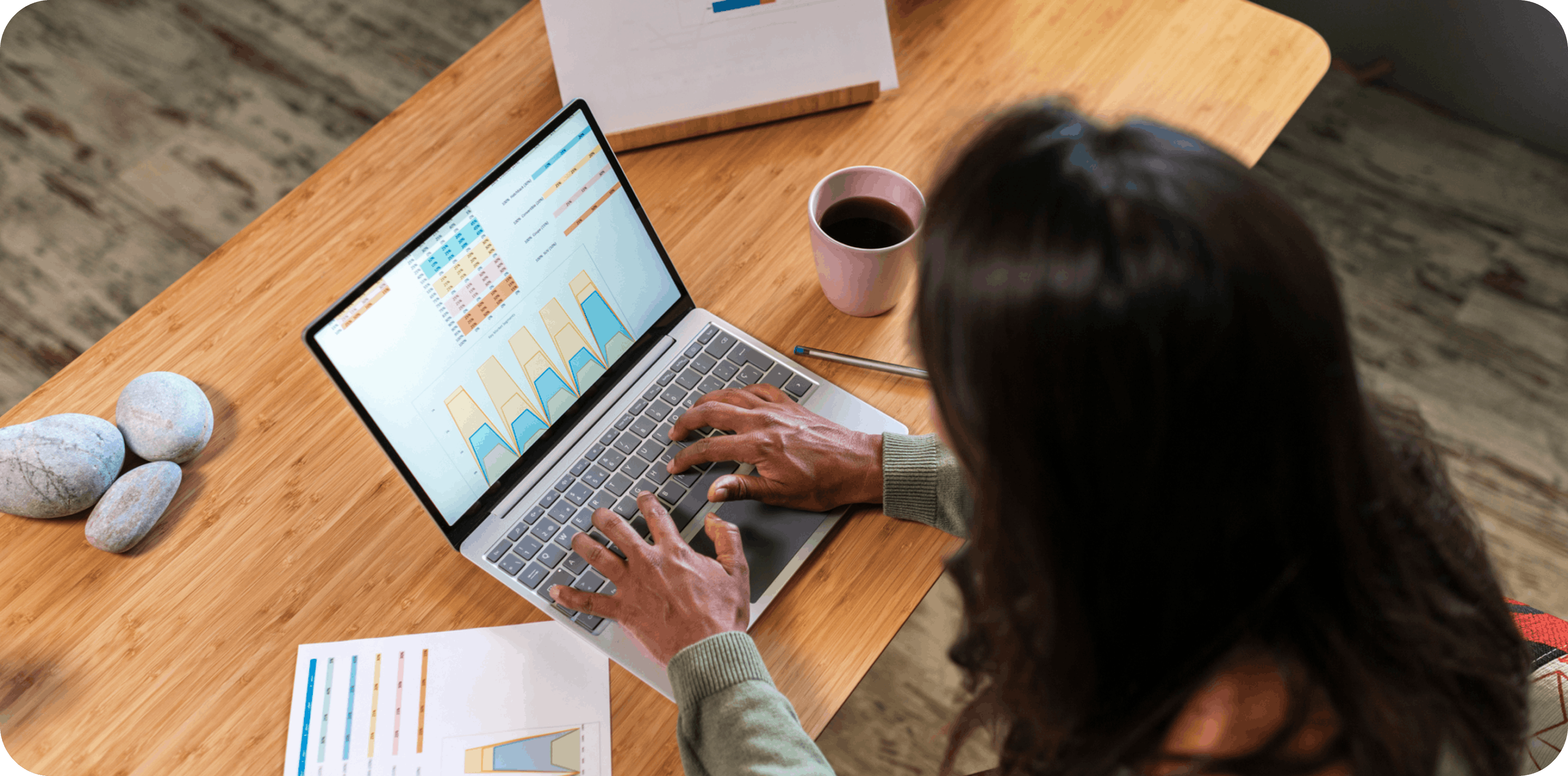

This is where modern spend management software and smart corporate credit cards come in. They allow companies to monitor and control every penny they spend, and tie it back to individual teams or employees.

Spend can be tracked and controlled with custom flexible budgets, while businesses get real time granular data for unrivalled reporting accuracy. As long as businesses are equipped with these flexible spend capabilities, flexible budgeting has a huge amount to offer.

White paper

Indirect costs: Optimising ad budgets in a downturn