Corporate cards, built for finance control

Set smart limits, track every transaction, and approve spend your way. Issue as many cards as your business needs — all with accounting built in.

4.8 on Capterra

Controls and limits you can trust

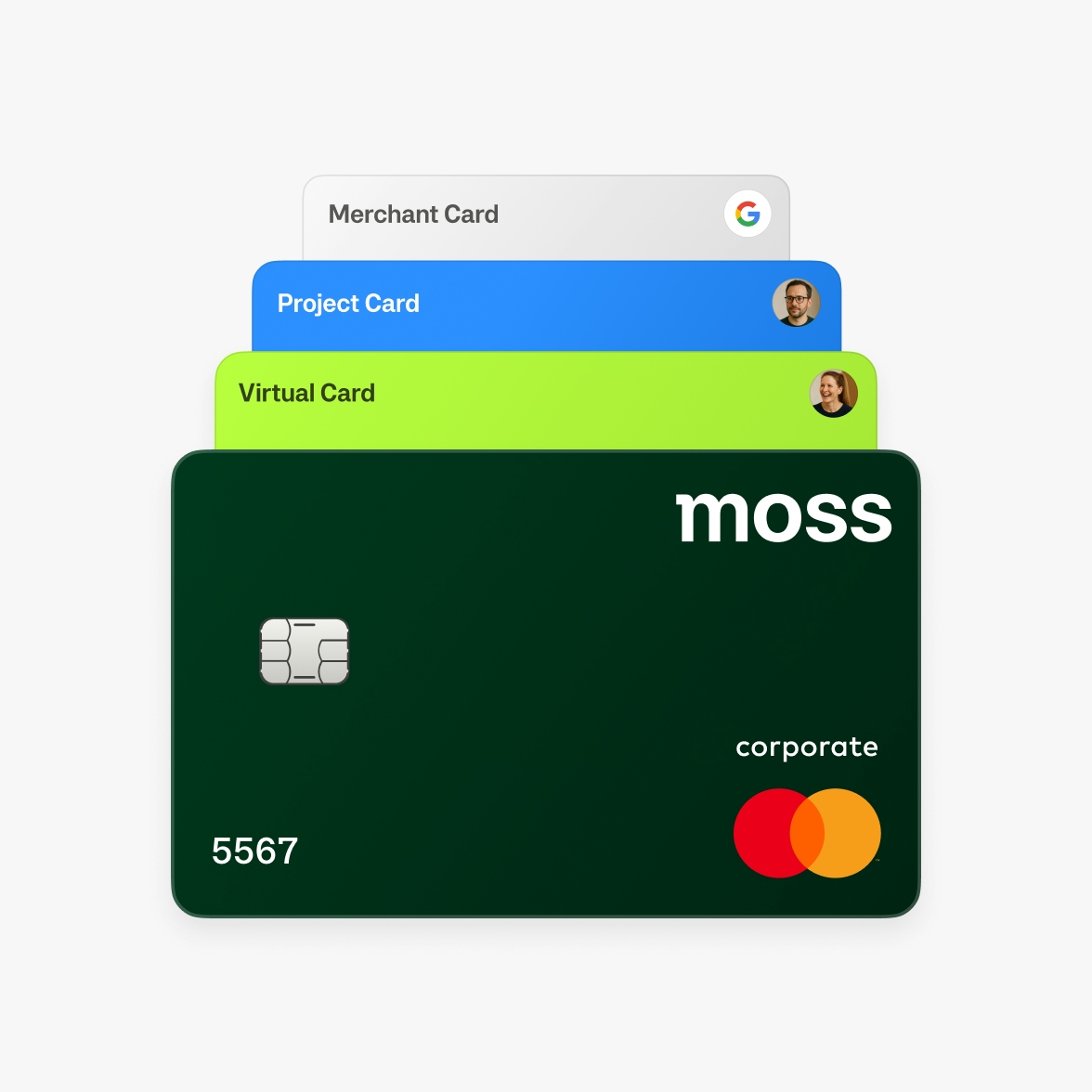

Create physical or virtual cards with custom limits. Prevent overspending across projects, teams, merchants, and more.

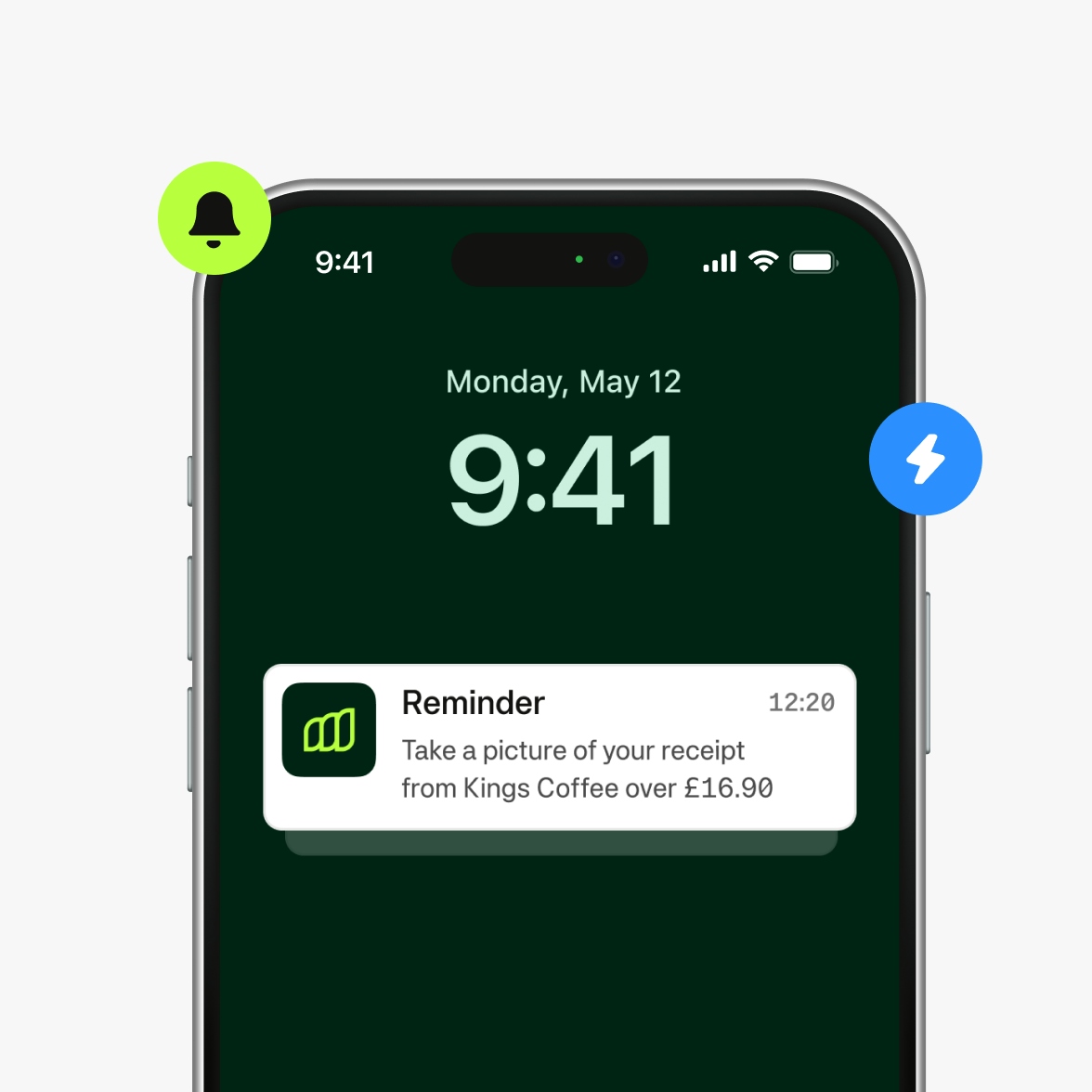

No more missing receipts

Auto-fetch from email, send reminders, or upload via mobile — so finance doesn't have to chase.

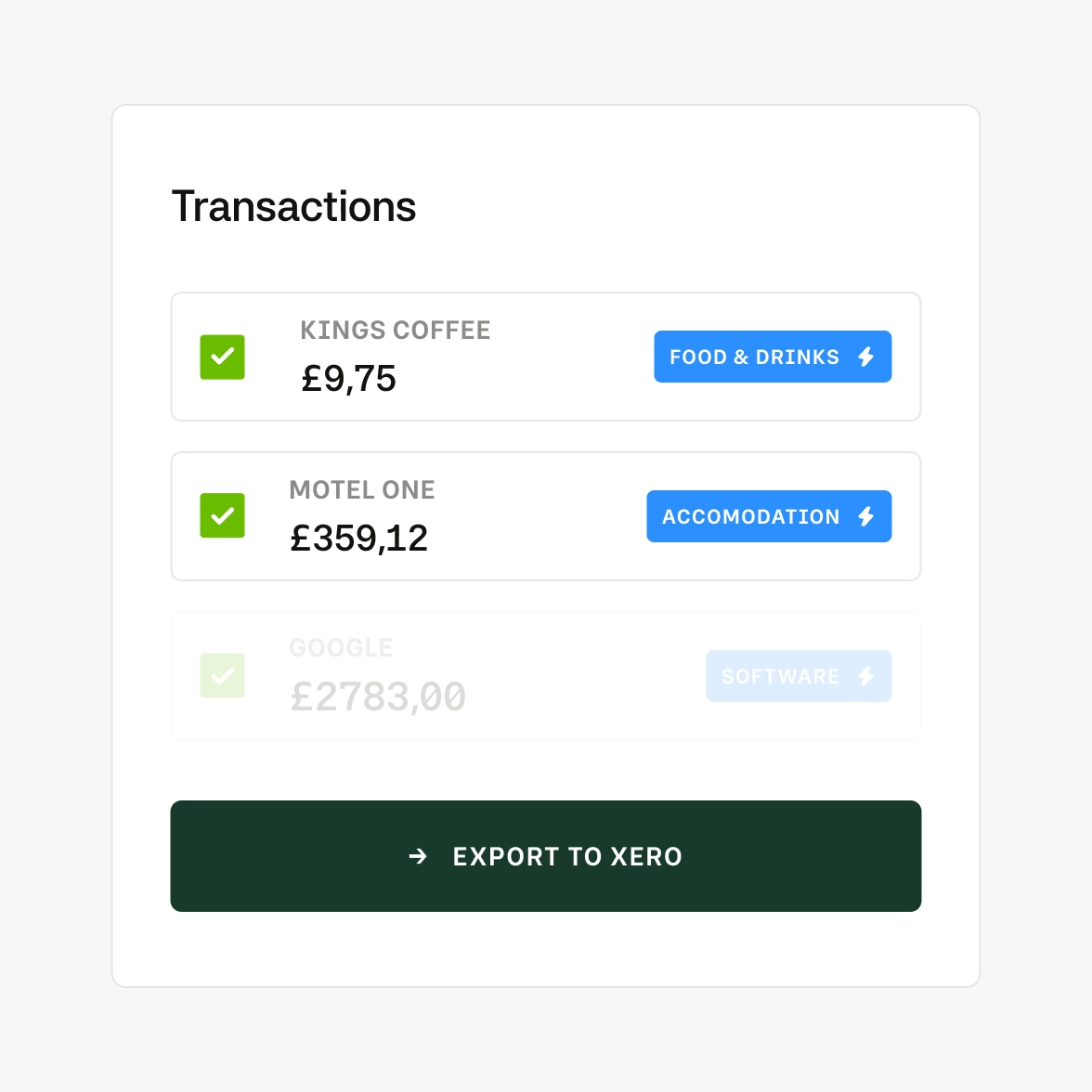

Pre-accounting that saves time

Auto-code transactions and sync directly with your accounting software. Save time and close books with confidence.

Trusted by finance teams at Europe's leading companies

The right corporate card for your business

Moss Credit Card

The smart business credit card with flexible payment terms.

- High credit card limits of up to £2.5 million per month

- Flexible payment terms

- Real Mastercard business cards accepted worldwide

- Corporate cards for various purposes and teams

- Create and customise virtual business credit cards with just a few clicks

Moss Debit Card

Stay in control with business prepaid cards.

- Unlimited virtual or physical cards created in one-click

- Individual and adjustable limits per card or transaction

- Automated spend approval workflows

- Global acceptance of Mastercard corporate cards

- Digitised in-app receipt capture

- Direct accounting integration

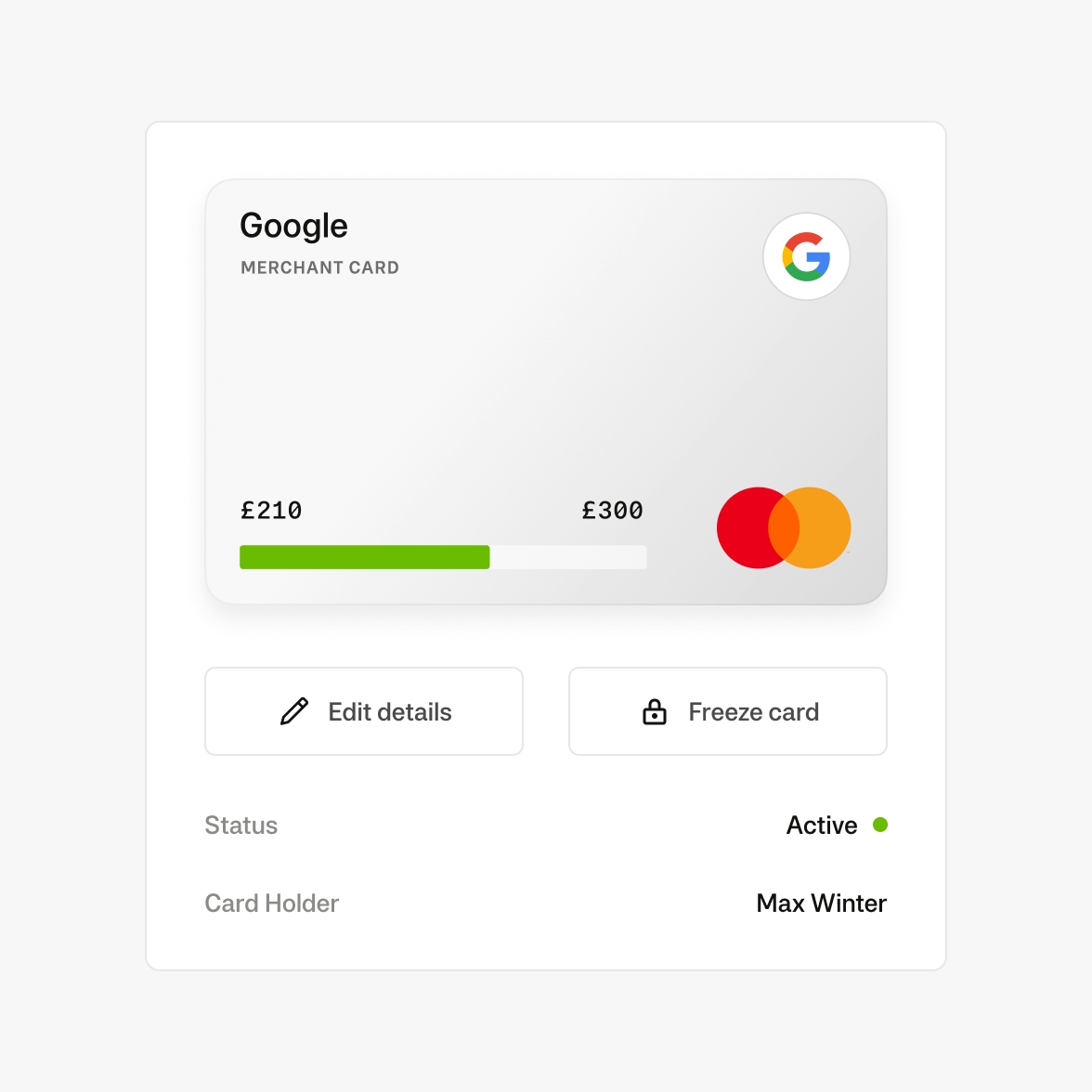

Cards with control, clarity, and complete visibility

Create cards in seconds, set custom limits, collect receipts automatically, and track spend in real time — all with full mobile readiness and accounting built in.

Pay instantly — anywhere

Add Moss cards to your mobile wallet and start spending in seconds. No delays, no extra steps. Ideal for subscriptions, team projects, or one-time purchases.

- Apple Pay & Google Wallet ready

- Add new cards to mobile in seconds

- Works globally, online and in-store

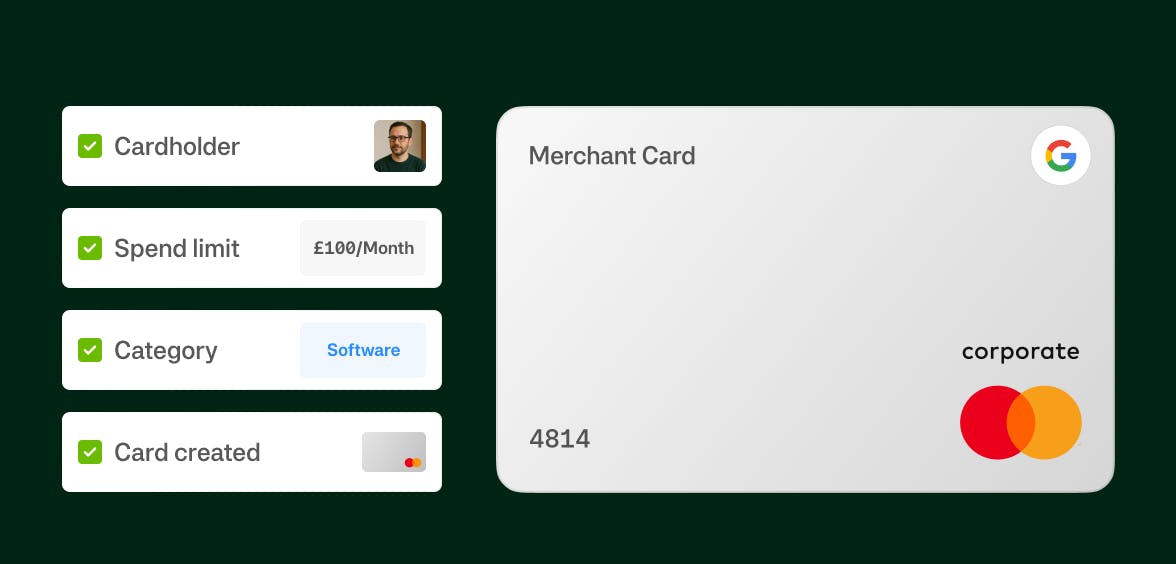

Control spend before it happens

Set flexible limits and approval flows by user, team, or spend type. Prevent overspending with real-time alerts and policies tailored to how your company works.

- Role-based limits and approval rules

- Alerts for unusual or failed spend

- Controls by category, time and more

Receipts submitted on time — without the chase

Moss reminds employees to submit receipts and can fetch them automatically from your inbox. Finance always sees what’s missing — and who owes what.

- Auto-fetch from Gmail and Outlook

- Upload via app, email, or browser

- Real-time view of missing or late receipts

Close the books on time, every time

Moss auto-categorises spend, matches receipts, and syncs with your accounting system — so closing the books is fast, accurate, and always audit-ready.

- OCR and AI-powered categorisation

- Configurable mapping for VAT, expense accounts and more

- Direct sync with Xero and other ERPs

The preferred spend management solution for modern SMB finance teams.

“Our go-to for employee payment cards, reimbursements, and any type of employee expense management. Immediate availability of digital payment cards for new employees and fast delivery of physical cards.”

G2

4.8

Smarter spend.

On your terms.

Start free with core features or unlock the full power of Moss with advanced approvals and smart automation.

Free Plans

Start free with Cards or Accounts Payable. Upgrade anytime as your needs grow.

- Up to 3 users with unlimited cards

- Up to 20 invoices per month

- Custom approval & verification steps

Paid Plans

from 99€ / Month

Build your ideal package and pay only for the features you use.

- Unlimited users, cards & invoices

- Advanced approval flows & budget controls

- Accounting integrations and access to add-ons

- Smart user management with HR integrations

- 1:1 onboarding support

Moss integrates with 50+ finance tools

FAQ

How quickly can cards be issued and used?

Cards are issued instantly and can be used immediately through digital wallets or as physical cards.

What types of cards does Moss offer?

Moss provides both physical and virtual corporate credit cards — issue as many virtual cards as you need for any use case.

What are Moss virtual credit cards?

Moss virtual credit cards are digital-only credit cards that link directly to your Moss account and are ready to use immediately after creation. Once you are approved for our card program, you can generate as many virtual cards as you need.

How can I fund my cards?

Start instantly with Moss by prefunding your Moss wallet (debit model), or apply for a credit line (subject to eligibility). Both options give you the same benefits of Moss cards.

Where can I use my Moss card?

Anywhere Mastercard is accepted — over 29 million merchants worldwide, both online and in-store.

How does the integration work with existing systems?

Moss cards integrate seamlessly with major accounting and ERP systems, supporting both 2-way data sync and real-time updates.

How do employees request and get approval for cards?

Employees request cards directly in Moss. Each request follows your company’s custom approval flows — based on amount, role, or team.