Why finance teams run better with Moss

Bring corporate cards, reimbursements, and invoices to one powerful platform. Automate pre-accounting, enforce your policies, and close your books faster. Precision, clarity, and control—finally in one place.

Powerful controls tailored to your organisation

Issue unlimited cards with confidence. Set custom limits and approval flows that align with how your teams work—whether by cost centres, departments, or projects. Moss keeps spend predictable and compliant without slowing you down.

Less time on receipts, more on results

No more chasing receipts or fixing errors. Moss captures expenses automatically—via email, app, or web—and organizes them into clear reports. Enforce policies while giving you hours back every week to focus on what really matters.

Pre-accounting finance teams actually enjoy

Automatically code transactions using AI and sync them to your accounting software for a faster, error-free month-end close.

Trusted by finance teams at Europe's leading companies

The smarter choice for modern finance teams

Moss is the all-in-one spend management platform that replaces scattered tools, manual work, and outdated processes. From card issuing to invoice handling and reimbursements, Moss puts finance teams back in control—with smart automation, flexible workflows, and deep accounting integration.

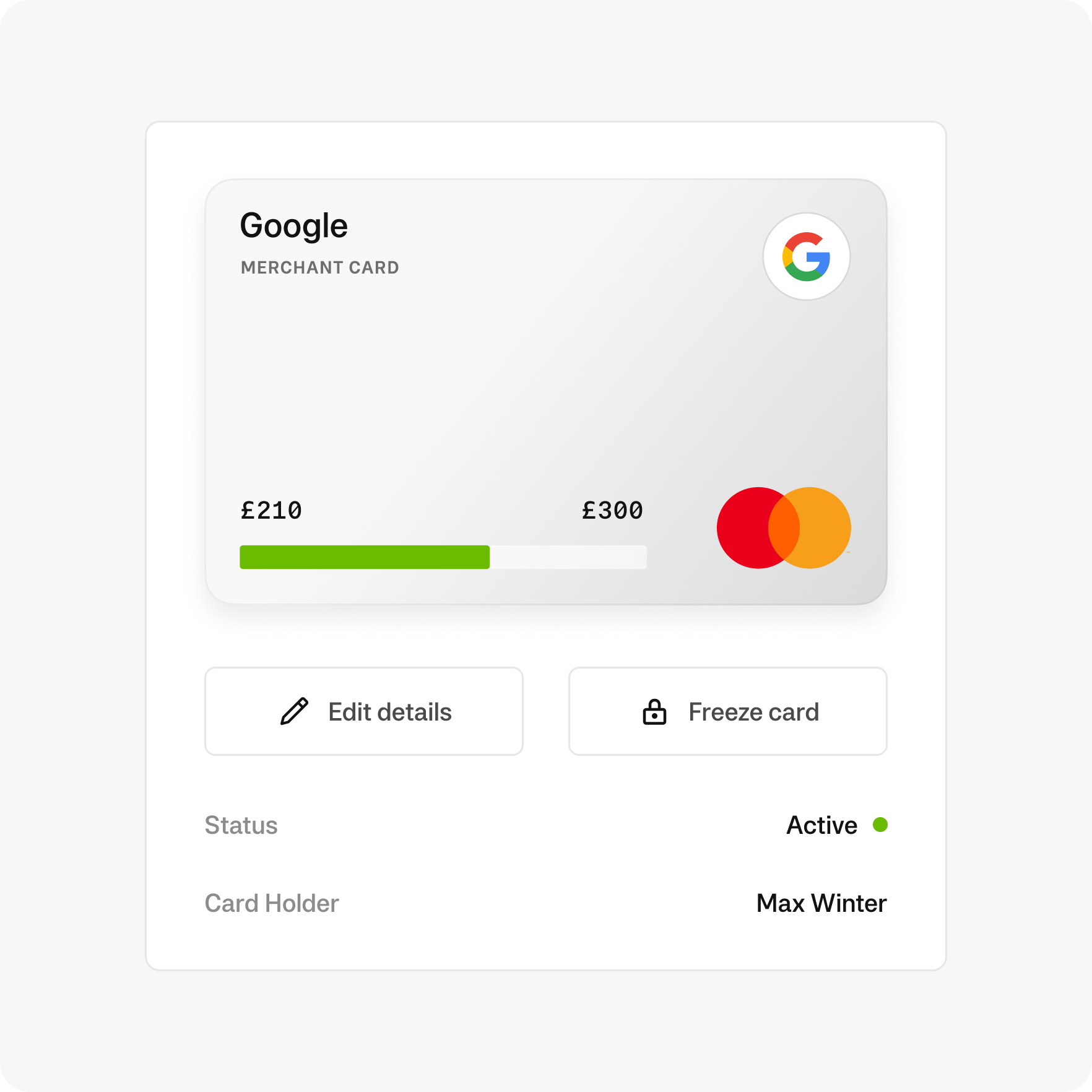

Corporate cards that follow your rules

Issue virtual and physical cards with pre-set budgets, approval logic, and full transaction visibility. Empower employees to spend without losing control.

- Unlimited virtual & physical cards with custom limits

- Role-based approval flows aligned with your org structure

- Spend control by team, project, or merchant—in real time

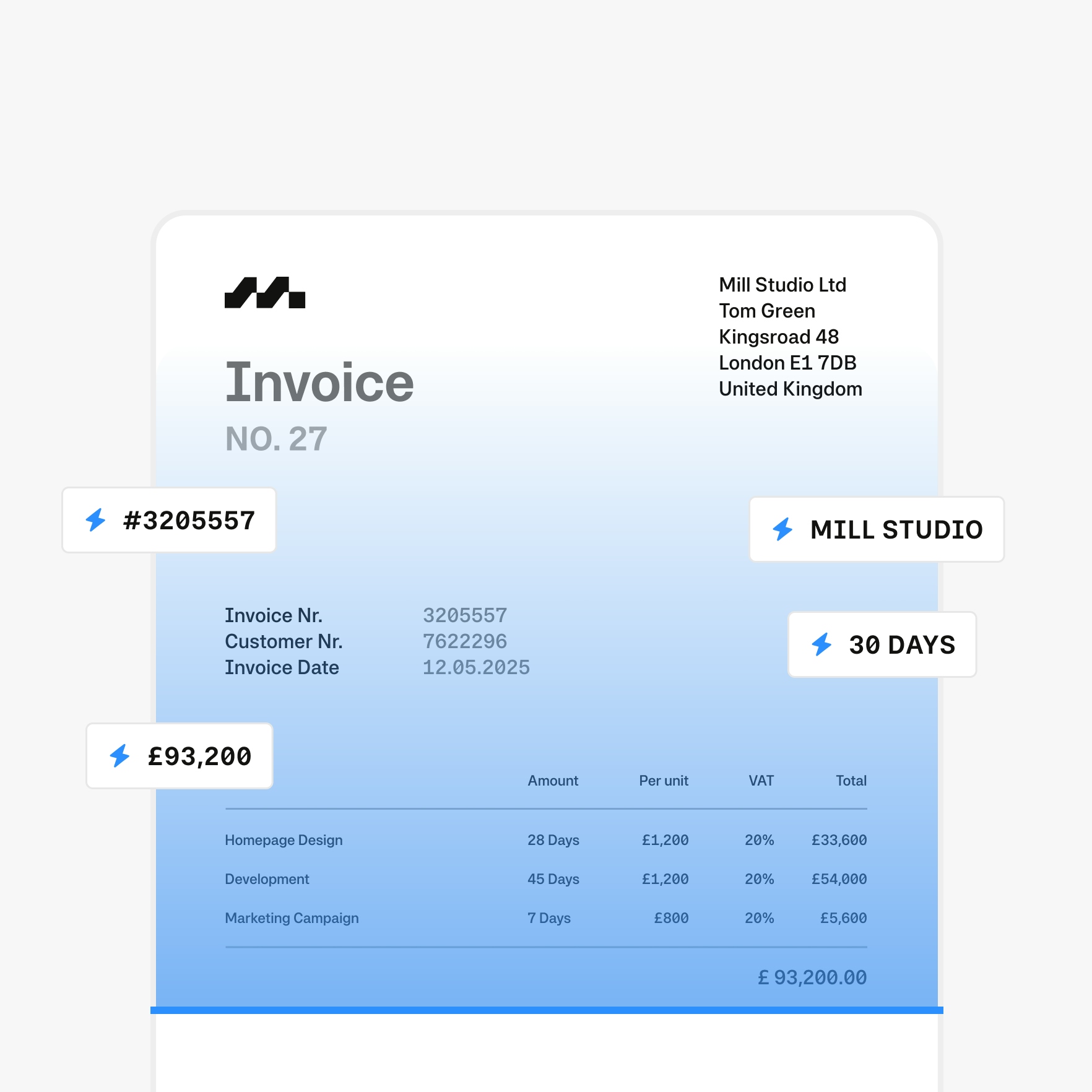

Smart automation for every transaction

"Invoices and card spend are automatically matched, coded, and enriched with VAT, supplier data, and payment terms—ready for export to your accounting system.

- Auto-coding of transactions with AI-powered rules

- Ready-to-export pre-accounting without manual entry

No more manual reconciliation

Connect Moss to your ERP or accounting software and sync all spend data with one click. From payment to posting, everything is fully traceable and audit-ready.

- One-click export to Xero, Exact & more

- Clean accounting data: from spend to booking without rework

- Fully traceable spend records—audit-ready by default

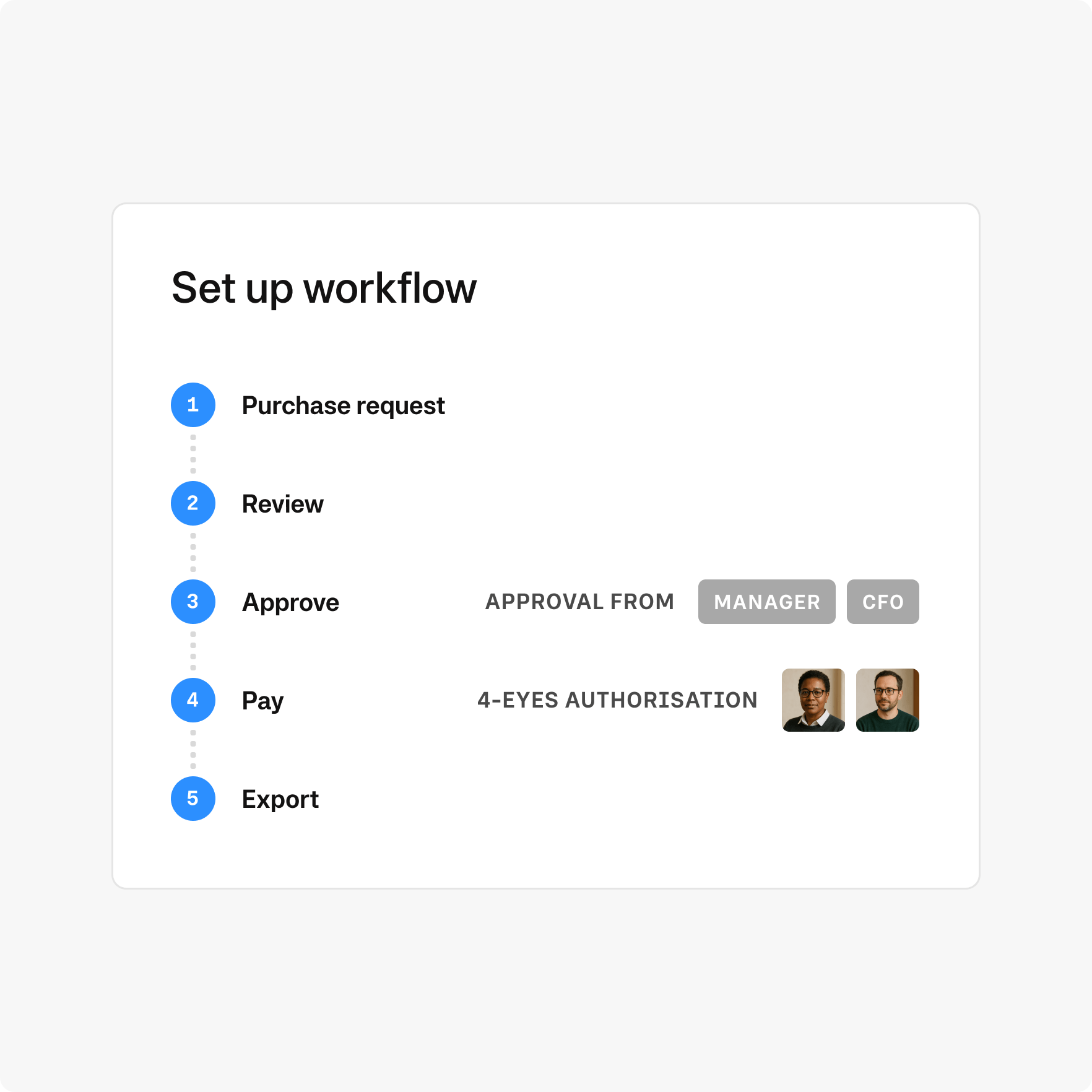

End-to-end process control

Track and manage spend across teams, departments, and entities—with role-based permissions and workflows that adapt to your organisation.

- Flexible workflows & permissions for scalable control

- Real-time overview of all transactions in one place

Pay as you grow

Our pricing model is unique—just like your business. Design your ideal package: start with a base like Corporate Cards, Employee Reimbursements, or Accounts Payable, enhance with add-ons like Advanced Accounting or ERP integrations, and upgrade to an integrated suite when you're ready.

Best-in-class customer service, mobile app, and all the financial integrations you need to start effectively managing your spend.

Maximise spend efficiency and control with unlimited cards, customisable limits, and automated receipt fetching.

Make submitting reimbursements quicker and easier through streamlined upload and approval, and employee payouts directly from Moss.

Streamline accounts payable flow with customisable review process, effective supplier and OCR based automation, and one-click payments.

Improve financial oversight through budget tracking, spend insights, and greater flexibility in your approval flows.

Simplify purchasing through real-time budget oversight and efficient handling of purchase requests.

Native integrations to your ERP system, including support for any controlling dimensions that your business uses.

Enhance your pre-accounting experience with AI based automation, project-specific tracking, or the setting of mandatory fields.

The preferred spend management solution for modern SMB finance teams.

Capterra

4.8

Experience effective corporate card features with Moss

FAQ

Who is Moss suitable for?

Moss is built for modern finance teams in growing and mid-sized companies. Whether you're managing a single entity or operating across multiple locations, Moss helps streamline spend management—from cards and reimbursements to invoices and approvals.

How can Moss help me save money?

With Moss, you reduce wasteful spend by assigning limits, enforcing approvals, and gaining real-time visibility across all expenses. Automation replaces manual tasks, reducing admin costs and allowing your finance team to focus on strategic work.

Can Moss integrate with my accounting system and other tools?

Absolutely. Moss integrates with leading accounting systems, ERPs, HR and travel tools, as well as SSO platforms. You can also export data manually if needed. Moss adapts to your existing setup—so you stay in control without having to change your systems.

Is Moss secure?

Yes. Moss is a licensed e-money institution regulated by BaFin and compliant with PSD2. We use bank-level security, including 3DS authentication, real-time fraud checks, and 4-eyes approval for payments. All data is stored securely in Germany and meets GDPR and ISO 27001 standards.

What makes Moss different from other providers?

While many spend management providers focus on surface-level features like card issuing or basic invoice tracking, Moss offers true depth where finance teams need it most. Moss combines unlimited card flexibility, invoice automation, and employee reimbursements with smart pre-accounting, powerful approval workflows, and deep accounting integrations.