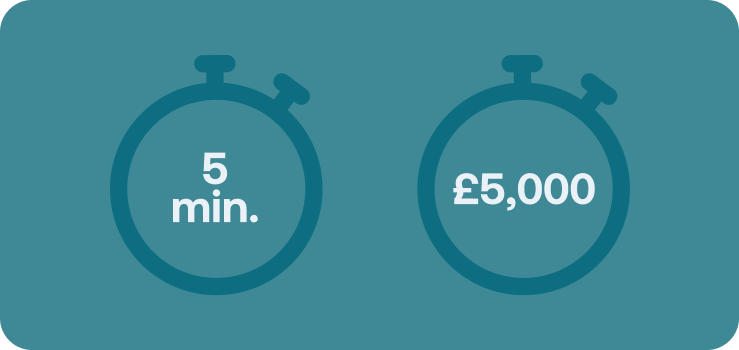

Each year, thousands of small businesses around the UK benefit from financial support offered by employment allowance. It’s an HMRC scheme that offers eligible businesses the chance to reduce their yearly National Insurance contributions by up to £5,000.

Unless your business is lucky enough to receive financial backing from investors, a few thousand pounds can be enough to make or break your bank balance at the end of the year. In this case, employment allowance could be exactly what you need. It’s one of many government incentives that are intended to help small businesses and employees ease their financial burden. Others include company car mileage rates and travel expense claims.

Thanks to an improved gov.uk online application process, it’s never been easier for businesses to claim employment allowance. In this guide, we’ll walk you through the eligibility criteria, how to apply, and explain some of the finer details of this form of HMRC tax relief.

Note: It’s important to remember that employment allowance is different to employment and support allowance. Employment and support allowance is another government scheme that provides financial assistance to people with disabilities and health conditions that affect their ability to work.

How much is employment allowance in 2022/23?

For the 2022/23 tax year you can claim up to £5,000 under the employment allowance scheme. Rather than a payment, it comes in the form of reduced Class 1 National Insurance liabilities.

This means you will pay less on your monthly Class 1 National Insurance deductions until you’ve reached the £5,000 limit, or the tax year comes to an end.

This represents a notable allowance increase over previous years, which were capped as follows:

- 2015/16 : £2,000

- 2016/17 – 2019/20 : £3,000

- 2020/21 – 2021/22 : £4,000

Don’t worry if this is the first you’ve heard about employment allowance and you’re thinking about those wasted opportunities. It’s possible to claim for the previous four tax years, meaning you can still receive an allowance back to 2018/19.

The employment allowance doesn’t carry over between tax years, so any unused balance you have left at the end of the year is discarded. You also have to reapply for employment allowance each year.

How much is employment allowance in 2023/24?

HMRC recently announced the employment allowance for the 2023/2024 tax year, which will retain the same £5,000 yearly limit.

Are you eligible for employment allowance?

It’s important to note that you can only apply for employment allowance if your total National Insurance payroll liability for the previous tax year is less than £100,000. For the 2022/23 tax year, employers pay 15.05% of their employees’ monthly salary as a National Insurance contribution. However, the threshold above which these contributions begin depends on the employee’s National Insurance category and salary range. You can find the full list of NI categories on the gov.uk website.

It’s not just businesses that can claim—charities, amateur sports clubs and people who employ carers or support workers can too. It also applies to connected companies, i.e. companies that are either controlled by the same person, or by one another. There are some pretty lengthy rules about precisely how to determine whether or not two companies are connected. You can also find these on the gov.uk website.

If you’re in control of more than one company, you can only claim the allowance on one PAYE scheme. Pay-as-you-earn (PAYE) is the government’s system for collecting tax directly from employees’ wages. If you’re responsible for more than one PAYE scheme, you’ll need to choose which one you want to claim against.

If both of these businesses are limited companies then you’re not allowed to transfer any unused employment allowance to the other. However, if both are unlimited/sole ownership companies, then you can apply to have your remaining allowance transferred to the other business’s payroll.

The same applies if you have multiple PAYE schemes within the same company. In this case you must choose one scheme, and you cannot transfer unused allowance between the two.

Additional eligibility criteria you should be aware of

Whether or not you can claim employment support also depends on how much de minimis state aid you’ve already received.

What is de minimis state aid? It may sound confusing but it’s simply state aid that falls under a threshold that’s deemed low enough to have no unfair effect on competition. These rules were initiated to protect industries from unfair competition between different EU member states. But the basis of the legislation has been carried over as part of the post-Brexit Trade and Cooperation Agreement between the UK and the EU. It now serves mainly to protect industries from unfair competition from other regions in the UK.

As such, de minimis state aid is calculated in euros. It uses the exchange rate at the end of the previous tax year (30 March).

Different sectors have different thresholds, all of which are counted over the past three years:

- Agricultural products – €20,000

- Fisheries and aquaculture – €30,000

- Road freight transport – €100,000

- Industrial/other – €200,000

Because employment allowance counts as de minimis state aid, you need to bear these thresholds in mind when you claim. If the total amount of de minimis state aid you’ve received over the past three years (including employment allowance) is below the threshold for your sector, you’re good to go.

Employment allowance eligibility also depends on whether the majority of your business is public or private sector. Unless you’re a charity, you won’t be able to claim it if you do more than half of your business in the public sector.

How to claim employment allowance

Although the rules and application criteria for employment allowance are complicated, it’s easy to make a claim. The process varies depending on whether or not you use HMRC’s Basic PAYE Tools software. This is a payroll software package offered by HMRC for smaller businesses with fewer than 10 employees. It provides all the basic functions businesses need to handle PAYE payroll, and pay tax on your employees wages. You can download it for free here on the gov.uk website.

If you do use Basic PAYE Tools, follow these steps:

- Select your employer name in the ‘Employer’ menu on the homepage.

- Select ‘Change employer details’.

- Select ‘Yes’ in the ‘Employment allowance indicator’ field.

- Next you’ll be asked ‘Do state aid rules apply?’. If you sell goods or services, answer ‘Yes’ and select the relevant business sectors. If not, select ‘No’ and select ‘State aid rules do not apply’.

- Submit your EPS (Employment Payment Summary). You can find out how to do this on the gov.uk website.

If you’re using another payroll software, simply put ‘Yes’ in the ‘Employment allowance indicator’ field next time you send an EPS to HMRC.

What is an employer payment summary?

An employer payment summary is a type of documentation that employers must submit to HMRC in various different circumstances. These include:

- If you’re applying for employment allowance

- If you haven’t paid any employees during a specific month

- To reclaim statutory maternity, paternity, adoption, parental bereavement or shared parental payments

The deadline for sending an EPS is the 19th of the month following the month you want to apply a reduction on your payments. If you don’t send an EPS, HMRC will estimate how much money you owe. This often means you’ll end up paying more than you should.

Why it’s worth taking the time to apply

£5,000 might not sound like much but, considering how easy it is to apply for employment allowance, there’s really no reason not to. If you are eligible, it means you pay less than £100,000 National Insurance on your payroll. In this case, £5,000 can probably have a significant positive impact on the health of your business. The allowance was set up precisely to help smaller businesses like yours with staffing costs.

While you won’t get this money in the form of a payment, you’ll still end up £5,000 better off at the end of the year, depending on how big your NI contributions are.

The 2022/23 allowance is up 25% over last year, mainly in response to the difficult economic climate businesses in all different sectors are facing. The costs associated with doing business are significantly higher across the board than a year ago. According to the Office for National Statistics, input requirement costs (the cost of resources required to produce goods and services) increased 18.6% year-over-year as of May 2022. Unsurprisingly, this played a key role in the government’s decision to offer an increase, with a significant increase in the number of businesses facing potential bankruptcy and layoffs.

Insights and reimbursements with Moss

Moss’s corporate spend management platform gives businesses the power to track and monitor every aspect of their company spending. With unlimited virtual credit cards, it’s possible to allocate your expense budget exactly how you need, employee-by-employee. Set spend limits and expiry dates for each and every card, so you know exactly how much money is being spent.

A core part of our software is reimbursements—we give our customers the power to centralise all of their reimbursements within our software. This means there’s no need to manually sift through receipts and invoices. It can all be handled through our software. Your employees can scan and digitise their receipts, and send them for quick approval from designated members of your team. Our insights module will then give you a detailed breakdown of who you’ve reimbursed, how much of your budget is being spent by different departments, and highlight any discrepancies that you might want to look into.

FAQs

Employment allowance is a UK government scheme that allows small businesses/employers to reduce their yearly National Insurance contributions.

The employment allowance for the 2022/23 tax year is up to £5,000, depending on how much your business has paid in Class 1 National Insurance contributions.

The employment allowance is available to small businesses who pay less than £100,000 in National Insurance contributions on their payroll. Charities and people who employ a support worker or carer can also apply. You can find additional eligibility information on the gov.uk website.

To claim employment allowance you need to apply when you submit an Employment Payment Summary. You can do this through your payroll software, or HMRC’s Basic PAYE Tools.

De minimis state aid is minor government aid that falls under a certain threshold during a three year period. Employment Allowance counts as de minimis state aid, so it’s important to note how much aid you have received from other schemes over the past three years before applying.

Class 1 National Insurance is an earnings tax that is paid on employee salaries. It is made up of contributions from both the employee and the employer. The amount of National Insurance paid is determined as a percentage of the employee’s monthly salary, and is only paid by employees above 16 years of age and below the state pension age.