It’s not unusual to see pending transactions on your banking app or statement after making a purchase. You’ll see this tag or label even after having your purchase confirmed by the vendor, and it’s particularly common when buying things online. But what does it actually mean?

What are pending transactions?

Pending transactions are transactions that have been initiated but are still being processed. Technically the money is moving between your bank and the vendor’s bank and, as such, is removed from your immediate balance.

What’s going on behind the scenes?

There are three distinct processes involved in card payment processing — authorisation, settlement, and funding. Usually, if a transaction is marked as pending, it means it has been held up during the authorisation phase of processing.

Here’s a more detailed explanation of what’s happening behind the scenes when you pay with a credit or debit card:

- Authorisation

Following payment verification (entering your PIN or paying online), the merchant requests payment authorisation from your bank (the issuing bank) via the payment processor and card association.

Upon receiving this request, your bank will evaluate factors like your available balance, security credentials, card validity, etc. Depending on the outcome of these checks, it will then approve or decline the transaction.

Note: From the moment the transaction is authorised by the issuing bank, it is marked as pending. This process is fully automated and happens within a matter of seconds.

- Settlement/Funding

After receiving payment authorisation the vendor sends the transaction details to their payment processor, who adds the transaction to a batch along with many other transactions. Batch processing helps to save time and increase efficiency. This may be at the end of the day, at the beginning of the week if a payment is authorised over the weekend, or even longer if the payment coincides with a holiday.

The payment processor then sends the transaction to the issuing bank (customer’s bank) via the appropriate card network. Upon receipt of the transaction, the issuing bank charges the customer’s account. It then sends the money to the merchant’s bank, who then deposits the money in the merchant’s bank account.

Note: The transaction is completed once the funds have been deposited into the merchant’s account.

What are posted transactions?

Posted transactions are simply transactions that have been fully processed. In other words, they are transactions that have been ‘posted’ to the cardholder’s account and the funds have been subtracted from the current balance.

Times when you may see a pending transaction

As we mentioned above, transactions are usually marked as pending following authorisation by the issuing bank, but before final settlement/transfer of funds. There are a number of common scenarios where you may see a pending transaction on your account, including:

- Subscription payments

Monthly subscription payments tend to be finalised on the same day each month, but initial authorisation may happen a couple of days before. As a result it’s normal to see your subscriptions as pending transactions. To find out more about subscription management check out our article.

- Transactions using pre-authorisation

Many vendors use pre-authorisation as a safety precaution when taking payments from customers. Pre-authorisation effectively allows vendors to take a deposit from customers’ cards in the form of a temporary hold on funds. Held funds are reserved and marked as a pending transaction on the card. When it comes time to pay this hold is reversed or converted to a charge to cover the final cost. Pre-authorisation is commonly used by hotels and car rentals because it gives an extra level of security in case the customer damages property and cannot pay, etc.

- Bank transfers

Bank transfers, including wire transfers and electronic funds transfers (EFTs), will often appear as pending transactions during processing. In comparison to card payments, bank transfers often take longer to process.

- ATM transactions

You may also see transactions made via ATM show up as pending on your banking app as it takes longer to process transactions involving cash. This applies to cash withdrawals and cash deposits.

- Online purchases

Many online retailers hold off on processing transactions until they have shipped the product. This means you’ll see a pending transaction until your item has been shipped.

How long do pending transactions take to clear?

One of the main questions that crops up in relation to pending transactions is how long do they take to clear?

Unfortunately, there’s no definitive answer here. The timeline for a transaction to move from pending to posted can vary significantly, depending on a couple of different factors:

- Merchant and transaction type

Different merchant and transaction types have different timelines for payment processing. For example, it’s common for ecommerce vendors to wait until they’ve posted an order to commence processing.

- When the transaction took place

Many transactions will show as pending over non-working days, meaning transactions may show as pending over weekends and holidays.

Typical processing times for different transaction types are as follows:

- Cash and direct deposits are usually cleared by the following business day

- Check deposits can take up to two business days

- ACH (Automated Clearing House) transfers typically clear within one to three days

- Standard wire transfers typically clear within a day, while international wire transfers clear within two days

- Pending credit card transactions may take up to three days to clear

Can you cancel a pending transaction?

While there is no quick and easy mechanism to cancel a pending transaction via your bank or card provider, it may be possible for the vendor to do so. However, you’ll need to contact them in time so that they can cancel the transaction before it is fully processed.

If you do not manage to do this in time, you do have a couple of other options that can help you get your money back:

- Request a refund

The most obvious way to get your money back is to request a refund from the vendor. However, contrary to popular opinion, sellers or retailers aren’t always obliged to offer you one.

While online purchases are protected by a 14-day return period (unless the item is personalised, perishable, gambling-related, etc.), in-store purchases are bound by each vendor’s specific returns policy. This can vary between shops, and you may need a valid reason to request a return. Additionally, many retailers only offer in-store credit, as opposed to a cash refund.

As a result, it’s important to be aware of the specific returns and refunds policy of any shop or vendor you purchase goods or services from.

- Request a chargeback

An alternative, more drastic option is to initiate a chargeback via your card provider. Chargebacks are a mechanism that allows cardholders to reclaim money from vendors via a dispute. While chargebacks are effective, provided you have a valid reason to initiate a dispute, they can negatively impact your credit score. You can find out more about this in our article on the advantages and disadvantages of credit cards.

Both of these options can help if you’ve accidentally approved a transaction or have a valid reason to reverse a purchase. However, if you see a pending transaction on your account that you don’t recognise, your first port of call should be your bank or card issuer. This could mean that your card has been used fraudulently or, if related to a corporate credit card, may suggest company card misuse by an employee.

Current balance vs. available balance

Because pending transactions are transactions that have not yet been fully processed, they have a different effect on your account balance than normal transactions.

It’s important to know the difference between current balance and available balance, as pending transactions are counted against your available balance, but not your current balance:

- Current balance

The total amount of money in an account including all cleared and posted transactions. The current balance reflects the actual balance of the account at the end of the last business day, and does not account for pending transactions that have not yet been processed.

- Available balance

The total amount of money in your account that is available to spend. This is the current balance plus or minus any pending transactions, including pending payments and pending deposits.

Because of the way these figures work, your available balance will often be different to your current balance. Pending transactions will reduce your available balance before your current balance, while pending deposits may be added to your available balance before being added to your current balance.

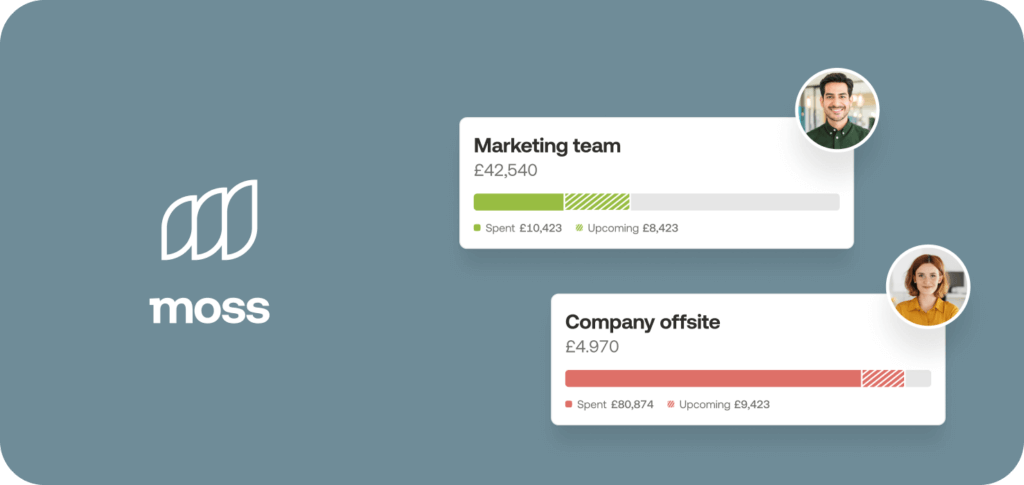

Business payments with Moss

Moss’ spend management platform is designed to give businesses end-to-end control over their business payments and expenses. Using our selection of spend management tools, businesses can save time and money through more efficient spend workflows.

Moss customers have access to an unlimited number of virtual credit cards that they can give to departments, teams, and individual employees. Each card can be set up with custom budgets to ensure that your team never spends more than they need.

You’ll get better spend visibility with a single repository of all spend data that’s gone through Moss and any other connected accounts. We also integrate directly with major accounting software platforms like Xero and DATEV to streamline your accounting and reporting flows.

FAQs

Pending transactions are transactions that are still being processed. Transactions are marked as pending following initial authorisation by the issuing bank and remain pending until final transfer of funds to the receiving bank account has been completed.

Posted transactions are transactions that have finished processing and have been ‘posted’, i.e. added to the recipient account.

How long a transaction takes to clear can vary depending on the vendor, payment type, and when the transaction took place. For example, credit card payments may take up to three days to clear, and potentially even longer if they coincide with a public holiday.

Unfortunately there is no mechanism that you can use as a customer/payer to cancel a transaction that is in progress, i.e. pending. However, the vendor may be able to cancel the transaction if you contact them in time.

Your bank account’s current balance is the total amount of money in your account, excluding pending transactions. It includes all transactions that have been fully processed and cleared. The available balance, on the other hand, takes pending transactions into account and represents the actual balance that can be used right now. This means it adjusts your current balance for any transactions that have been authorized but not yet posted, providing a real-time estimate of the funds you can access.