When it comes to paying for minor expenses, many businesses still favour cash. It’s simple, convenient and can be handed out readily whenever needed. The most popular way for businesses to disburse petty cash payments is the imprest system. It helps them reliably cover minor expenses by crediting cash in exchange for receipts.

Diligent bookkeeping is the key to the imprest system’s success. But, with the rise of electronic payments and expense management it’s somewhat losing its relevance.

In this guide, we’ll explain the imprest system for the unacquainted and demonstrate why it’s still popular with small businesses that deal with cash. We’ll also cover some alternatives that manage to eliminate the drawbacks and streamline some of the manual processes associated with imprest expense management.

What is the imprest system?

So, what is the imprest system and how does it work? Put simply, it’s a way for businesses to quickly and easily disburse funds when they need, without having to deal with the lengthier admin associated with writing a cheque.

The imprest system is most commonly used to keep track of petty cash payments. It’s popular among smaller businesses because it’s reliable and straightforward. It allows them to pay out for small expenses at short notice and means they don’t have to withdraw cash from a normal bank account.

The imprest system works by allocating a set amount of cash to an account or ‘float’. This float is a standalone fund that’s used to pay out cash for small, incidental expenses. This could be money for coffee for the staff break room, or any other day-to-day cost. When money is taken out of the float to pay for an expense, it is exchanged for a receipt.

Imprest system key features

The defining features of the imprest system are:

- A standalone cash account/float

- A custodian who is in charge of allocating cash in exchange for receipts

The key rules for the imprest system are:

- All cash that comes out of the float must be documented and replaced with a receipt of equal value

- At the end of the month, the cash that has been taken from the float is replenished with cash from the business’s general ledger when the custodian reconciles the imprest account

To make this a bit clearer, let’s give an example of the imprest system in action:

- An employee notices that the office water cooler has run out of water

- They go to the shop and buy two replacement water bottles totalling £15.00

- They bring the receipt for the two water bottles to the custodian who is in charge of the £100.00 petty cash float

- The custodian gives the employee £15.00 cash in exchange for the receipt, and puts the receipt in the register along with a petty cash expense form explaining the purchase

- At the end of the month, the custodian counts the remaining cash in the register and replaces the receipt with £15.00 from the company’s general account

- Provided there have been no errors or theft, the value of the remaining cash plus the receipts will always be £100.00

Under the standard imprest system, the employee presents a receipt and receives a cash reimbursement in return. But expense payments can sometimes be handled the other way around. In the case of an expense advance, the employee requests the funds for an expense first, and presents the receipt later. This comes with the added headache of reimbursing employees for their expenses, which we’ll cover later.

At the end of the month the custodian who is in charge of the imprest expense fund reconciles the imprest float. The remaining cash is counted alongside any receipts that have accumulated. Any missing cash that has been taken out of the float to pay for an expense is then topped up ready for the next period. This is usually per month, but it can be any period that suits the business’s requirements. The cash that’s used to replenish the float comes from the business’s general expenses account.

The remaining cash plus the value of the receipts should always match the total float amount.

What are the benefits of the imprest system?

The imprest system is regarded as the most effective method for dealing with petty cash transactions because it is simple and reliable.

This reliability stems from the fact that every transaction has to be documented and approved by the account custodian. In theory, no money should be able to leave the cash float without their approval. Each exchange of money from the float has to have an equal value receipt. This is usually accompanied by a petty cash form which outlines the reason for the withdrawal, who has requested it, and when it happened.

Another key feature of the imprest system is its fixed balance or cap. The float is always filled to the same amount at the end of each month and, unless urgently needed, is not refilled before. The float is generally quite small. Ideally, any larger expenses should not be paid using cash because dealing with larger amounts of cash naturally comes with increased risk.

The float cap serves two purposes. Firstly, it encourages the custodian and employees to be more cautious with spending funds. Once the money has been depleted, it’s gone. Think of it like an overdraft limit. Without a cap, employees could request money from the petty cash float as often as possible. This would inevitably lead to money being requested for less important things.

Secondly, the cap makes it easier to budget and calculate outgoing expenses at the end of the month. Recurring expenses are easy to spot in the account records, which gives better visibility over unusual withdrawals and one-off costs.

Drawbacks of the imprest system

Despite being the best best option for conventional petty cash funds, the imprest system does have its drawbacks. Most of these arise when dealing with larger amounts of cash.

- Like all methods of dealing with cash, the imprest system is vulnerable to theft.

- The approvals and tracking process becomes more inefficient as the amount of money the custodian has to deal with increases. Keeping track of receipts and outgoing cash can get very messy once the float reaches a certain size.

- Bypassing the float cap and spend limits for individual transactions reduces the effectiveness of the imprest system. The spend limit helps the business encourage careful spending. If it’s easy to simply increase the float limit, employees are much more likely to add unnecessary items to the expense list.

How will the decline of cash affect expenses?

While the imprest system is still regarded as the best way to deal with petty cash expenses, the reality is that fewer and fewer businesses are using cash. It continues to lose market share to card transactions for both consumer purchases and business transactions. Experts predict that cash could decline to as little as 10 percent of payments in the UK within the next 15 years.

The same applies for larger B2B payments. Think about large recurring business costs that businesses pay each month, like inventory replenishment or service subscriptions. These are usually paid electronically via automated clearing house (ACH) payments or wire transfer. Paying these costs with cash is simply impractical and unfeasible in the vast majority of cases. As a result, it’s no surprise that petty cash payments are becoming less and less relevant for businesses, especially larger companies with lots of employees.

Alternatives to the imprest system

One common alternative to a typical imprest petty cash fund is to simply reimburse employees in their pay cheque. Instead of getting employees to request funds from the petty cash account before buying, they provide the receipt and will have the money added to their monthly pay once the transaction has been approved.

The problem is that reimbursements usually involve a lot of paperwork and additional administration. Non-deductible expenses are also subject to tax. This is something you typically don’t have to worry about when using an imprest petty cash fund.

Instead, many businesses find that electronic payments are a superior option. Not only are they better for high value expenses, they’re also now better for costs on the lower end of the spectrum—the smaller expenses that are usually covered by cash. Once upon a time electronic payments were associated with higher transaction fees, but they’re now so ubiquitous that this is no longer an issue. Corporate cards are now easily accessible for all companies, and they can fundamentally change the way businesses operate.

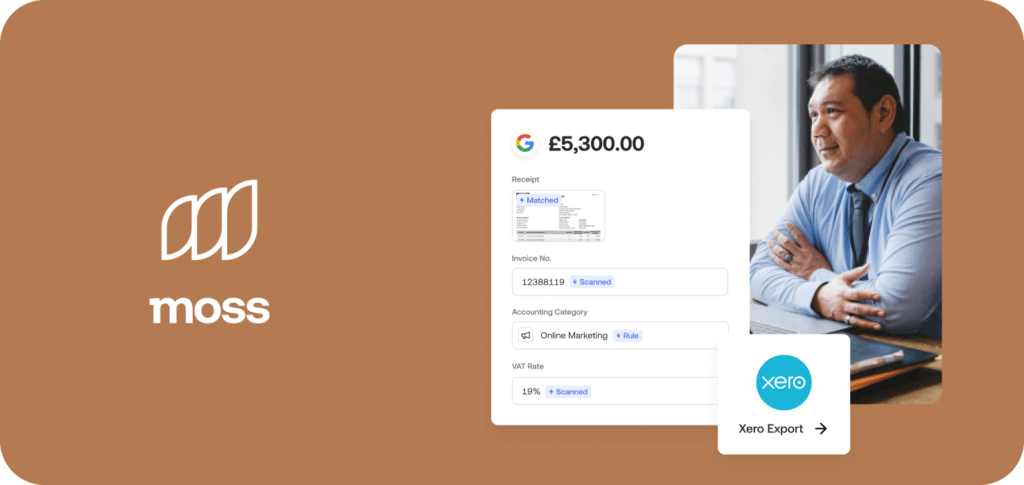

Managing expenses with Moss

Moss’s expense management software and corporate credit cards offer businesses of all sizes a better way to handle their money. With individual, customisable cards, there’s no need to worry about managing and maintaining a petty cash fund. Your employees can spend as much as you give them access to, and you can keep track of all of your outgoing expenses wherever you are with the Moss app. Moss cards are now supported in Apple Wallet and Apple Pay, so you can pay directly from your iPhone.

You’ll save time on unnecessary processes and administration, and even be able to budget better with detailed insights provided by Moss. With Moss credit, you’ll have access to up to £1 million per month, and you’ll get cashback on high value transactions.

FAQs

The imprest system is a process that helps businesses disburse petty cash payments. It uses a petty cash float and a custodian to ensure that outgoing cash is balanced with corresponding receipts.

A petty cash fund is a small reserve of cash that is used to cover incremental expenses. It’s typically used in situations where it’s not worthwhile going through the additional administrative effort of using other payment methods.

The imprest system is regarded as the most reliable accounting system for petty cash because it’s easy to reconcile and difficult to withdraw cash without good reason.

Imprest accounts are generally topped up monthly, although this varies from business to business depending on the amount of money they use for expenses. The priority should be to replenish the fund on a regular basis so that money is readily available when needed.

Nowadays, corporate expense cards are a more effective alternative to deal with petty cash expenses. They allow businesses to give their employees company funds without having to deal with cash.