Company credit cards allow businesses to streamline all sorts of internal processes by giving employees direct access to company funds. But this involves a great deal of trust between a business and its employees. Employees are effectively given free reign to spend the company’s money on business-related expenses.

When it comes paying, there’s little in the way of direct restrictions on what company cards can be used for. As a result, there’s a significant risk of misuse unless proper precautions are taken.

What happens in the unlikely event that an employee uses a corporate card for personal purchases? Is there anything a business can do once a purchase has been made? And what additional measures can you take to discourage misuse in the first place?

In this guide, we’ll cover the topic in more detail, and outline how businesses can tackle company card misuse with a few simple measures.

Is it illegal to use a company card for personal use?

First, let’s cover legality. Contrary to popular belief, it’s not actually illegal for an employee to pay for personal items with a company card. Normal business cards function just like personal debit cards in the sense that you can use them at any vendor that accepts card payments.

However, it is illegal for an employee to use a company card fraudulently. Fraud is sometimes a bit of a grey area. But in this case it mainly depends on whether or not the employee follows the procedure laid out by their employer.

This means only using a company credit card for expenses that are permitted in the company’s expenses policy. What it really boils down to is whether or not the employee informs the employer of accidental company card misuse as soon as possible.

If misuse deliberately goes unreported it crosses into the territory of fraud. Once this happens, it’s the amount of money that’s been misappropriated that will determine whether the employee is simply fired or potentially reported on grounds for criminal charges. Corporate card misuse in is actually one of the most common forms of embezzlement, and it can come with serious prison time in the event of a conviction.

What should you do if an employee intentionally misuses a company card?

Company credit cards link directly to company funds or credit, and any mis-spend directly affects the company’s finances. Depending on the amount of money in question, this could have a serious impact on credit eligibility, investor confidence, even customer confidence.

However, intentional misuse is often tricky to prove. The first sign will usually be a pattern of unusual payments, either by the same employee, or on the same card. Unfortunately, it can be difficult to get up-to-date information on payments made on conventional business cards because statements are only available at the end of the month.

First, you’ll need to get the payment receipt from the employee. This should be a fundamental part of your corporate card policy to approve and check payments.

Depending on the amount of money in question, and the number of transactions you’re investigating, you’ll also want to go to the vendor directly to obtain their transaction records. If something doesn’t add up, you should be able to spot the discrepancies when you compare records. If you’re sure you’ve spotted genuine, deliberate misuse of your company cards, you may want to take the case to the police. Regardless, this is usually grounds for dismissal or disciplinary action.

The importance of a company expenses policy

As an employer, you expect your employees to stick to the general terms and rules of conduct laid out in their employment contract. This is how you define responsibilities, expectations for behaviour and practically every other aspect of your relationship with them.

When it comes to defining rules of conduct for spending money on company cards, your company expenses policy serves the same purpose. It’s the first and most important line of defence against company card misuse.

It should lay out rules to regulate how your employees can spend company money—what they can buy and when, and who has the final say on approvals.

A company expenses policy should outline the following:

- What employees will be reimbursed for when they spend their own money

- What employees can charge to the company credit card

- Procedures in the event of accidental company card misuse

- What disciplinary action employees will face if they misuse a card

At the heart of the expense management process and any well managed company credit card program is the expenses receipt. They provide the paper trail (literally and figuratively depending on whether you use paper receipts or digital receipts) that allows you to track activity on your company cards.

What should you do in the event of accidental company card misuse?

Even with a comprehensive expenses policy it’s completely within the realm of possibility that an employee accidentally uses a company credit card to pay for personal items. This is especially true when they’re carrying a physical business credit card in their wallet alongside their own personal cards.

If this does happen, it’s best for the employee and the employer to act as quickly as possible.

As an employee

As soon as you realise you’ve accidentally paid with your business card, your first priority should be finding the purchase receipt. With a valid receipt, you’ll have a lot easier time for a couple of reasons:

- You should be able to get a refund, depending on what you’ve bought and how long it took you to realise your mistake

- It will be much easier to prove the details of the transaction to your employer

If you don’t have a receipt, it’s not the end of the world. The transaction should appear on the next card/account statement.

Regardless of whether you have a receipt, you should inform your employer immediately. They will ask for details of the transaction and explain the course of action from that point onwards.

As an employer

As an employer your first priority should be clarifying what happened and why. As mentioned above, the most crucial part of this is obtaining a purchase receipt.

Generally it will be obvious if the incident is a one-off accident, and not part of a more serious pattern of misuse. Fraud is usually committed as subtly as possible. While it’s not always the case, it’s unlikely a guilty employee will willingly highlight unusually spending activity.

However, you should always check just in case. Take a more detailed look at spending activity on your corporate cards to see if you can identify any other abnormal transactions.

You’ll also want to inform your accountant about the mis-spend straight away. Having non-business expenses on a business card or account will have implications for the tax you pay. You’re fully within your right to request repayment from the employee for the personal transactions they’ve made on their company card.

Who is responsible for credit card charges from unauthorised transactions?

The terms and conditions of corporate card agreements vary from provider to provider. In most cases the company is liable for any charges accrued on their cards. However, in some cases where the employee has applied for the business card themselves, it’s the employee that is held personally liable for payments made on the card.

You’ll mostly find this model in use with conventional business cards provided by big banks and credit providers. With these providers, it’s also common for personal use to violate the terms of the card agreement. So you’ll want to be extra careful when it comes to paying for anything outside of common business expenses.

It’s important to note that mis-spending on corporate credit cards can affect your credit score. If credit charges go unpaid, the creditor can report both the business and employer.

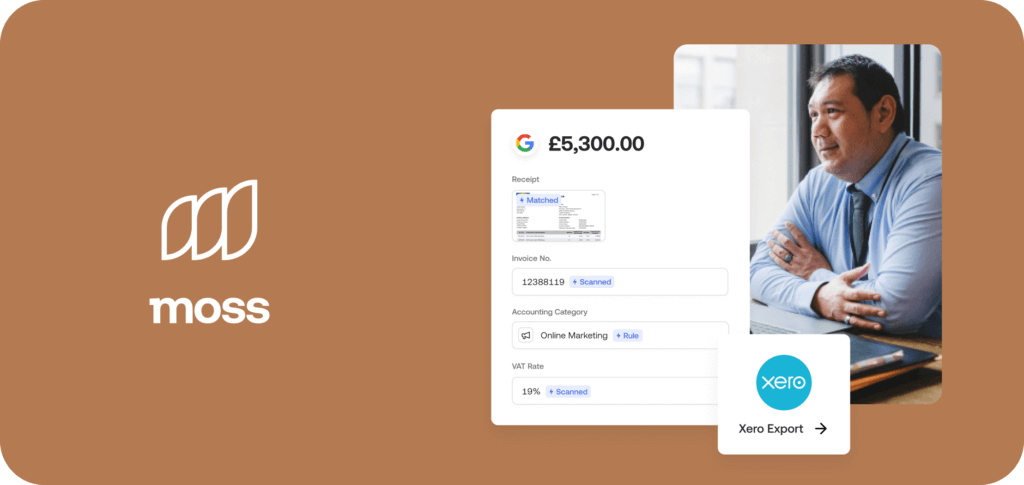

Moss corporate credit cards

Moss corporate credit cards remove all of the negatives of conventional business credit cards with the help of software. There’s no need to worry about waiting for statements because you can track and manage your spend directly via the Moss app. You’ll have a direct digital paper trail for every payment made on your account.

Our customers can create unlimited virtual credit cards with fully customisable spend limits, and allocate individual cards to individual employees. With full control over your account and cards, you can massively reduce the likelihood of accidental and deliberate card misuse by your employees.

FAQs

While it’s not illegal to pay for personal expenses using a company card, it goes against company expense policy and will likely result in disciplinary action if it happens regularly. It will also have adverse effects on the company’s tax liabilities. In more serious cases deliberate card misuse is considered fraud.

Personal expenses are any expenses that are not wholly necessary for you to complete your responsibilities as an employee.

Perform a thorough investigation by collecting receipts of all suspicious transactions and, if necessary, contact the vendors for their transaction records. Interview the employee for additional context around the payments. If you’re still suspect foul play after this, contact the appropriate authorities with the evidence you’ve gathered.

In the majority of cases it’s the business that is liable for any charges made on a business card. In some cases, the employee will apply for a business card that is reimbursed by their employer. In this case the employee assumes liability for the credit.