HMRC offers employers and employees in the UK a range of ways to reclaim tax for work related expenses. There are ways to claim money for everything from fuel mileage rates you pay for car travel, to employee travel expenses in the UK and abroad.

Unfortunately, the processes involved are usually somewhat tricky. Luckily, HMRC has simplified the claim process for business travel expenses with different per diem rates for employees.

They allow employers to offer employees a set rate of money per day for business travel. This includes meal allowance rates and a general subsistence allowance for accommodation and other expenses.

The per diem allowance system can save time and money, and generally makes the expense process easier for everyone. As long as employees stick to these daily rates, their employer doesn’t have to pay tax on the expense allowance.

One of the most popular and widely used per diem expense allowances is the HMRC meal allowance. It covers food and drink costs for travel, both in the UK and overseas.

In this guide, we’ll explain how the HMRC meal allowance system works, and how it can benefit your business. We’ll also outline some special cases, like custom rates, which can be a useful way for you to save even more money on business travel.

What is the HMRC meal allowance?

First, let’s clear up the confusion about the different names given to the various travel expense allowances offered by HMRC.

The HMRC meal allowance rates are a type of per diem allowance, i.e. an amount that is calculated on a ‘per day’ basis.

The per diem system is usually used to cover subsistence expenses, i.e. expenses related to work-related travel, or time that an employee has to spend away from their normal workplace while working.

HMRC meal allowance sits within the wider bracket of subsistence expenses. But, where subsistence allowance covers necessary costs of travelling, like accommodation, parking charges and food, the mean allowance is only related to food and drink purchases made while travelling for work.

The other term often associated with business travel expenses is scale rate payments. This is the system HMRC uses to determine the amount of money employees are entitled to. It’s based upon the amount of time the employee has to spend away from work, as well as the location of travel.

Why are subsistence rates beneficial for businesses?

Subsistence rates are beneficial for businesses because they simplify the process of giving employees money for work-related expenses. HMRC allows businesses to claim a set rate for a range of expenses, without having to keep receipts for every item they have bought.

How do HMRC meal allowance rates work?

As we mentioned above, benchmark HMRC meal allowance rates are calculated based upon a few different criteria:

- The minimum journey time

- The location of the business trip

The exact amount a business can give to their employee for meal expenses varies depending on these two different factors.

But HMRC outlines some additional criteria that have to be met to qualify for the meal allowance on business travel:

- The employee must be away from their normal place of work for more than 5 hours

- The travel must be carried out for work duties or to a temporary place of work

- The meal cost must have been paid after starting the journey

If your claim doesn’t meet these requirements, you won’t be able to receive tax relief for the expense.

Remember, it’s up to each company what they offer their employees for their business expenses. This can include higher rates for more senior employees.

If the value of the food and drink for a claim goes above the corresponding daily meal allowance rate, you can still get the value of the scale rate payment tax-free. However you’ll have to pay tax and National Insurance on the remaining value that exceeds the limit.

Alternatively, companies can offer their employees a lower expense allowance than the standard scale rates. If they do, their employees cannot claim tax relief on the difference.

That is unless the employee spends more than the allowance offered by their employer, and less than the scale rate. In this case, the employee can claim tax relief on the difference between the two amounts, provided they have evidence. This includes receipts, and proof of the expense allowance offered by their employer.

Custom meal allowance rates

The benchmark meal allowance rates are offered to all businesses by default. However you do have the option to negotiate a custom meal allowance rate directly with HMRC.

This can help businesses which face higher average costs for business travel. But to get a custom rate you have to prove to HMRC that this is the case, and provide supporting evidence. To do this, you’ll need to submit an exemption form to HMRC.

HMRC meal allowance rates for 2022/2023

HMRC sets different rates for business meal expenses depending on where you’re travelling. For foreign trips, the meal allowance rates account for the local cost of living.

However, in the UK, meal allowance scale rate payments stay the same, regardless of where the trip is taking place.

Domestic trips

For 2022/2023, the meal allowance rates for travel in the UK are as follows:

| Minimum journey time | Maximum meal allowance |

| 5 hours | £5 |

| 10 hours | £10 |

| 15 hours | £25 |

| After 8pm | +£10 |

Foreign trips

The meal allowance rates for overseas travel are more complex, as they are calculated in local currency. However, they still follow the same scale rates as domestic trips, i.e. above 5 hours, above 10 hours, and above 15 hours.

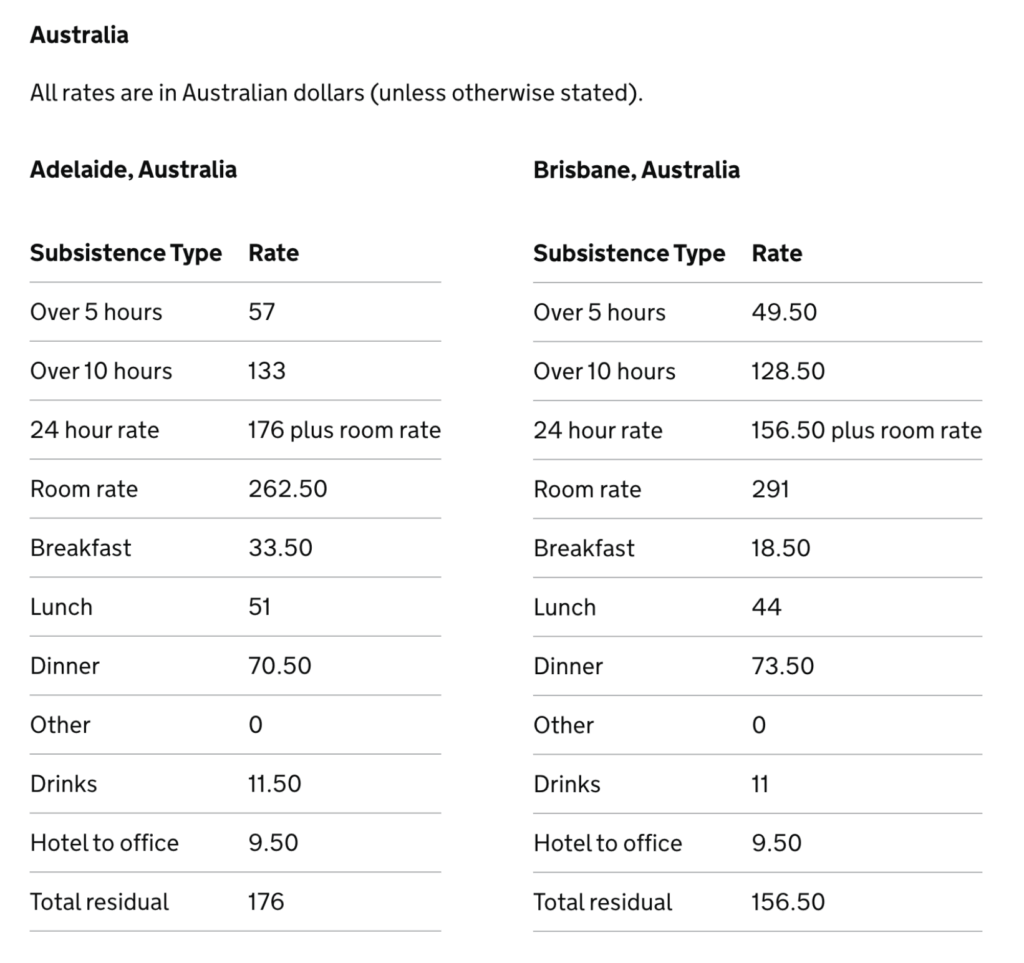

The meal allowance rates offered by HMRC are included in a general table of subsistence expenses. This includes rates for accommodation and travel to the accommodation, etc., as you can see in the example below.

Image: HMRC

These subsistence rates are published for a long list of major cities for business around the world. But what happens if you’ve staying somewhere that’s not on the list? HMRC’s official guidance is to use the rates for the city that is closest to where you’re staying on your trip, as long as it’s in the same country.

Below you can see some more examples of HMRC meal allowance rates from other international cities.

| City | 5 hours | 10 hours | 15+ hours |

| Berlin | 22 | 65.50 | 72 |

| Dublin | 38.50 | 94 | 99 |

| Jakarta | 347,139.50 | 723,469.50 | 986,827 |

| Rio de Janeiro | 102.50 | 242.50 | 268.50 |

| Rome | 35.50 | 81.50 | 90 |

| Seoul | 64,949 | 147,488 | 167,991 |

| Vienna | 33 | 84 | 89.50 |

| Warsaw | 154 | 372.50 | 393 |

General rules for claiming meal allowance

HMRC used to require receipts for every item on a meal allowance claim. However, these rules were changed back in 2019 and employees no longer have to keep every receipt from their trip.

Instead, it’s now enough for the employee to keep one receipt to prove that their food expenses were accrued whilst on business. Nevertheless, it’s still a good habit to collect all employee expense receipts for auditing purposes.

Managing expenses with Moss

With unlimited virtual credit cards, our customers can allocate individual budgets to each team, team member, or cost centre in their organisation. If you provide work mobile phones to each of your employees, you can set up a specific card just for contract payments, and track every penny you spend with Moss budget trackers. There’s no need to hunt down individual meal payments in a sea of transactions records, because they’re all stored in one place.

If you want to reimburse your employees for other expenses they’ve paid, you can use Moss’s reimbursement tools to slash admin time and automate much of the process via our app. Employees simply scan their receipts with their smartphone, and your team admin will receive an automated approval request, which they can review on the go.

Moss also integrates with a range of other enterprise tools, including accounting and HR software, so you can enjoy the benefits of smart spend management across your business.

FAQs

HMRC meal allowance expense rates that are set by HMRC. Businesses can offer this money to their employees to cover food and drink costs when away from the office for work. To be eligible for HMRC meal allowance, employees must:

– Be away from their normal place of work for more than 5 hours

– Travelling for work

– Have incurred the cost for food and drink after the start of their journey

HMRC meal allowance rates are one of a number of subsistence allowances that HMRC calculates on a per diem (per day) basis. HMRC uses a scale rate payments system to calculate meal allowance based upon the number of hours employees are away for work.

Employees used to have to provide receipts for every item on their meal allowance claim. However, the rules were changed back in 2019. Employees now just have to provide one piece of evidence that an expense was incurred whilst on their business trip.

Meal allowance rates for business travel within the UK are set at standard rates. However, for foreign trips HMRC sets rates for individual cities. These are based upon local costs and can be found on the HMRC website.

It’s possible to agree special custom rates for subsistence allowance. You’ll need to fill out an exemption form and send it to HMRC along with supporting evidence for your claim.