Why finance teams run better with Moss

Built for finance teams who need more than just basic spend control. Moss combines real credit cards, scalable approvals, advanced accounting workflows, and AI-powered automation in one platform.

Built for finance teams

Moss covers the details that matter: automated VAT splits, prepaid expense handling, and advanced accounting integrations.

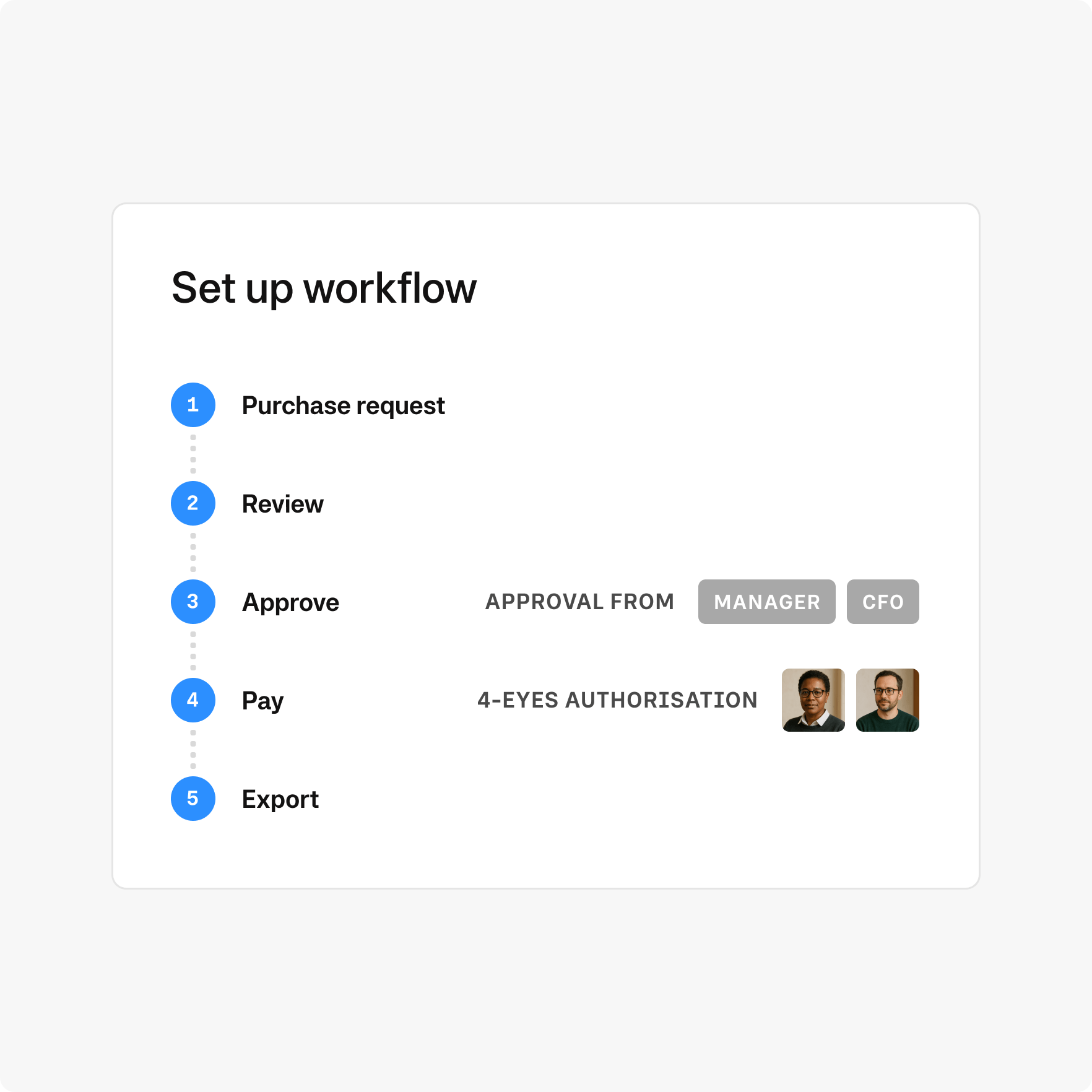

Made to match your processes

Custom approval flows, supplier management and flexible coding. Moss adapts to your workflows, not the other way around.

Ready to scale with you

Unlimited virtual cards, flexible pricing, and automation built for complex teams so you scale without slowing down.

Trusted by finance teams at Europe's leading companies

Why companies switch to Moss

Moss offers what spend tools often lack: real Mastercard credit cards instead of debit, smart accounting automations that go beyond OCR, and two-way sync with tools like Xero. No user-based pricing, no caps on virtual cards, and support from people who understand finance teams.

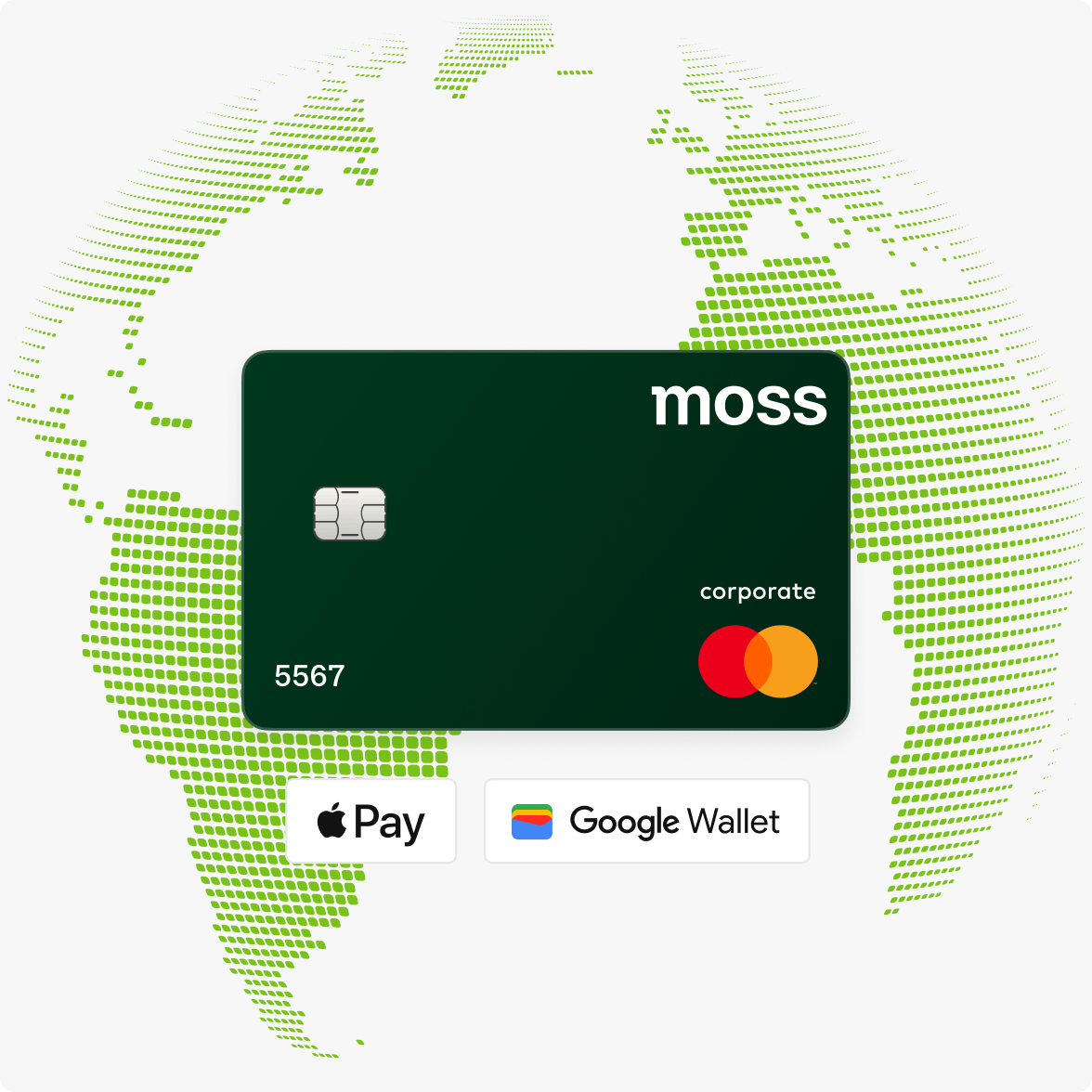

Full control. Global reach.

Avoid shared cards, blocked payments, and inflexible rules. With Moss, every employee gets the right card with the right controls, and finance keeps full visibility.

- Unlimited virtual cards for any purpose

- Custom rules by merchant category, time, or amount

- Real Mastercard credit cards for global acceptance

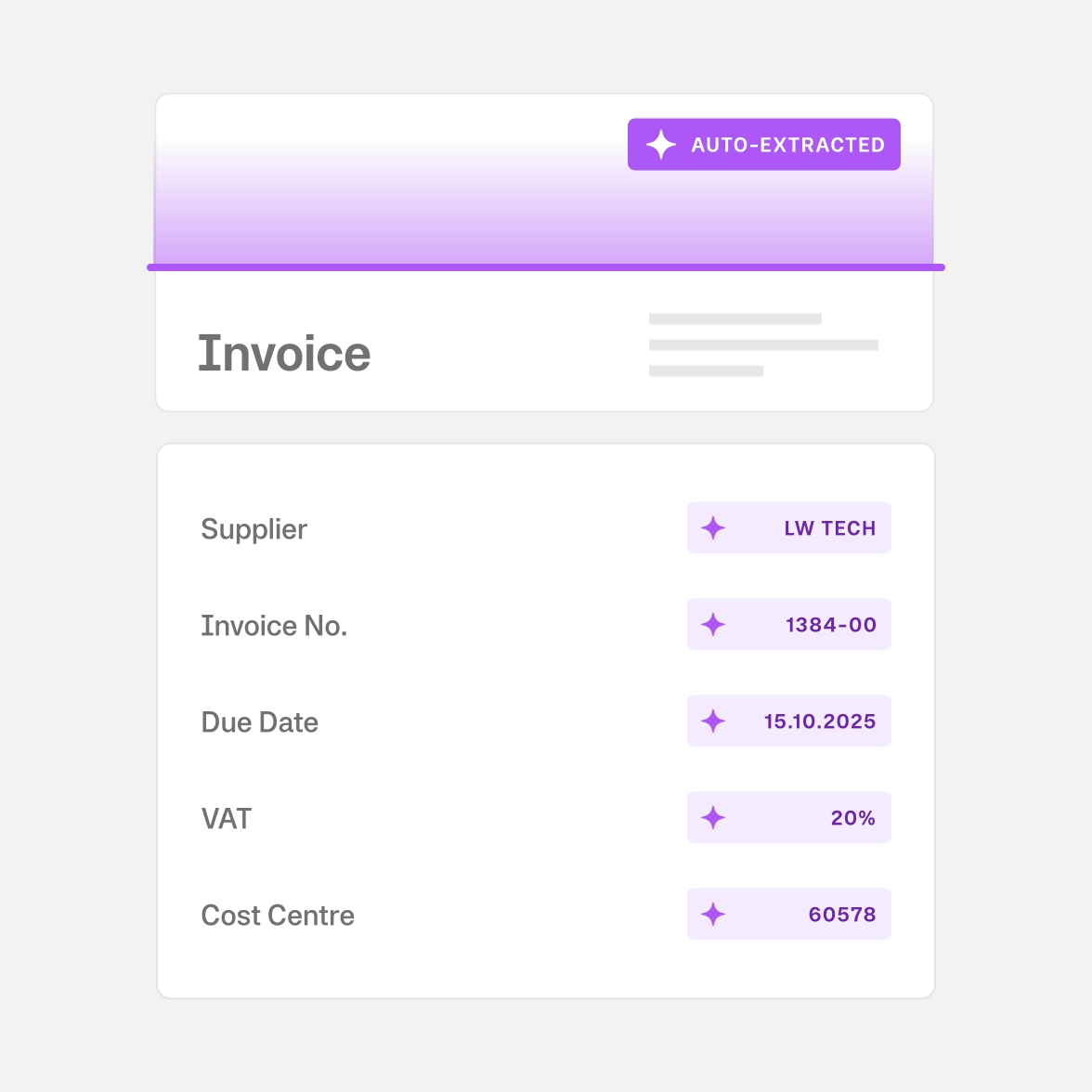

Built-in invoice workflows that scale

Moss combines invoice automation with built-in procurement workflows. From pre-approved purchase requests to final payment, everything runs in one tool.

- Powerful OCR with automatic supplier updates

- AI-powered automation and validations to reduce manual work

- Four-eyes payment approvals and audit-ready documentation

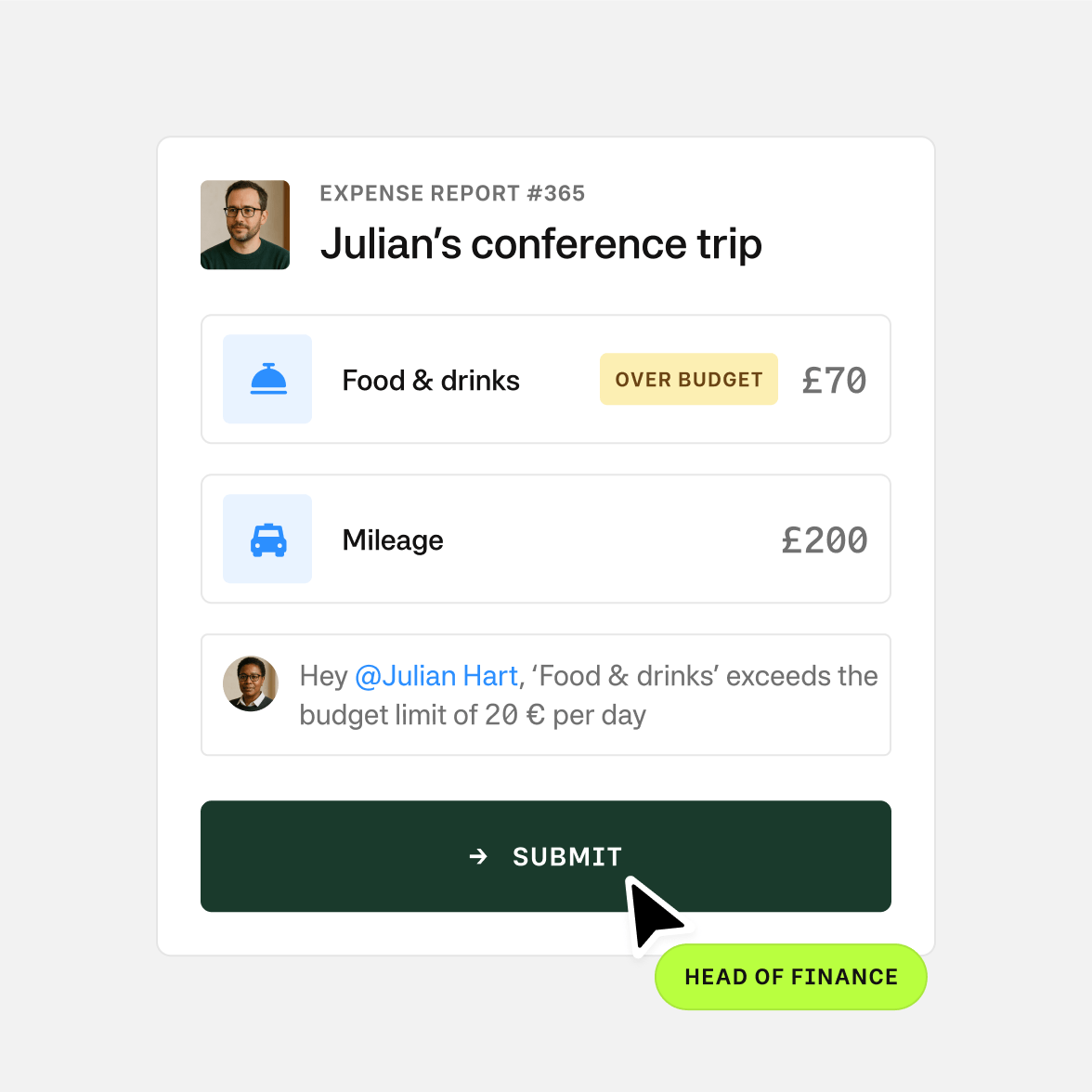

Make out-of-pocket spend painless

Moss speeds up reimbursements while giving finance full control — with automation, approvals, and better tracking built in.

- OCR reads receipts and groups expenses into reports

- Bulk payouts save time and reduce errors

- Supplier logic ensures clear spend tracking per employee

Built for accurate books

Moss connects to your accounting tools the right way. With two-way sync, AI-powered coding, and reliable data flow, your books stay clean and audit-ready.

- Integrations with Xero, Oracle NetSuite, QuickBooks, and more

- AI suggests fields based on historical data and custom rules

- No manual workarounds — exports follow local accounting standards

The preferred spend management solution for modern SMB finance teams.

Pay as you grow

Our pricing model is unique—just like your business. Design your ideal package: start with a base like Corporate Cards, Employee Reimbursements, or Accounts Payable, enhance with add-ons like Advanced Accounting or ERP integrations, and upgrade to an integrated suite when you're ready.

Best-in-class customer service, mobile app, and all the financial integrations you need to start effectively managing your spend.

Maximise spend efficiency and control with unlimited cards, customisable limits, and automated receipt fetching.

Make submitting reimbursements quicker and easier through streamlined upload and approval, and employee payouts directly from Moss.

Streamline accounts payable flow with customisable review process, effective supplier and OCR based automation, and one-click payments.

Improve financial oversight through budget tracking, spend insights, and greater flexibility in your approval flows.

Simplify purchasing through real-time budget oversight and efficient handling of purchase requests.

Native integrations to your ERP system, including support for any controlling dimensions that your business uses.

Enhance your pre-accounting experience with AI based automation, project-specific tracking, or the setting of mandatory fields.

FAQ

Who is Moss built for?

Moss is built for modern finance teams who need more than just a tool for spenders. Whether you're scaling a fast-growing startup or managing multiple locations, Moss gives you full control over cards, invoices, and reimbursements — all in one platform.

How does Moss help reduce costs?

Moss helps prevent overspending with real-time limits, custom approval flows, and clear budget ownership. Automation replaces manual work, saving time and headcount. Unlike tools with rigid user pricing or hidden fees, Moss offers flexible plans that grow with your business.

Can Moss integrate with my accounting software?

Yes. Moss integrates with leading systems like Xero, Oracle NetSuite, QuickBooks, Exact and more. HR and travel tools can also be connected.

Can Moss handle complex approval flows?

Yes. Moss lets you build custom, multi-step approval flows using conditional logic — based on roles, departments, amounts, and more. Whether it's for cards, invoices, or reimbursements, Moss adapts to your real processes.

Is Moss secure?

Absolutely. Moss meets high security standards with 3DS authentication, real-time fraud detection, and four-eyes approval for payments. All data is stored in compliance with GDPR and protected by ISO 27001-certified infrastructure.

What makes Moss different from other platforms?

Most tools focus only on spenders. Moss gives finance teams the control they need — with deep accounting integrations, advanced approvals, and automation that actually scales. Powerful for finance, simple for teams.

What support does Moss offer?

Moss offers fast, expert support from trained finance professionals who understand how UK teams work. No outsourced call centres — just knowledgeable people who speak your language and are ready to help when you need it.

Capterra

4.8