Integrate Moss with DATEV

As an official DATEV interface partner, Moss connects your company directly with DATEV Unternehmen Online or Rechnungswesen. Card payments, invoices, and employee expenses are automatically synced.

DATEV Marketplace

Save hours of manual work

Stable and reliable exports ensure that bookings are processed automatically — no manual steps required.

Data you can rely on

All master data stays correct and up to date. Thanks to two-way sync, Moss and DATEV always work with the same information.

Audit-proof

All transactions and receipts are GoBD-certified and archived in Moss, then exported to DATEV completely and transparently.

Trusted by finance teams at Europe's leading companies

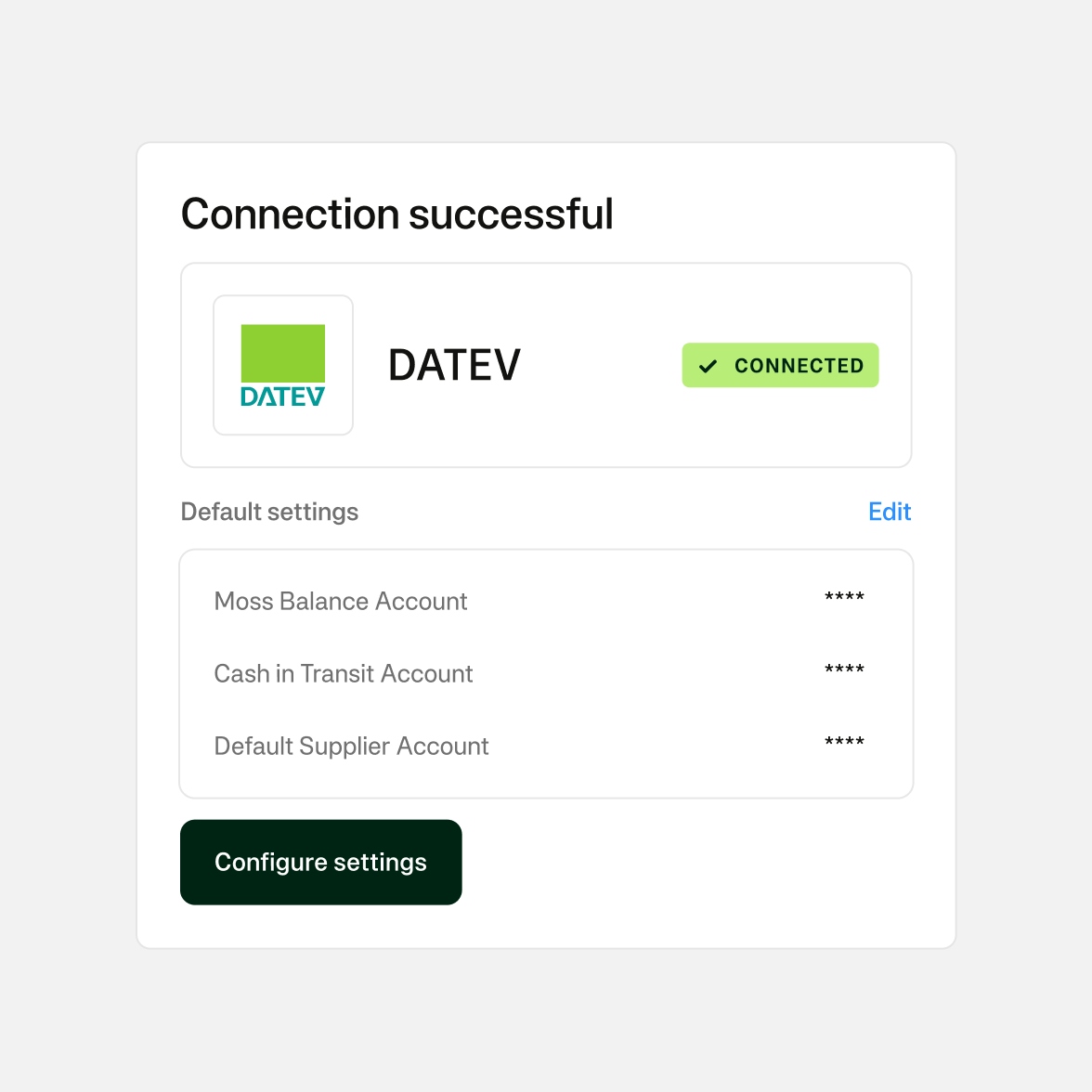

Quick connection to DATEV

Use the standard integration with DATEV Unternehmen Online, included in all Moss plans, or connect with DATEV Rechnungswesen for advanced two-way sync and master data mapping.

- Connect Moss with DATEV in just a few steps and start syncing immediately

- Custom setup to support your organisation’s needs

- Set default posting accounts to enable automated bookings

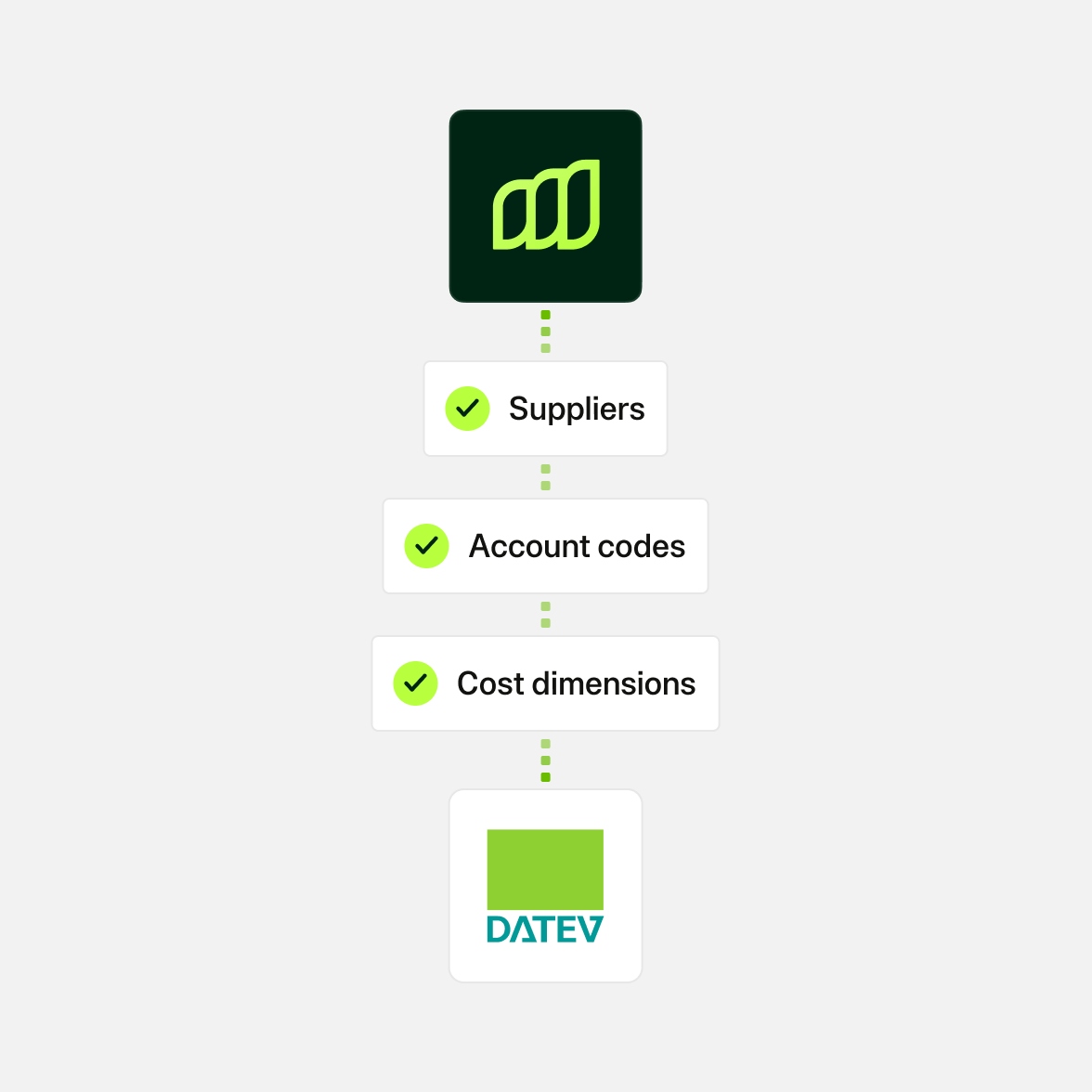

Master data and expenses always up to date

With the advanced Rechnungswesen integration, Moss and DATEV stay aligned via a 2-way sync.

- Import suppliers, account codes and cost centres from DATEV into Moss automatically

- Create and update suppliers directly in Moss and sync to DATEV Rechnungswesen

- Automatic daily sync, plus manual trigger on demand

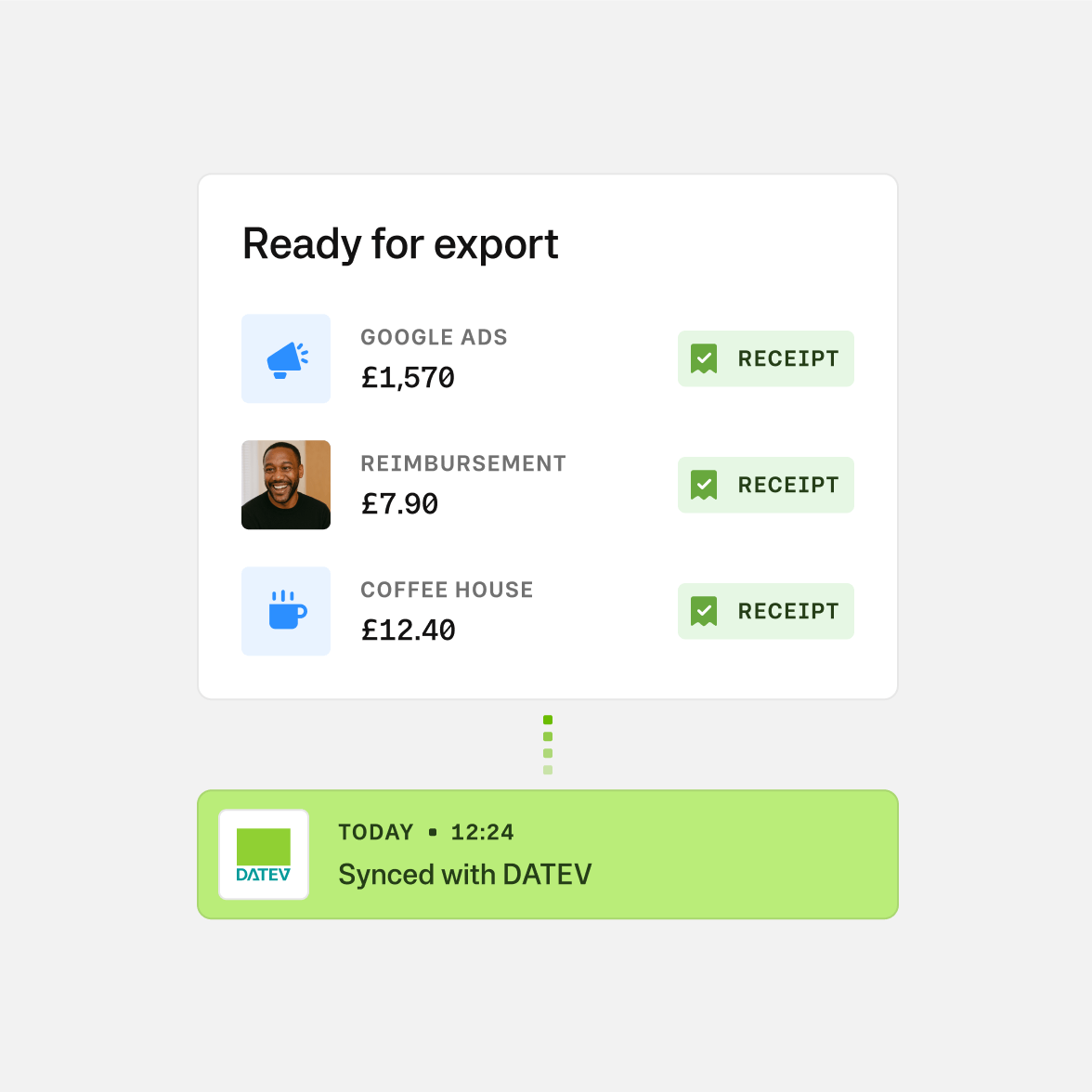

Every spend transaction matched with its receipt

Moss exports all transactions with their supporting documents directly into DATEV.

- Receipts are always linked to the correct bookings

- Complete traceability with a full document history

- Every export includes a detailed audit trail

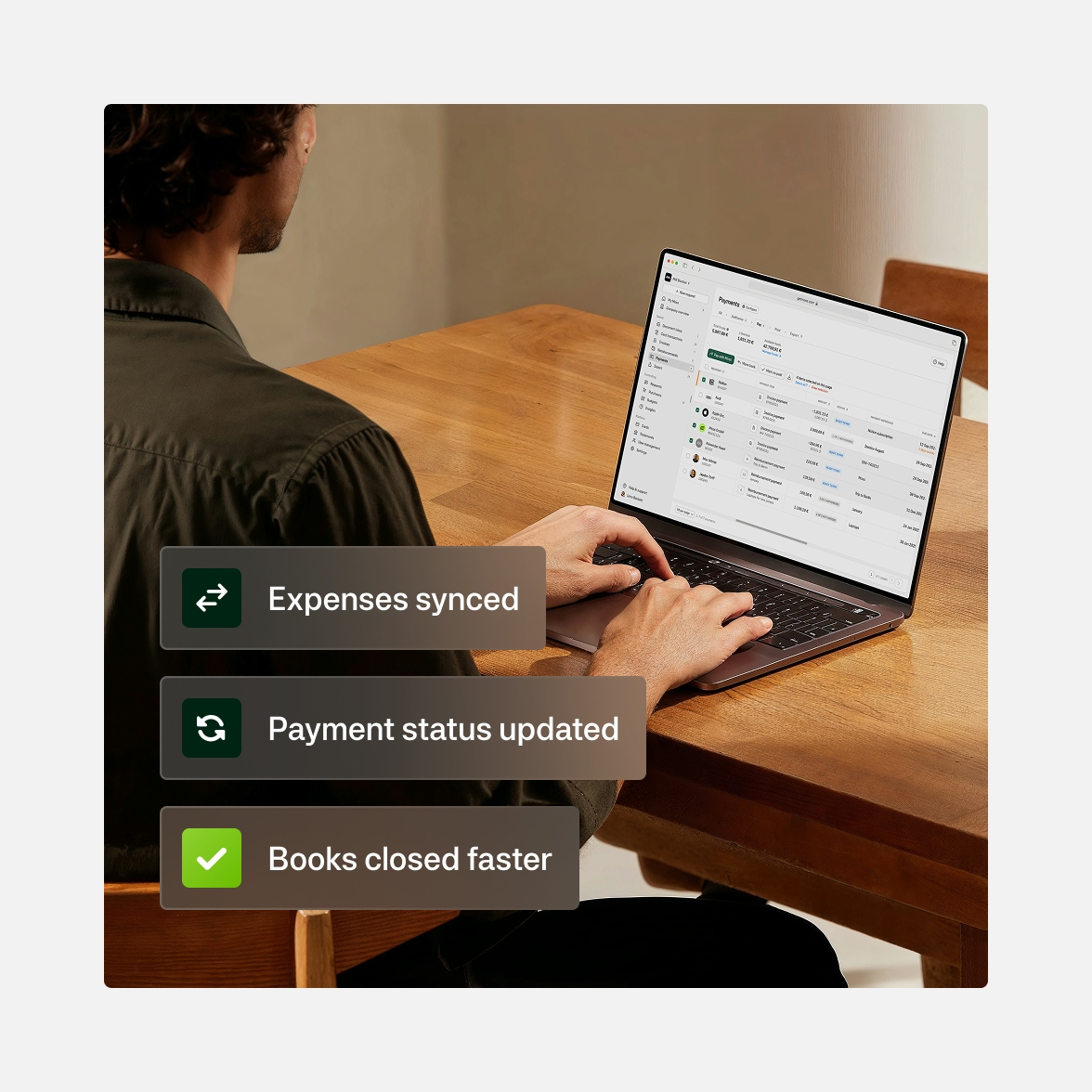

Accounting entries and payment status updated automatically

Moss reduces manual work by posting spend data to the correct accounts and keeping invoice payment statuses in sync with DATEV.

- Automatic generation of journal entries for all expense types

- Payment status of invoices is transferred from Moss to DATEV

- Less manual effort, more time for review and analysis

DUO

1-click exports to DATEV Unternehmen Online2-way sync

Save time with automatic sync of master data and posting directly in RechnungswesenMoss with DATEV. Flexible options for every accounting workflow.

Pay as you grow

Our pricing model is unique—just like your business. Design your ideal package: start with a base like Corporate Cards, Employee Reimbursements, or Accounts Payable, enhance with add-ons like Advanced Accounting or ERP integrations, and upgrade to an integrated suite when you're ready.

Best-in-class customer service, mobile app, and all the financial integrations you need to start effectively managing your spend.

Maximise spend efficiency and control with unlimited cards, customisable limits, and automated receipt fetching.

Make submitting reimbursements quicker and easier through streamlined upload and approval, and employee payouts directly from Moss.

Streamline accounts payable flow with customisable review process, effective supplier and OCR based automation, and one-click payments.

Improve financial oversight through budget tracking, spend insights, and greater flexibility in your approval flows.

Simplify purchasing through real-time budget oversight and efficient handling of purchase requests.

Native integrations to your ERP system, including support for any controlling dimensions that your business uses.

Enhance your pre-accounting experience with AI based automation, project-specific tracking, or the setting of mandatory fields.

FAQ

What does the Moss + DATEV integration do?

The Moss + DATEV integration connects your company spend with DATEV. Transactions, receipts and invoices are coded in Moss with the correct accounts, VAT rates, suppliers and cost cost centres, and then exported to DATEV with these attributes already applied. This reduces manual work and speeds up bookkeeping.

What does it mean that Moss is an official DATEV interface partner?

As an official DATEV interface partner, Moss provides certified and technically reliable integrations with DATEV. Our connections are regularly validated by DATEV to ensure full compliance with technical standards for secure and stable data exchange. Moss also has an in-house DATEV expert team that supports customers during setup and with any DATEV-related questions.

What is the difference between the standard integration with Unternehmen Online vs. the 2-way sync with Rechnungswesen?

The standard integration exports transactions and receipts from Moss to DATEV Belege Online, where they can be booked in Rechnungswesen. This integration is included in every Moss plan. In the 2-way sync integrations data flows in both directions. Moss exports expenses to DATEV and also imports and updates master data such as suppliers, accounts and VAT rates. Payment statuses are kept in sync automatically.

How does the setup work?

Moss provides a guided setup process. You connect your DATEV environment once and configure the mappings for account codes, VAT and suppliers according to your needs.

Which data is synced between Moss and DATEV?

Moss exports card transactions, reimbursements, supplier invoices, payments and receipts into DATEV. With the 2-way sync, Moss also imports master data such as suppliers, accounts and VAT rates, and keeps payment statuses aligned between both systems.

Does Moss support postings at the line-item level?

Yes! Moss captures all relevant details such as tax rates, accounts, and the KOST1 and KOST2 fields in DATEV. Additionally, credit card transactions can be posted directly at the supplier level to enhance accuracy and traceability.

What options do you provide to handle document management?

Documents stored in Moss can be transferred to DATEV Belege Online or to third-party solutions, ensuring synchronisation across systems. Moss is GoBD-certified, which means all receipts and documents are stored and processed in compliance with German bookkeeping and audit standards for digital record-keeping.

Is the integration included in my Moss plan?

The DATEV Unternehmen Online integration is available in the standard plan for every customer at no additional cost. The 2-way sync with DATEV Rechnungswesen is part of the ERP add-on and requires configuration based on your setup.

G2

4.7

Experience modern spend management with Moss.