Reverse VAT for businesses was introduced in the EU in 1993 and eventually also adopted within the UK across specific sectors. It is a variation of the standard Value Added Tax (VAT) regime, under which suppliers have the responsibility to account for VAT and remit it to the tax authorities in the event of a sale. The reverse VAT mechanism is a specific application of this where the responsibility gets shifted to the buyers instead. This is primarily an intervention by the tax authorities to simplify tax administration, improve compliance while reducing fraud in industries where tax evasion had become a concern.

In this blog, we break down everything you must know about reverse charge VAT.

What is reverse VAT?

Reverse VAT or reverse charge VAT is a mechanism in which the obligation to report and pay VAT to the HMRC is transferred from the seller(supplier) to the buyer(recipient). It also sometimes also called tax shift.

How does reverse VAT work differently from standard VAT processes?

As per the standard VAT process, the seller is required to collect VAT from the buyer and remit it to the tax authority HMRC. In other words, the buyer needs to pay the VAT in addition to the price of the goods/services bought. Buyers can usually claim this back as input VAT, provided they are VAT registered.

Under the reverse charge VAT mechanism, the seller does not need to charge VAT on the invoice. Instead, the onus lies with the buyer to calculate the VAT which is due on the transaction and pay it to HMRC directly. They need to report this in their own VAT return as both output tax (as if they had sold the item) and input tax (as if they had paid the VAT).

If the buyer is eligible to reclaim VAT, the output tax and input tax usually cancel each other out, leaving no net VAT as due. However, in situations where the buyer is partially exempt or is not registered for VAT, they may have to incur the VAT payment liability without getting to reclaim it.

Why was reverse VAT introduced in the UK?

Reverse VAT was introduced to enhance overall the country’s tax administration and mitigate the risk of revenue loss arising from missing trader fraud. In cross-border transactions and specific sectors, fraudulent traders were collecting VAT but were not submitting it to the tax authorities and going missing. According to estimates, revenue losses from such missing trader fraud in certain industries added up to as much as 5% of VAT revenue, which led to the introduction of reverse VAT.

Where is reverse charge VAT applicable in the UK?

In the UK, reverse VAT’s implementation formally came into play, starting in 2016. It began with the telecommunications sector and has expanded ever since to include various sectors such as the construction. As of today, reverse VAT is applicable in the UK across the following specified goods and services:

List of specified goods where reverse VAT is applicable in the UK:

- Mobile phones

- Computer chips

- Wholesale gas

- Wholesale electricity

List of specified services where reverse charge VAT is applicable in the UK:

- Emission allowances

- Wholesale telecommunications

- Renewable energy certificates

- Construction services

The term “wholesale” in the above refers to business-to-business (B2B) supplies where the intention is to sell on the supply with no or negligible consumption of the supply by the concerned businesses. Each of these have their specific details, definitions and exceptions that can be accessed in detail here.

An example of reverse VAT application

Let’s look at a B2B scenario involving a cross-border supply of construction services. Let’s assume, the buyer, ABC Ltd, is a VAT-registered business established in the UK. It is purchasing services worth £1000 from a German company, XYZ Ltd.

The German company XYZ issues an invoice for £1000 with no VAT applied to ABC Ltd. In this situation, ABC Ltd, as the buyer, has the responsibility to assess the VAT obligation. It needs to apply the same VAT rate to the purchase that would accrue if it purchased the same services from a UK company. Let’s presume it’s the standard 20% UK VAT rate. In this situation, the resulting £200 VAT liability needs to be accounted for by ABC Ltd in its VAT return.

Is there any situation where reverse VAT doesn’t apply?

Yes. Reverse VAT mechanism isn’t effectively applicable under the following circumstances:

- Non-VAT registered entities:

VAT registration within the UK is a prerequisite for the reverse charge mechanism to be applicable. If your business has not crossed the VAT registration threshold or you have not voluntarily registered for VAT, you’re deemed to be outside the scope of reverse VAT. This means you can handle VAT as usual, charging it on sales and reclaiming it on your purchases.

- Zero-rated supplies:

Zero-rated supplies refer to taxable goods and services whose VAT rate is set at 0%. Some examples include food items, books, and children’s clothing. Since no VAT is charged on these supplies, the reverse charge VAT mechanism also does not apply.

- International export from UK:

The territorial limits of VAT, a UK tax, come into play here. If a UK business provides services or works overseas, those activities fall outside the UK’s VAT system, and the reverse charge VAT does not apply in those cases.

- End-users and intermediary suppliers:

An end-user is the final consumer of a product or service. Intermediary suppliers are those who provide a service but do not significantly consume the goods or services involved. In both cases, the reverse charge does not apply because these entities are either the final point of VAT collection or do not engage in further taxable supplies that would trigger the reverse charge.

- Compensation of employees and temporary workers:

This exemption arises from acknowledging that such payments are wages or salaries which beyond the scope of VAT altogether (VAT only applies to goods and services, not employment costs). Therefore, whether you hire someone directly or through an agency, the reverse charge VAT does not apply to their compensation.

Now that we understand the basics, let’s get into the implementation side of things.

How to implement reverse charge VAT compliance?

Calculating and implementing the reverse charge VAT mechanism involves the following steps:

Step 1: Ascertain the applicable VAT rate

You need to start by checking the exact tax rate applicable. The standard VAT rate under the reverse charge mechanism is 20% which applies to the value of the service or item purchased. However, there are some goods and services that are eligible for a reduced VAT rate or are zero-rated. So, you need to check on these and your reverse charge VAT calculation for these needs to be adjusted accordingly.

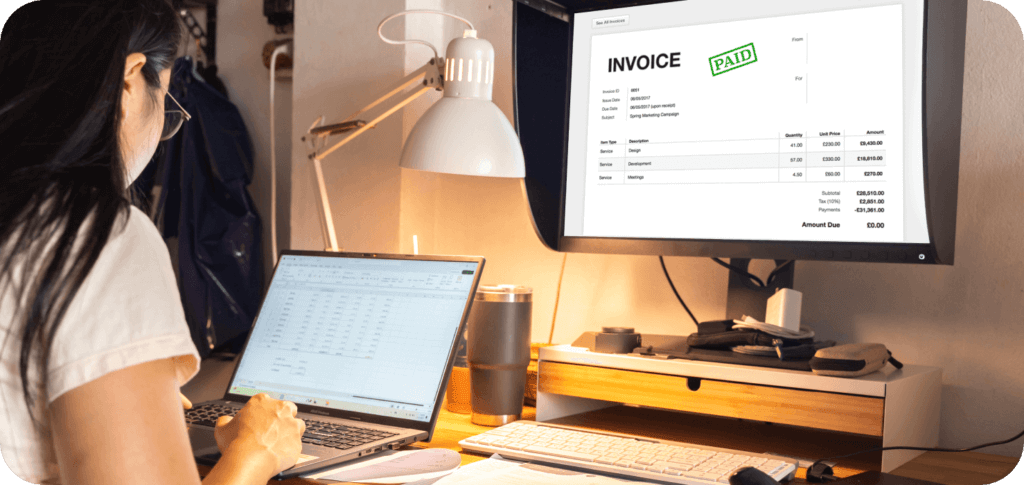

Step 2: Supplier issues invoice indicating the applicability of reverse charge

The supplier will issue an invoice for the service or item they provide. This invoice will list only the net cost without adding any VAT when reverse charge VAT applies. The same invoice will also specify that the reverse charge mechanism applies to this transaction. If you’re a buyer, this should act as an alert about your responsibility to calculate and account for the VAT instead of the supplier charging VAT directly.

Step 3: Calculate the reverse charge VAT applicable

The next step is to calculate the exact amount of reverse VAT charge that you need to account for.

For this, start with the total cost of the service or item as stated on the invoice. Divide the amount by 100 to determine 1% of the total. Next, multiply this result by 20(or the applicable rate) to calculate the VAT that needs to be applied.

As an example, let’s assume the cost of the service or item is £1,000, and a 20% rate is applicable: You need to divide £1,000 by 100, which equals £10. Next, multiply £10 by 20, which gives you £200. Therefore, the reverse charge VAT on this transaction would be £200.

Step 4: Apply the reverse charge VAT and account in your return

Finally, after calculating the reverse charge VAT amount, you need to account for it in your VAT return. You need to report this calculated VAT as output VAT (the VAT you would typically charge) and input VAT (the VAT you would normally reclaim). These would effectively cancel each other out if your business is VAT registered.

Getting these steps streamlined becomes much simpler using the support of specialised software.

How can using software simplify implementing reverse VAT invoicing?

- Introduces ease and accuracy in calculating VAT

Implementing software with advanced VAT management features can help you reduce the manual effort and risk of potential errors associated with traditional VAT calculation methods. You can configure the software to recognise transactions under the reverse charge VAT system, ensuring VAT is always accurately accounted for and reported. Such automation is particularly beneficial in high-volume environments with frequent and complex transactions. - Simplifies VAT compliances

Accurate invoicing and documentation from the use of software ease out compliances. Compatible software helps ensure that invoices indicate the use of the VAT reverse charge, including necessary details such as the VAT rate and the buyer’s VAT registration number. Automation minimises the risk of errors and ensures that all the required information is consistently included. This helps ensure compliance and avoid any disputes with tax authorities. - Helps prepare better for any audits and regulatory checks

Software solutions offer powerful record-keeping capabilities, enabling excellent storage of transaction data, invoices, and VAT returns within a centralised system. This ensures that all records are well-organised, easily accessible, and comprehensive – an essential factor for smooth audits and regulatory checks. - Provides a way to keep up to date with regulations

Advanced software solutions offer upgrades that help you stay abreast with any changes in VAT laws and regulatory changes. This ensures your business workflows are always aligned with current regulatory requirements. Furthermore, inbuilt automated alerts and compliance checks also help to identify any potential issues before they turn into significant problems. - Ensures consistency in financial records

VAT management solutions integrate with other financial systems, like Enterprise Resource Planning (ERP) and accounting software. This integration allows for a cohesive approach to financial management, where reverse VAT data is synchronised across various platforms. This helps to enhance overall efficiency by providing a unified view of financial transactions and ensure consistency across financial records.

How do you streamline your reverse VAT accounting workflow using technology?

Here are some steps to follow if you’re implementing reverse VAT using specialised software solutions:

Step 1: Ascertain applicability

Start by assessing whether reverse charge VAT applies to you. This can be challenging if your business has extensive supply chains or operates across multiple jurisdictions. To avoid mistakes, consult relevant VAT regulations or seek professional advice on applicability. Make sure your staff is on board, and they understand this too.

Step 2: Upgrade your accounting systems

Look into your accounting system and check if it can correctly apply reverse VAT charges and manage transactions wherever applicable based on your declarations in the software. If it lacks these capabilities, look for upgraded technology to support you. This will help you ensure your reverse VAT transactions are always processed accurately, with minimal intervention needed to ensure the integrity of your financial reporting.

Step 3: Train your staff in using relevant tools

Make sure your employees are well trained adept in using the software to ensure accurate VAT application and compliance. See to it that they get proper training sessions on using the software and have the availability of prompt, ongoing support, should they have any doubts.

Step 4: Maintain records and documents.

Make sure you keep the invoice records complete and up to date. Any lapse in documentation can result in compliance issues and potential penalties. Using VAT software solutions usually simplify this record-keeping process. Take proper backups.

Step 5: Monitor and review compliance

Remember, reverse VAT for businesses is not a one-time setup; It requires ongoing monitoring and review to ensure continued compliance with evolving regulations. To remain compliant, review regulatory changes from time to time and ensure your transactions and VAT filings are applied correctly.

Want a head start with simplified VAT compliance? Explore Moss’s AI-powered, precision accounting

Moss’s automated VAT feature can help you streamline your VAT and reverse VAT compliance and help you do much more to simplify your accounting workflows and ensure compliance.

Moss lets you assign attributes such as Cost Centres, Subcategory and other to transactions. Based on this, the tool follows different rules, patterns and practices unique to your company. The Smart Automation in the back end also utilizes AI capabilities to automatically pre-code your transactions, based on its learnings from your unique historical data. These predictions by Smart Automation significantly outperform the accuracy of any default accounting rules that you set up. In short, you get improved accounting accuracy with reduced time, effort and costs.

Finance teams at Europe’s leading companies trust Moss to streamline their accounting. Read our customer success stories here. Prefer to see how it works? Book a demo to learn more.

FAQs

Reverse VAT, or VAT reverse charge, is a mechanism where the responsibility for VAT reporting and payment is transferred from the seller to the buyer for specific transactions.

Reverse charge VAT works by transferring the onus of paying VAT from the seller to the buyer. Under it, the buyer accounts for and pays the VAT directly to the tax authorities rather than the seller collecting and remitting it.

Buyers do not pay the reverse VAT directly to the seller. Instead, they account for it and pay the VAT themselves to the tax authorities in their returns. However, it’s important to note, this mechanism applies to certain types of transactions within specific industries.

Reverse charge VAT is primarily designed to prevent VAT fraud by combatting MTIC fraud or carousel fraud. This happens when businesses charge VAT but then disappear before paying the VAT to the government. Reverse VAT also simplify the VAT reporting process in many cases, and reduces the administrative burden on businesses. It shifts the responsibility for reporting and paying VAT from the supplier to the buyer, particularly in cross-border transactions and high-risk sectors.