When expense policies live in people’s heads, they’re bound to cause confusion. Over time, as memory fades and details get fuzzy, employees — unsure of what’s allowed or where to check — act on guesswork. Some overspend without realising it, while others hold back valid claims because they’re uncertain of what’s justified. Teams and managers end up defining “acceptable” differently.

The result: delayed approvals, drawn out reimbursements, and unnecessary tension for both employees and finance.

A well-articulated business expense policy replaces ad hoc decision-making with rules that everyone can see and apply the same way. This guide explains how U.K. businesses can create corporate expense policy that employees can easily follow. It covers what to include, how to comply with His Majesty’s Revenue and Customs (HMRC) regulations, what mistakes to avoid, and how Moss enforces policy without holding teams back.

Why your U.K. business needs an employee expense policy

An expense policy provides written guidance on expenses and allowances, including how to submit claims, who approves them, and where to go in case of questions. It simplifies compliance by setting guardrails — for VAT, travel, meals, and reimbursements — that align with local regulations.

Beyond clarity and compliance, an expense policy:

- Improves cost control and supports audit trails: Documented limits and required receipts prevent unauthorised spend, making month-end close smoother.

- Provides clarity and fairness for employees: Instructions on what’s allowed and what isn’t reduce confusion and ensure consistent approval decisions.

- Frees up time for finance teams: Standard workflows make day-to-day decisions easier by replacing case-by-case calls with rules that everyone can understand and follow.

- Reduces friction between employees and finance: Clear processes and escalation steps remove ambiguity, shorten reimbursement cycles and promote a culture of accountability.

Key elements of a company expense policy

An effective corporate expense policy should lay down how the company categorises and approves expenses, while making sure its approach meets HMRC requirements. Here are the main topics an expense policy should cover.

Rules for common expense categories

An effective expense policy should spell out spending rules for common categories, like travel, meals, accommodation, and corporate expenses.

For most organisations, these rules are a good starting point:

- Travel: Make standard-class rail the default mode for business travel in your travel expense policy, since it’s usually the most economical option. Permit domestic flights only when they’re more efficient in both time and cost. Also, clarify when employees may take taxis, when to use ride-hailing services, and what documents they must submit for reimbursement.

- Meals: Set spending caps per meal and make itemised receipts mandatory. This ensures employees don’t use all-day allowances to justify overspending on a single meal.

- Accommodation: Set nightly limits for national and international locations, with guidance on when exceptions would apply. Employees must demonstrate rate shopping — that is, comparing providers to find the best deal — or use approved booking channels.

- Corporate costs: Include frequent purchases, such as office supplies, software, and vendor invoices, within the scope of corporate costs. Employees should ensure all expenses meet set purchasing parameters, including purchase orders and preferred suppliers.

Budgets and spending limits

An expense policy should set clear limits on who can spend how much. It needs to outline budgets that connect directly to departments, projects, or roles, with documented caps for common expenses such as per-diems and mileage rates.

The policy should also clarify who can approve exceptions and how those approvals should be documented. By addressing these points in advance, you shrink the risk of inconsistent, one-off decisions.

Reimbursements

Giving people simple instructions for claiming expenses helps diminish delays and maintain consistency across departments.

A solid expense policy clarifies:

- Documents to be attached with reimbursement↗ claims, including receipts that outline cost centre details, business purpose, and attendees for business outings.

- Timelines for claims submission and payment, and what to do if receipts go missing.

- Which claims are ineligible, such as fines or premium seat upgrades made without prior approval.

Many organisations use employee expense cards↗ that automatically track spending — like Moss — to cut down on paperwork. We support collecting receipts automatically via the Email Inbox, or via the Moss App and Receipt Finder, helping teams centralise documentation for spend.

Nonemployee expenses

Organisations usually need to reimburse contractors, freelancers, or even interview candidates for travel and meal costs. In most cases, expense cards for contract employees↗ and simple reimbursement instructions are enough to keep the process hassle-free.

However, your expense policy should spell out who approves these expenses and how to submit claims — whether through vendor invoices or online forms. Providing standard claim forms or template letters for nonemployees helps ensure their submissions include the same required details each time, which quickens the approval process and lowers the chance of errors.

U.K.-specific guidance

VAT regulations require receipts that meet HMRC standards to reclaim input tax. Including U.K.-specific guidance in your policy ensures employees know what is needed for VAT recovery and how to submit it for proper compliance. Your policy should also define approval thresholds and simple steps for handling cases where receipts are unavailable.

With regard to governance, the policy should name the individuals or departments responsible for monitoring compliance within the business. These oversight roles — distinct from line managers who approve day-to-day claims — are usually in finance or HR. They’re responsible for ensuring the policy is enforced consistently and that audit standards are met.

The policy should also specify how often limits are reviewed, since HMRC thresholds and market prices change frequently. Regular reviews protect both finance teams, who need accurate forecasts, as well as employees, who need allowances that remain fair.

Mileage reimbursement

To avoid tax complications, align mileage reimbursements with HMRC’s published mileage and fuel allowances, and require employees to keep appropriate records (for example, distance travelled and business purpose). When personal vehicles are used for work purposes, require employees to have insurance that covers business use. Properly documented mileage may be included in the broader list of business expenses eligible for tax relief↗.

Fraud procedures

Include a fraud statement in your policy to set clear expectations: explicitly state that submitting false claims constitutes misconduct and may lead to disciplinary or even legal consequences, in line with U.K. employment regulations.

Mistakes to avoid in your expense policy

Even thoughtfully designed policies can fall short if certain details go unchecked. Here are the common issues that can make expense policies less effective:

- Vague categories: When expense categories are unclear, it leads to frustrating back-and-forth between employees and finance. Adding expenses policy examples under each category, especially advice on discretionary spending↗, can prevent confusion.

- Outdated limits: Allowances that don’t reflect current prices lead to more out-of-pocket spending and policy breaches. Regularly review meal, hotel, and mileage caps to keep them relevant, and document any adjustments you make.

- Unclear approval roles: Not knowing who’s responsible for authorising claims creates delays. Your policy should state who has approval authority, when delegation applies, and how the system logs exceptions.

- Weak receipt controls: When the policy isn’t clear about what counts as a valid receipt, it’s harder to stay audit-ready. Describe acceptable proofs for both digital and paper receipts, and outline a simple process for handling missing receipts.

- No centralised version of the policy: If employees can’t locate the most recent version, compliance suffers. Publishing the policy in one accessible location, such as the intranet or an expense tool, gives employees a consistent reference point.

Automate policy enforcement with Moss

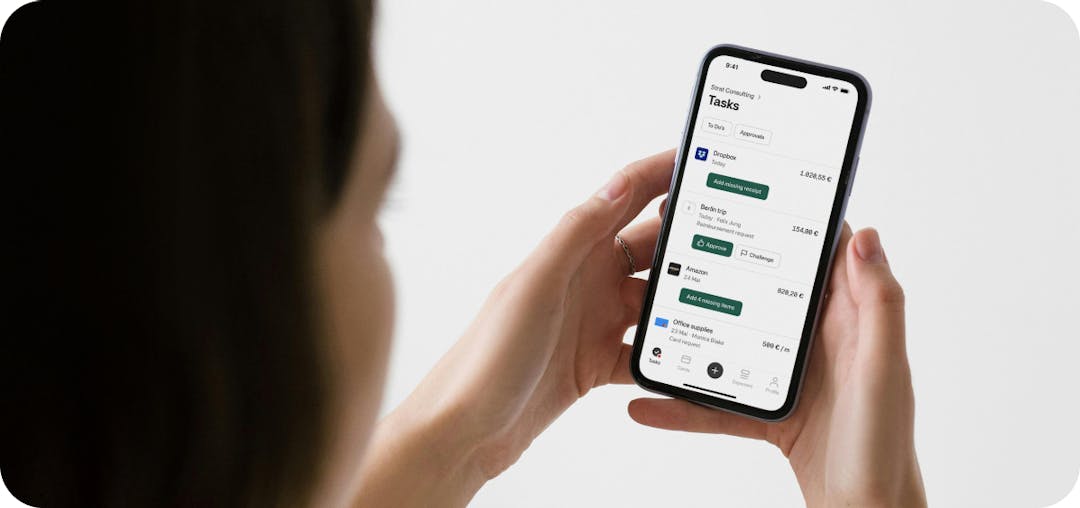

Moss and Moss’ corporate cards↗ help teams enforce expense policies with approval routing rules and workflows, so requests are automatically sent to the right approvers and supported with tracking and audit trails. Moss approval routing can be configured with custom rules (for example by amount, team, supplier, department, cost centre, or general ledger codes) and card usage can be controlled with merchant category restrictions and time/date controls.

Approvers receive requests automatically via your approval rules, and budgets provide visibility via budget status and ‘Spent’/‘Upcoming’ sections for expenses assigned to that budget. For finance teams, real-time visibility into both past and upcoming spend keeps forecasts current and supports accurate reporting.

Moss combines approval routing and spend controls to help teams apply policies more consistently, with tracking and audit trails for visibility. For organisations that want to simplify expense management, improve compliance, and give employees a clearer process, Moss provides an integrated solution.

Book a demo to see how Moss’ corporate cards↗ keep spending transparent and employees policy-compliant in every transaction.