Accelerate your accounting with Ai powered automation

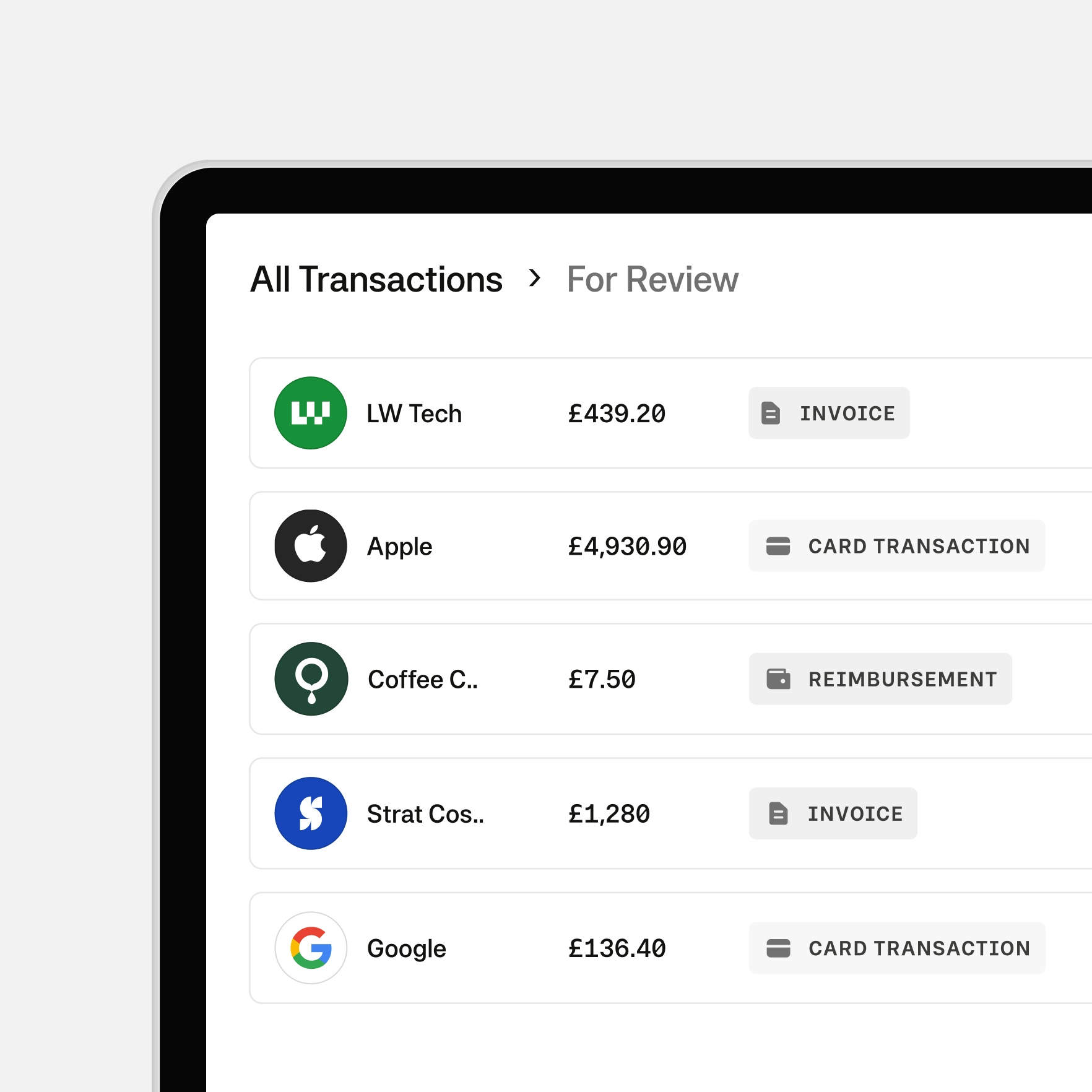

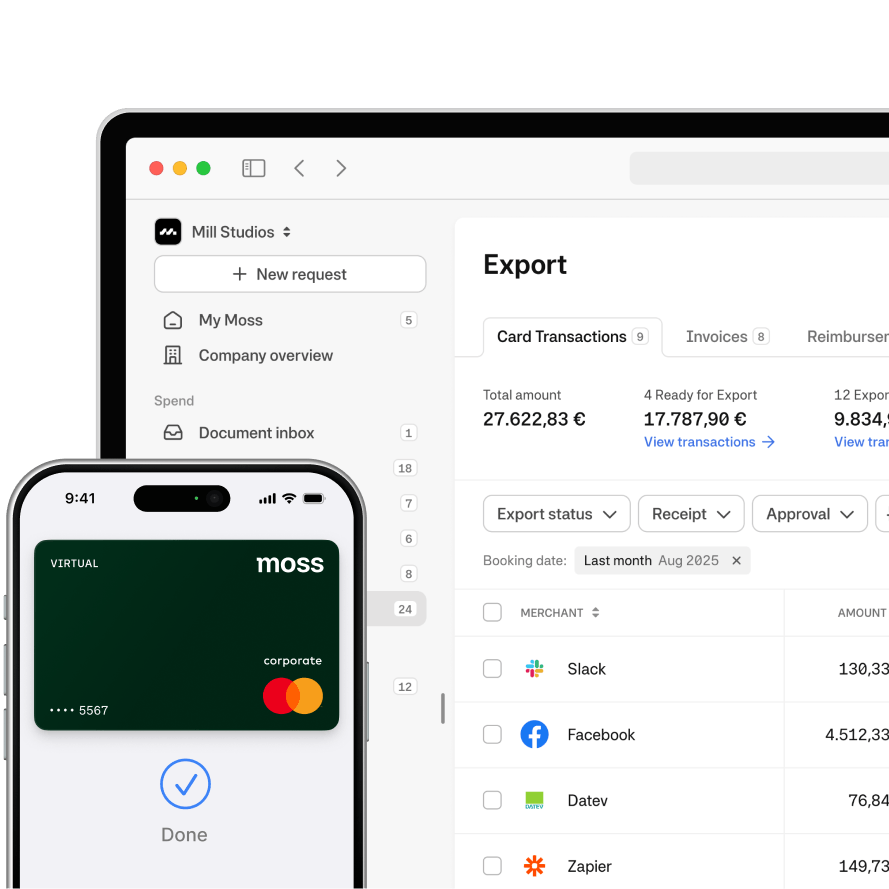

Moss captures, processes, and reconciles invoices, card transactions, and reimbursements end to end, delivering clean accounting data automatically.

Automation across your entire accounting workflow

From invoices to card spend to reimbursements, Moss automates every step of accounting data preparation.

Transactions coded and reconciled automatically

Every transaction becomes a complete record, reducing manual checks and month-end stress.

Built to your accounting standards

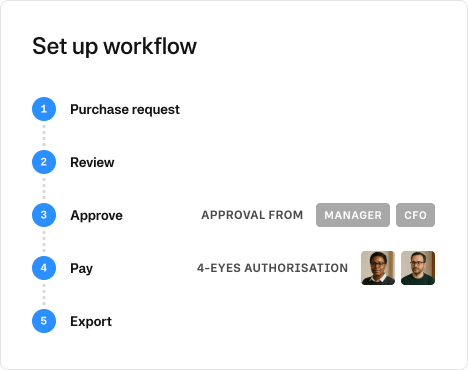

Moss applies your rules on coding, approvals, and data fields, ensuring compliance from day one, and keeping you in control at all times.

Trusted by finance teams at Europe's leading companies

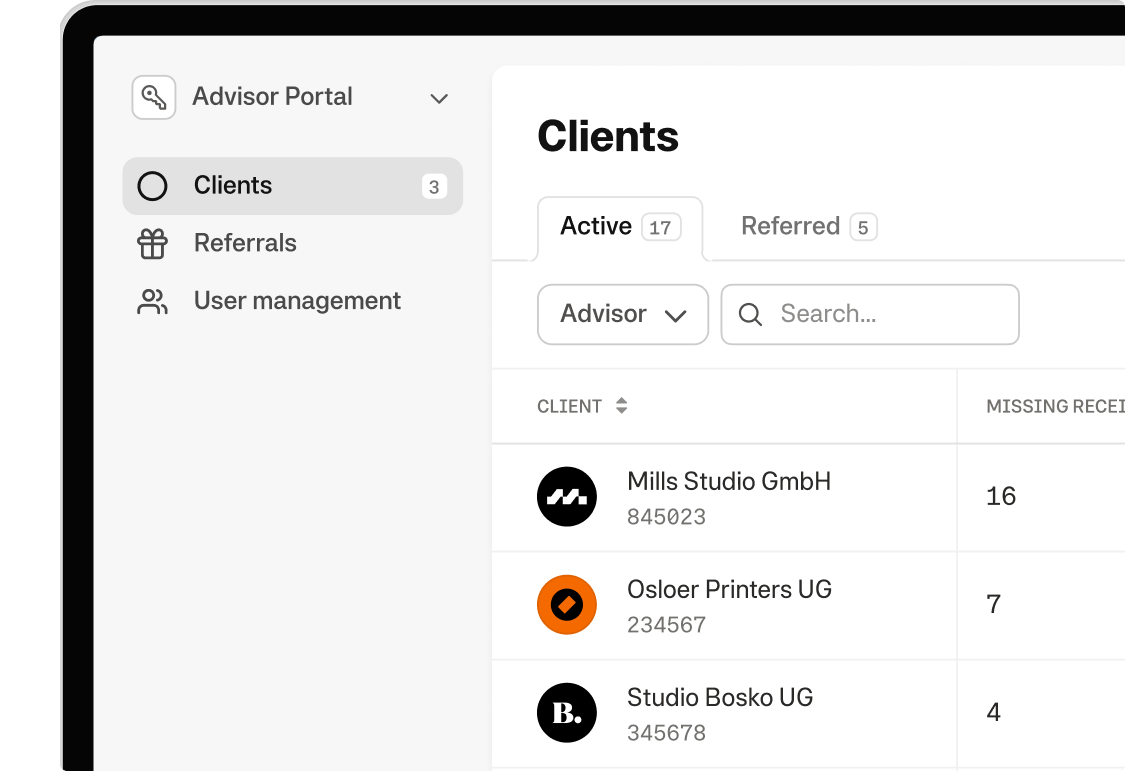

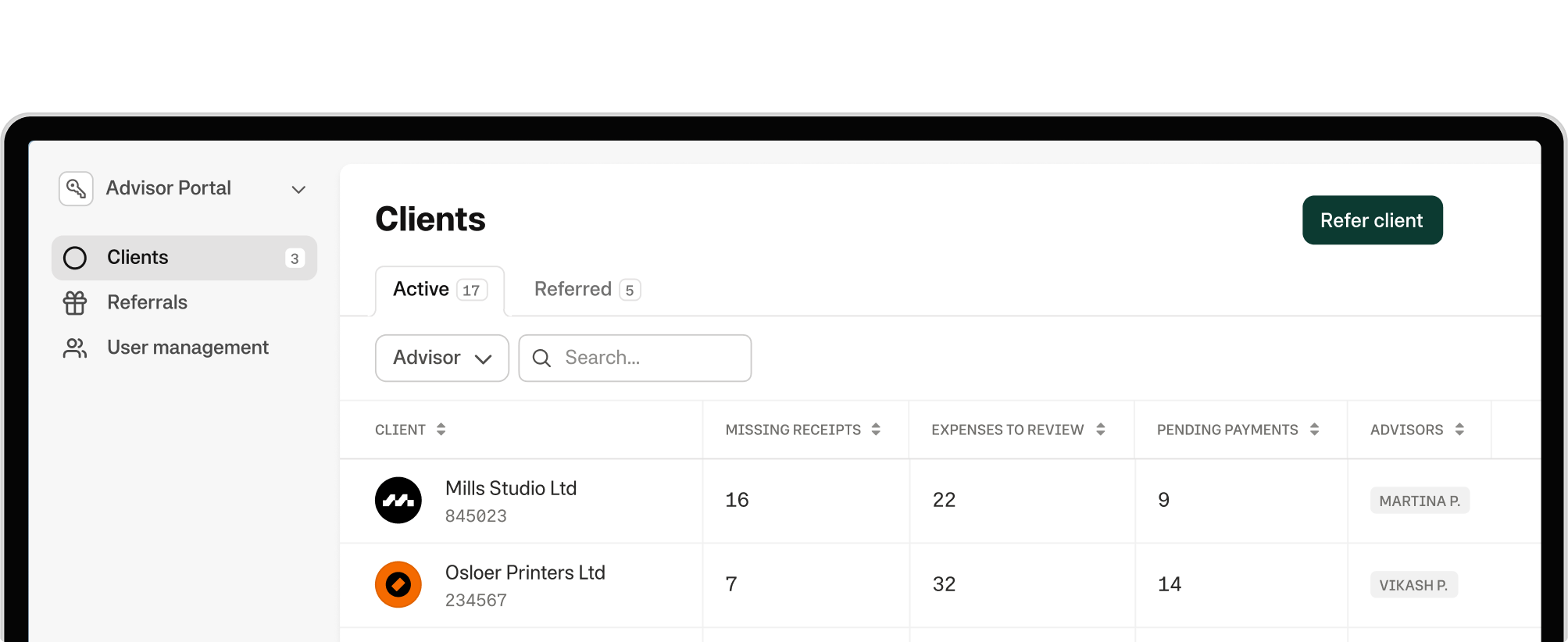

Are you an accounting firm?

Our free Advisor Portal helps firms manage external clients at scale and brings real value to your practice.

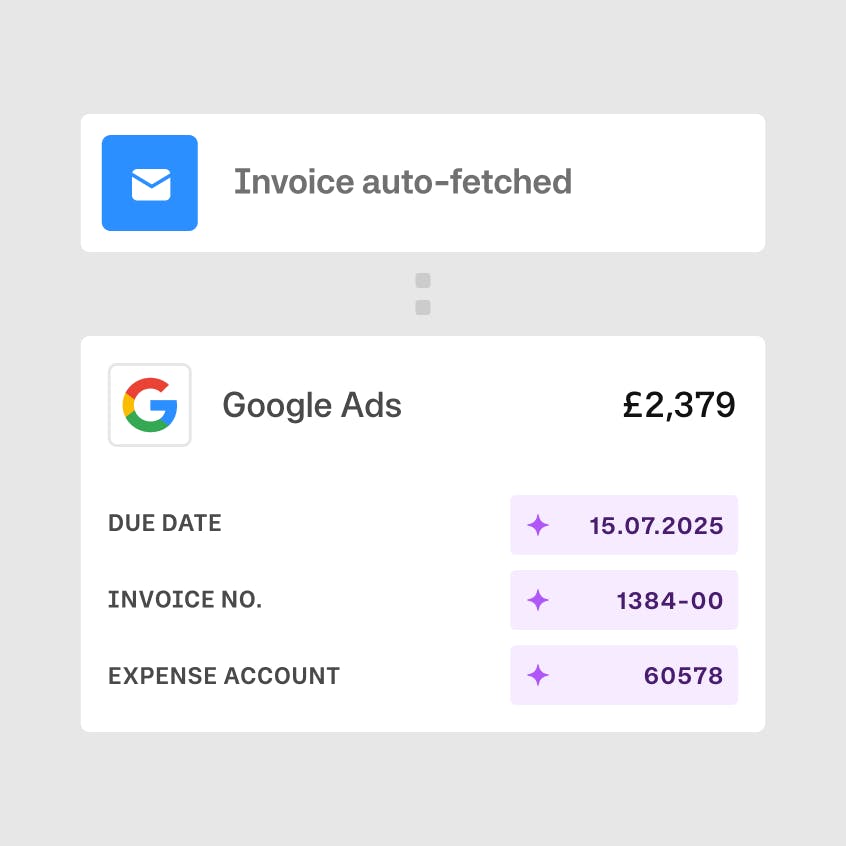

Accounting records built with automation

Moss turns card transactions and supplier invoices into complete accounting records, automatically adding categories, projects, and approvals.

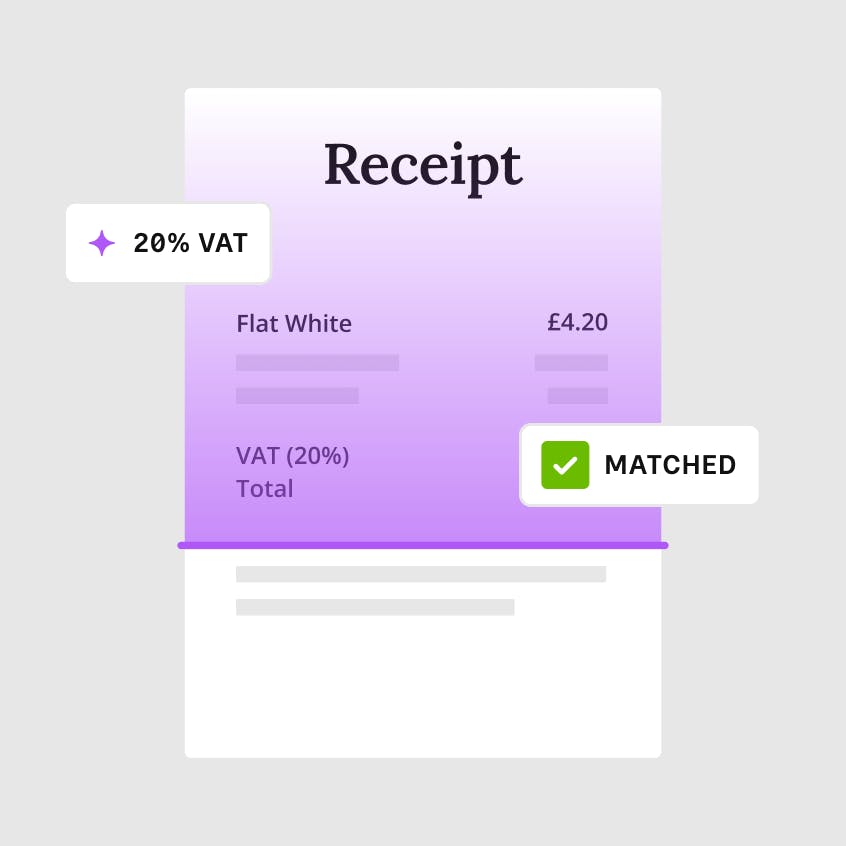

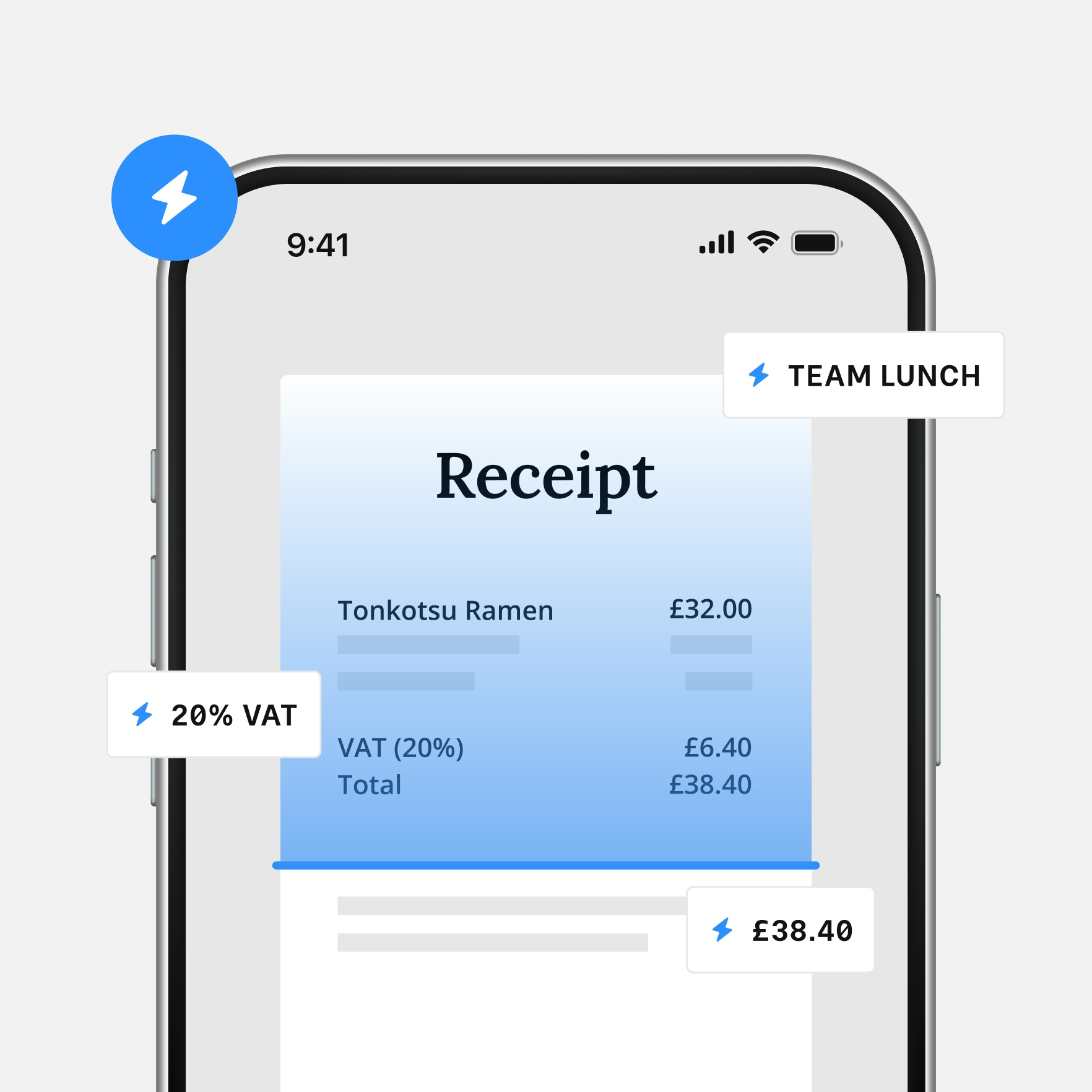

Receipts chased, found, and matched for you

Upload receipts by mobile, email, or desktop. Moss matches them directly to card transactions, flags what's missing and chases them for you.

Custom finance workflows, fully under your control.

Moss adapts to your needs with custom, rules, data fields, approval flows, and payment runs.

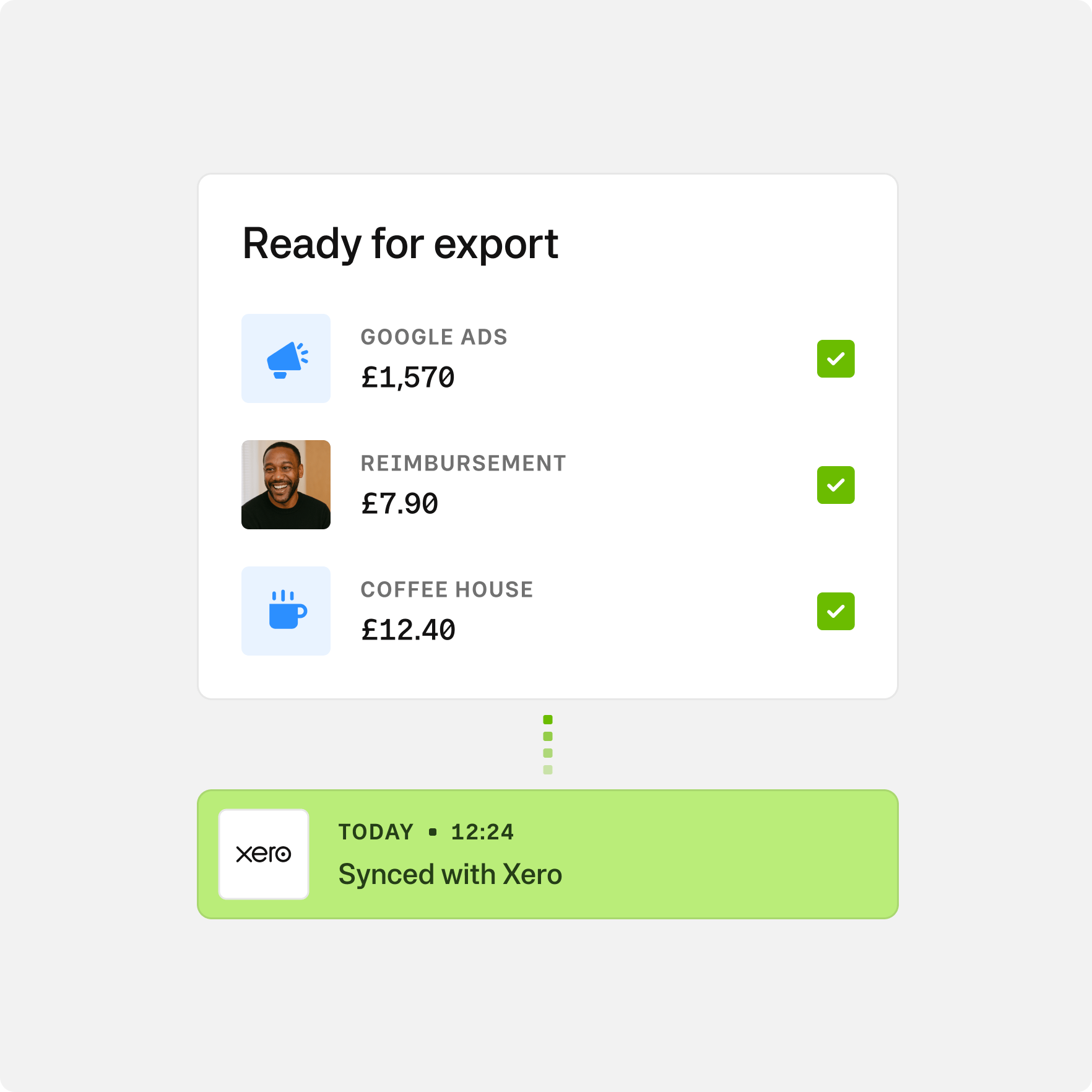

Integrations you can always rely on

Moss syncs reconciled transactions instantly with your accounting tools, while keeping master data up to date automatically.

The preferred expense management solution for modern SMB finance teams

“It doesn’t matter which country the transaction is from. We have one system for approvals, accounting export, and audit documentation.”

FAQ

What is Moss, and how does it fit into our finance tech stack?

Moss is a spend management platform that gives you corporate cards, invoice processing, supplier payments, and end to end accounting automation.

It captures and structures every transaction precisely, turning spend into complete accounting records automatically.

How does Moss automate accounting work?

Moss uses AI to extract, classify, enrich, and reconcile all spend data, from invoices to card transactions to reimbursements.

Receipts are chased automatically. Missing data is flagged.

By the time it reaches your accounting software, every record is complete, precise, and ready to by synced with your ledger.

Does Moss integrate with our accounting software?

Yes. Moss connects directly to tools such as DATEV, Xero, Quickbooks, Exact, NetSuite, and SAP B1.

Transactions sync as pre-reconciled, and accounting attributes stay up to date automatically.

Moss also connects to your HRIS, making user management, team setup, and permission control simple and consistent across your organisation.

Can Moss scale with us as our finance function grows?

Yes. Moss adapts to your structure and complexity.

Whether you are a small finance team with standard accounting needs or a larger organisation with multiple entities, cost centres, and bespoke reporting requirements, Moss scales with you, giving you exactly what you need, when you need it.

How does Moss help with receipts and missing documentation?

Moss uses AI to chase missing receipts, match uploads to card transactions, and flag anything still outstanding.

Receipts can be uploaded via mobile app, desktop, or email, and are stored with each transaction for audit-ready precision.

How secure and compliant is Moss?

Moss is an EMI regulated by BaFin in Germany and the FCA in the United Kingdom.

Moss is GoBD certified in Germany and ISO 27001 compliant.

All financial data is encrypted and processed in accordance with GDPR.

How long does it take to get started?

Most teams are onboarded in days. Moss imports your chart of accounts, syncs with your ERP or accounting tool, connects to your HRIS, and begins automating your workflows from day one.

Is Moss suitable for accounting firms and outsourced finance providers?

Yes. Moss offers a dedicated advisor portal for accounting firms, allowing you to manage all clients in one place and receive clean, coded, and complete spend data without manual clean up.

Explore more: Moss for Accounting Firms