The list of business expenses that you can claim for a tax deduction is long and, frankly, rather daunting. This is especially true for freelancers and new entrepreneurs who may not have the support of accounting professionals. But, even well established small and medium-sized companies can struggle when it comes to claiming expenses. Despite the difficulties, everyone should know about the tremendous benefits that tax deductions can offer. So, let’s dive in!

What are business expenses?

First of all, let’s talk about what business expenses actually are, and why they can make such a huge difference to claiming tax. For a company or a business idea to truly work and thrive, it’s often essential to spend money first. A fashion label, for example, has to produce clothes upfront to fulfil orders. The employees that make the clothes need to be paid, and sewing machines and fabric have to be provided. The premises where the designs are made and later produced need electricity and, unless it’s an owned space, there’s probably rent to pay too. All of these expenses add up, but they’re essential to keep the business going.

Noting down and keeping track of receipts can help save money and even secure liquidity when funds are especially tight. If a business cannot function without those expenses, the costs are not taxed. The amount can be deducted from the gross income to lower tax costs. Here’s an example: If a small business had an income of £100,000 last year and £10,000 in tax-deductible costs, only £90,000 is subject to tax.

Making a list of business expenses can come in handy

Because of the wealth of tax-saving opportunities, we highly recommend taking a closer look at the necessary business expenses you incur on a regular basis, as well as those which might pop up on bank statements from time to time. Writing down every cost that comes to mind with regard to business-related work essential for finding out what the individual business expenses of a business are. This technique is also useful for freelancers who want to make the most of their self-assessment tax returns.

As a second step, we suggest categorising expenses into main topics. Later on, you can match specific expenses to their respective category to keep an overview of what, for example, staff, business travel, or the office costs you.

List of business tax-deductible expenses

While the list of expenses for business owners may seem long, the good news is that many of them are tax-deductible. It’s even possible to claim tax relief for working from home. Due to the fact that every business operates differently, the following list may miss some examples that may apply in some cases. But it should give companies and freelancers a good idea of different expense categories and the vast amount of business expenses it’s possible to claim against.

Here’s a list of the most common expense categories and their respective business expenses:

- Utility costs (e.g. rent, phone and broadband bills, heating and electricity costs)

- Finance-related costs (e.g. bank charges)

- Insurance costs

- Travel costs for business-related trips (e.g. petrol, mileage, parking, rental cars, hotels, fares)

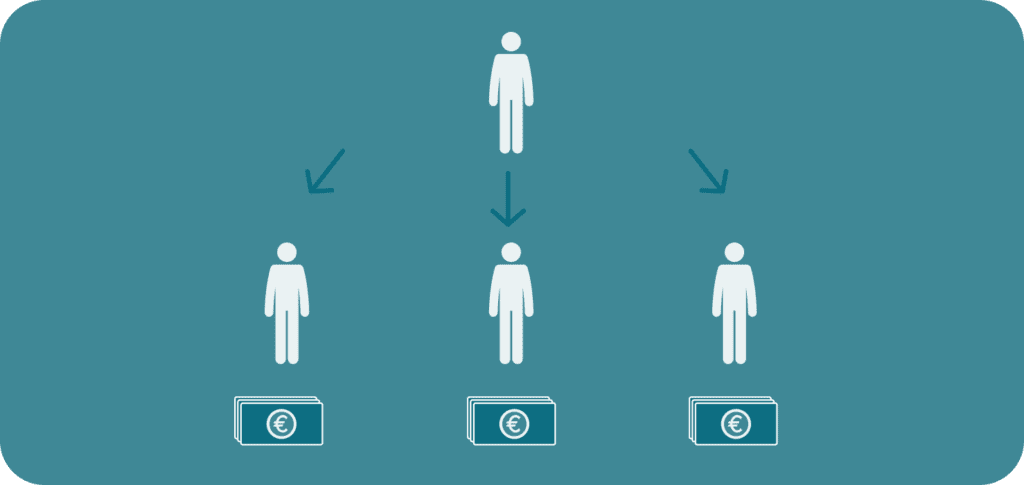

- Employee costs (e.g. salaries, clothing expenses for uniforms or mandatory protection, subcontractor payments)

- Material costs (e.g. stock or materials a business needs to fulfil orders)

- Marketing and advertising costs

- Consultant services (e.g. tax professionals, risk advisory, IT)

- Training

- Website and servers

- Office supplies (e.g. notebooks, paper, pens, stamps)

- Benefits for employees

It should be highlighted here that so-called capital assets are different from typical business expenses. Things a company or a freelancer buys to keep and use can be machinery, furniture or certain types of vehicles, except for cars. In these cases, it’s possible to claim capital allowance against the purchase price. This way, up to £1 million per year on new assets can be spent, which, in return, can be deducted from taxable profits.

It is crucial that this expenditure is for business use only, though. In order to claim the expenses, there must be documentation and proof of purchase. Employees also need to know this, so that no money gets lost along the way.

Tax-deductible expenses for freelancers

HMRC highlights that freelancers can also deduct several business-related expenses. Of course, they are also confronted with a certain amount of office and travel costs. Moreover, they can hire employees or subcontractors, which makes for deductible salaries and subcontractor costs. They usually pay for business travel themselves when doing their jobs, might need specific clothes, stock or raw materials, and they pay similar insurance and bank charges as well as advertising and marketing costs.

All in all, being self-employed is not so different from running a small or medium-sized company—at least tax-wise. It should be noted, though, that it is not possible to claim expenses if someone uses their £1,000 tax-free ‘trading allowance’.

List of non-deductible business expenses

Unfortunately, not all business expenses are tax-deductible. This should be kept in mind when doing the self-assessment tax return to avoid financial surprises later on. Some of them very much look like the usual business expenses, but are not recognised as such by HMRC.

Companies and self-employed people, including freelancers, should watch out and not claim against the following:

- Entertaining clients (e.g. taking them out to see a show or visit a sports event)

- Client gifts

- Income that is paid as dividends

- Fines such as parking or speeding tickets

- The majority of legal fees including those when buying property

- Wear and tear or improvement of assets

- Donations that are not in line with Gift Aid

- Certain travel costs such as commuting between home and workplace

Keep in mind that none of these points will lead to a recognised tax deduction, so it is important to refrain from claiming. However, dinners for employees, a paid coffee for a client and certain gifts under £50 such as books, flowers, or business advertisements can count. Also, legal fees for obtaining trademarks, patents or loans, as well as asset repairs can count as tax-deductible.

Double-checking with a professional is recommended

As clear as many tax regulations are, some can still cause confusion and lead to misconceptions and failure. We cannot stress enough how important it is to get help from a professional tax advisor. Especially for issues revolving around the question ‘deductible or non-deductible?‘, an expert can clarify things easily.

However, there are two essential questions to ask with regard to claiming company expenses: Is it clear that the business and its employees cannot work without it? and is there a receipt that proves a purchase was made?

List of business-deductible expenses: how to claim

By compiling a comprehensive list of their business expenses, self-employed people and businesses can gain an overview of how best to manage their funds and avoid paying too much tax or too little tax.

The next step is using the purchase records to claim via the annual self-assessment tax return. It won’t be necessary to submit those proofs of purchase to HMRC. A representative will only ask for them if there’s a reasonable doubt. One thing becomes clear during the self-assessment process: The more transactions, the greater the need for a professional accountant or smart finance insight features. Otherwise, bookkeeping and doing taxes can take too much time out of an otherwise productive work day. Sole traders or freelancers can also benefit from an automated system to stay on top of their business expenses.

Better financial insights with Moss

Keeping track of business expenses should be an absolute priority for every company or self-employed person. This will help manage costs more efficiently and also ensure liquidity when it is needed most. With Moss, every business can gain access to real-time data on their funds and current expenses. Moss insights automatically consolidates transactions from all accounts as they happen. The result: an overview of the company’s financial situation in one place that’s easily accessible when needed.

Moss insights not only helps managers and CEOs stick to their set budgets, it also supports the accountant’s work with streamlined, automated processes—including a smart interface for Xero. This makes time-consuming data search a thing of the past, as all information is gathered and displayed in a structured way, and is even searchable by expense category.

Companies and single entrepreneurs using Moss can also profit from functional invoice management and simplified reimbursement processes for out-of-pocket business expenses. Accurate documentation thanks to OCR scanning and powerful corporate cards for every need imaginable are further benefits enjoyed by Moss customers. Say goodbye to wasted money from poor financial management and welcome the easy way of handling otherwise tedious business tasks.

FAQs

Business expenses are costs which are absolutely necessary to run a business successfully. Most of them are tax-deductible because companies or self-employed people have no choice but to pay them. However, there are a few non-deductible business expenses that should be considered too.

There are plenty of tax-deductible business expenses, such as rent, phone and broadband bills, heating and electricity costs, travel costs for business-related trips, salaries, stock or materials as well as marketing and advertising costs. Also, training and subscriptions can be claimed against taxes.

Entertaining clients, e.g. taking them out to visit a sports event, is not considered a tax-deductible expense. You should also be cautious about expensive client gifts and refrain from deducting income that is paid as dividends. Fines like parking tickets are not deductible either.

You can claim expenses via the annual self-assessment tax return. You won’t have to submit proofs of purchase. HMRC only requires them if there is reasonable doubt about the numbers you’ve submitted. But it should be noted that a high number of transactions throughout the year will likely require a professional to look over the books.

Freelancers, given they do not choose to use their £1,000 tax-free ‘trading allowance’, are treated just like every other self-employed person. This means that they can deduct similar business expenses and should watch out for issues regarding non-deductible taxes.

Filling out spreadsheets is the old way of doing business expenses. Instead of time-consuming labour, we at Moss recommend using automated software and artificial intelligence that detects expense categories and recurring payments to bundle expenses neatly. This makes self-assessment tax returns a piece of cake.