Modern Spend Management for Scaling Portfolios

Help your Private Equity portfolio companies reduce costs, improve compliance, and scale faster; with secure, automated spend management across cards, invoices, reimbursements, and budgets.

Optimise Operational Spend

Secure corporate cards, invoice management and reimbursements, all controlled from one GoBD-certified platform.

Instant Impact

Launch in days, scale across entities. A Private Equity support tier and consistent onboarding for every portco.

Automate Finance, Reduce Risk

AI-powered automation that cuts manual work and ensures compliance, visibility and control at scale

Get to know Moss

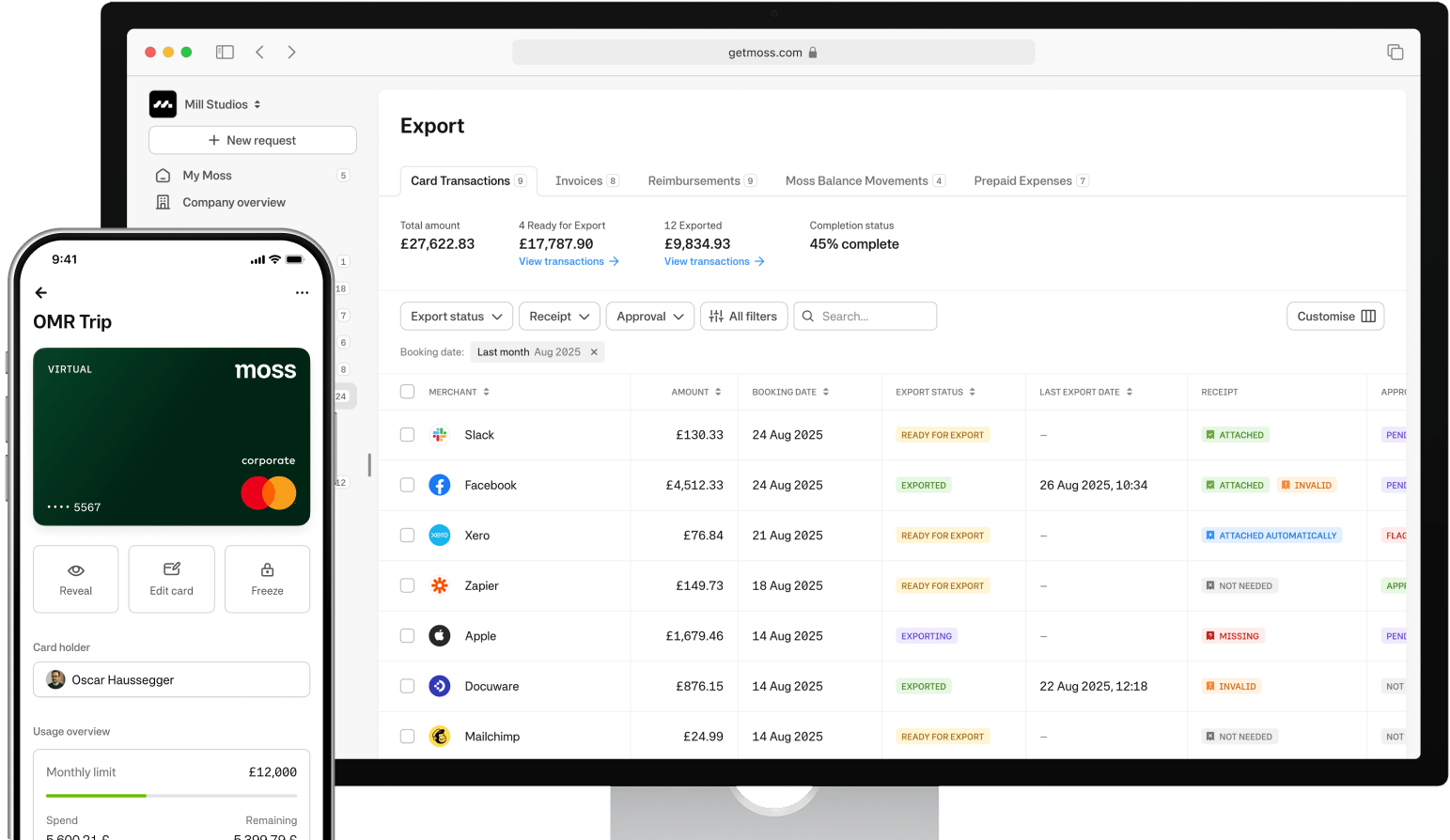

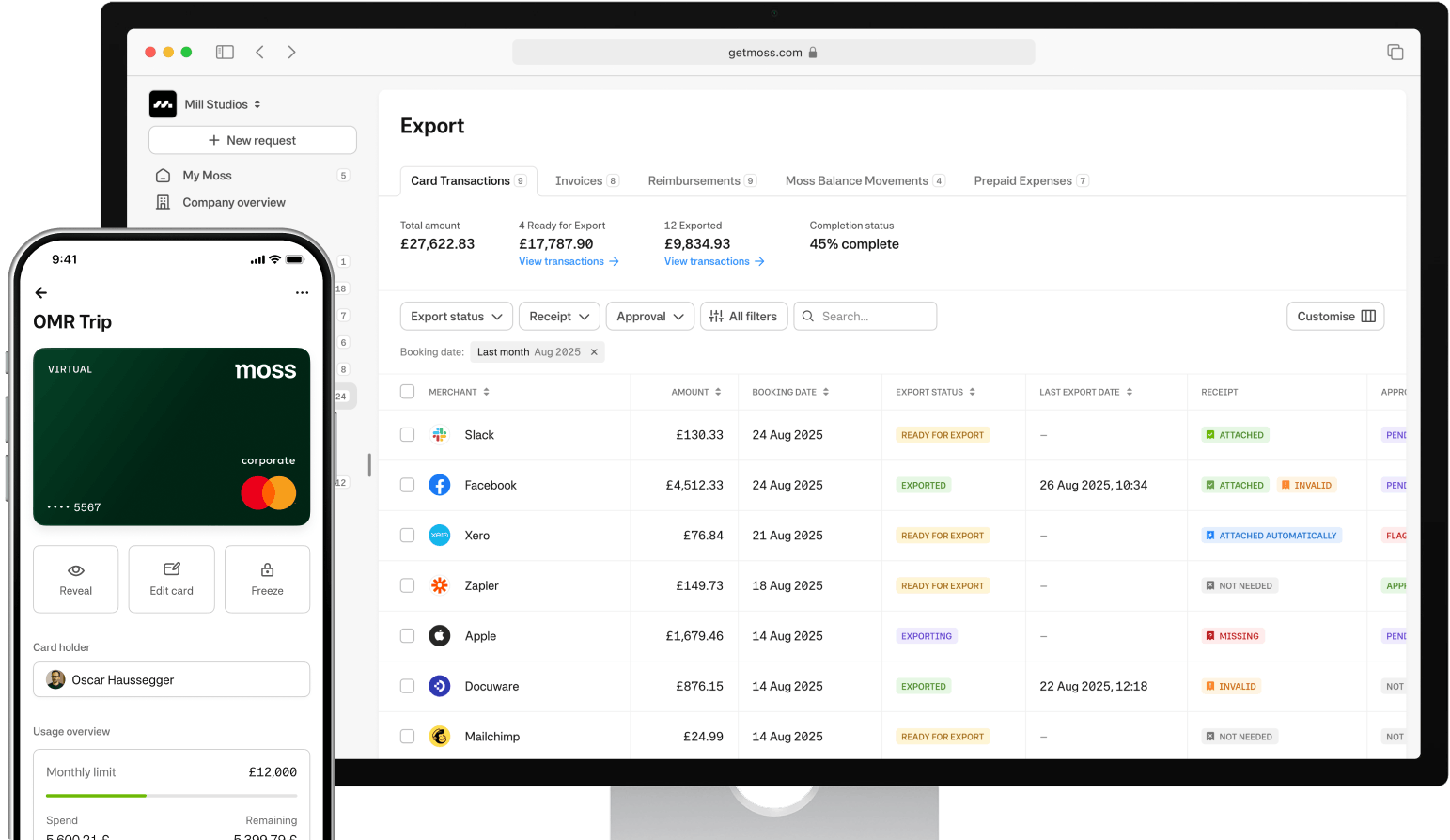

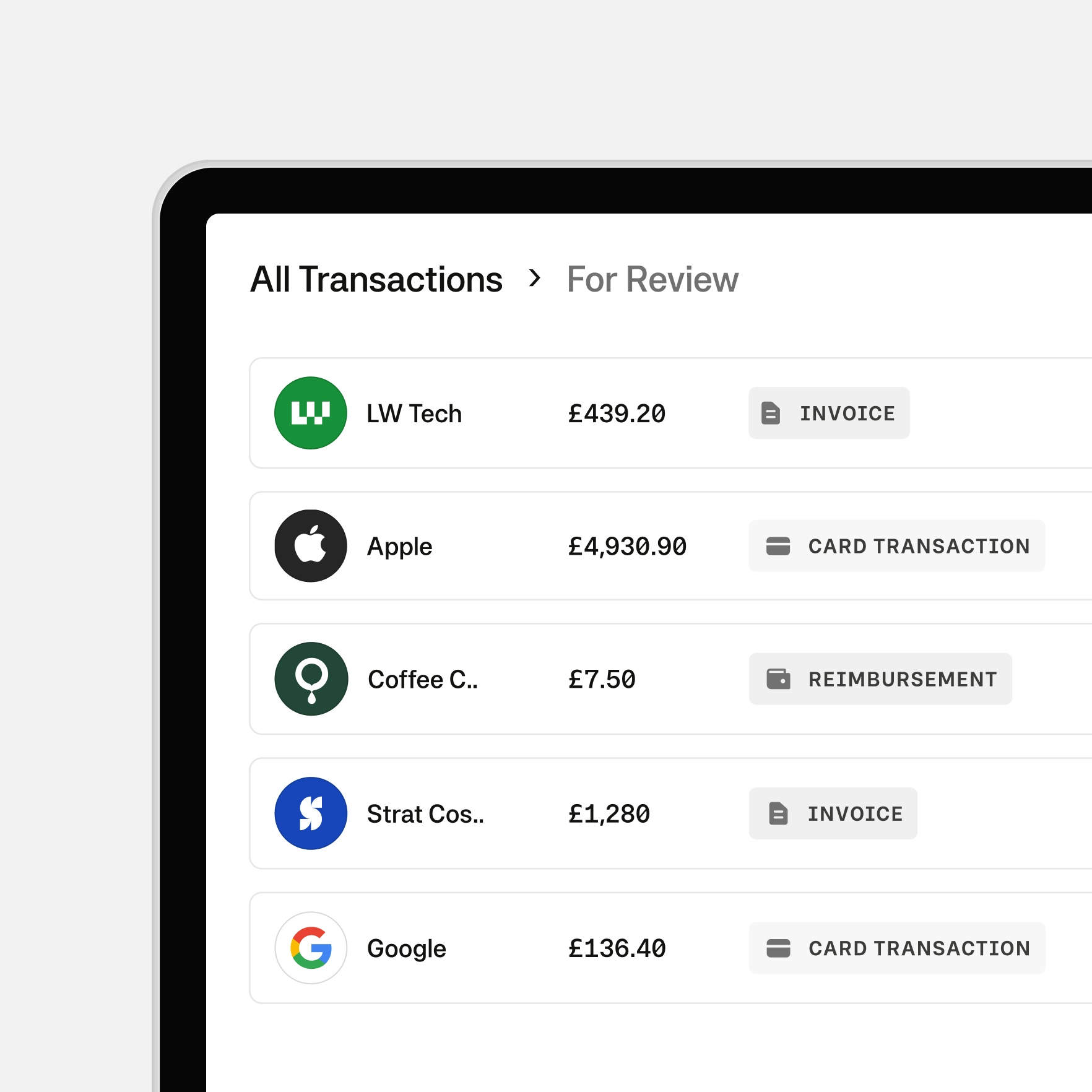

Moss is the finance-first spend management platform for businesses to take control of company-wide spend. Combining cards, invoices, reimbursements, and budgets in one secure, connected system with full visibility and approval flows.

Accounting automation that makes life easier for finance teams

Replace manual fixes with automated processes that work reliably every time

Modern Spend Management for Scaling Finance Teams

Moss brings together cards, invoices, reimbursements and payments; all with built-in approval flows, audit trails, and spend limits.

A single, secure finance layer that’s easy to replicate across your portfolio.

Save Hours and Stay in Control

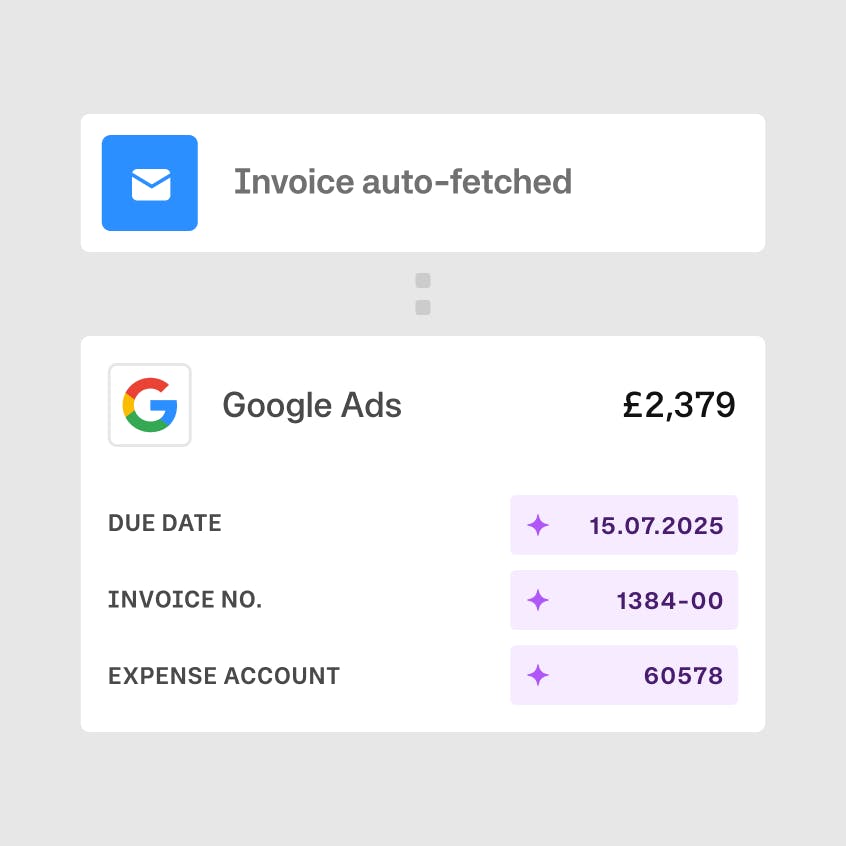

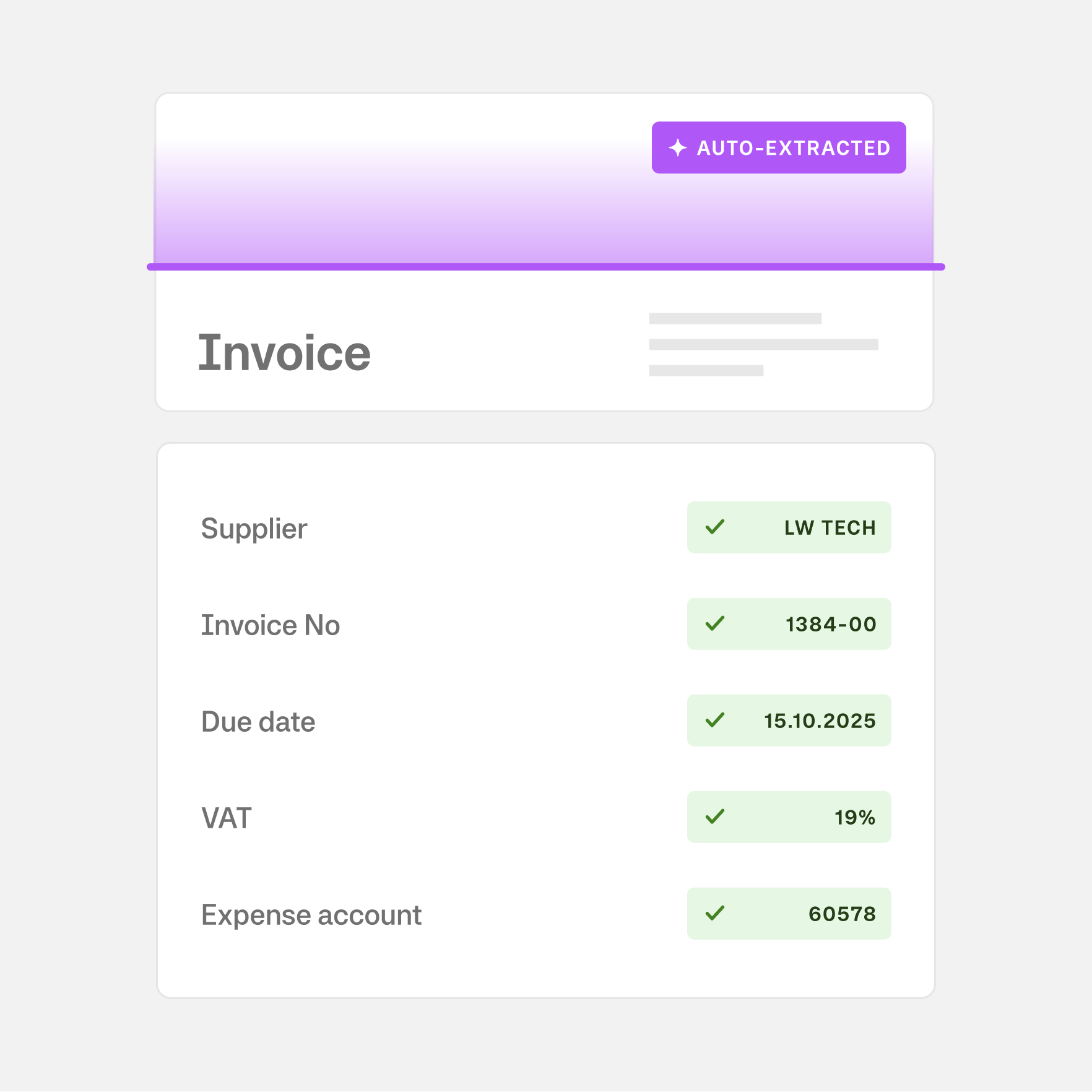

Moss AI automates data entry, coding and categorisation, across all spend types. Built-in rules and logic ensure finance teams keep control while spending less time chasing receipts or fixing errors.

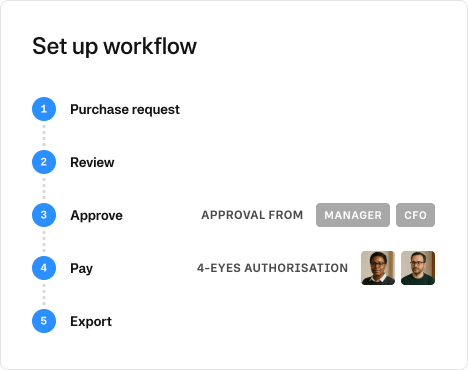

Approvals That Scale With Your Team

Create custom approval chains by role, department or spend type. Ensure compliance with mandatory fields and audit trails without slowing down finance operations.

Integrate With the Tools You Already Use

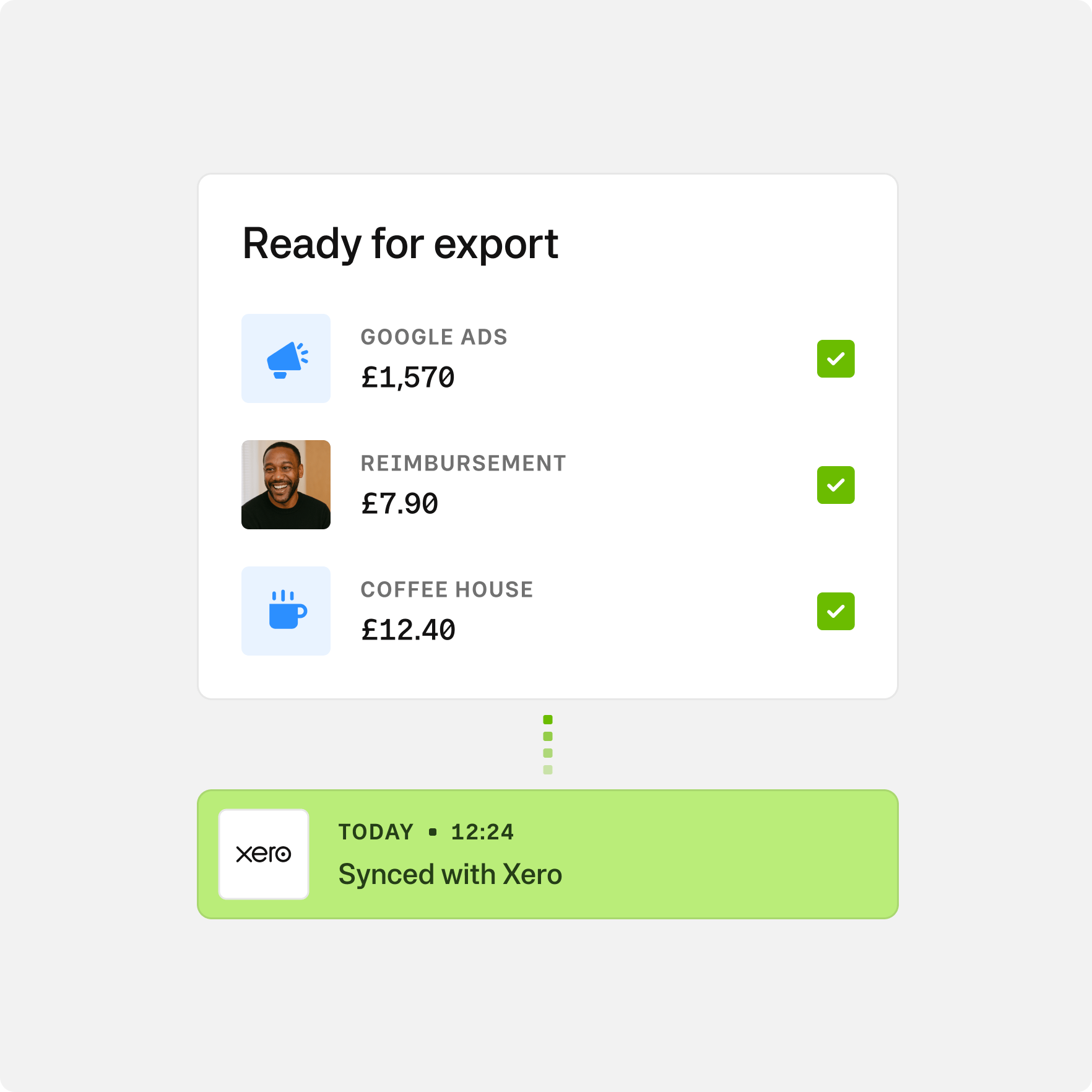

Moss connects with Xero, NetSuite, DATEV, QuickBooks, SAP and more, syncing spend data in real time for faster close and cleaner reports.

The preferred expense management solution for modern SMB finance teams

“It doesn’t matter which country the transaction is from. We have one system for approvals, accounting export, and audit documentation.”

FAQ

What is Moss, and how does it fit into our finance tech stack?

Moss is a spend management platform that gives you corporate cards, invoice processing, supplier payments, and end to end accounting automation.

It captures and structures every transaction precisely, turning spend into complete accounting records automatically.

Who is Moss suitable for?

Moss is built for modern finance teams in growing and mid-sized companies. Whether you're managing a single entity or operating across multiple locations, Moss helps streamline spend management—from cards and reimbursements to invoices and approvals.

Does Moss support multi-entity rollouts?

Yes. Moss supports multi-entity and multi-country portfolios with shared standards and local flexibility

How fast can Moss be implemented?

Most portfolio companies are live in under a week. A dedicated onboarding team supports setup, training and policy alignment from day one.

Can Moss handle multiple types of financial transaction?

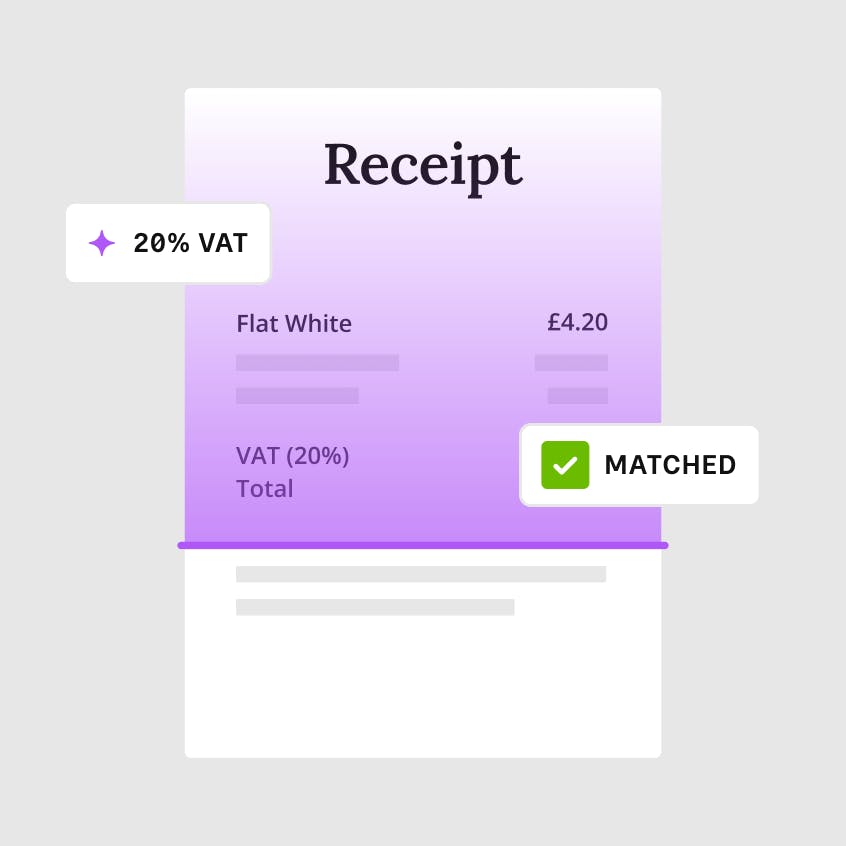

Moss uses AI to chase missing receipts, match uploads to card transactions, and flag anything still outstanding.

Receipts can be uploaded via mobile app, desktop, or email, and are stored with each transaction for audit-ready precision.

How secure and compliant is Moss?

Moss is an EMI regulated by BaFin in Germany and the FCA in the United Kingdom.

Moss is GoBD certified in Germany and ISO 27001 compliant.

All financial data is encrypted and processed in accordance with GDPR.

How long does it take to get started?

Most teams are onboarded in days. Moss imports your chart of accounts, syncs with your ERP or accounting tool, connects to your HRIS, and begins automating your workflows from day one.

Is Moss suitable for accounting firms and outsourced finance providers?

Yes. Moss offers a dedicated advisor portal for accounting firms, allowing you to manage all clients in one place and receive clean, coded, and complete spend data without manual clean up.

Explore more: Moss for Accounting Firms

G2

4.7

Ready to simplify how you support clients?