Take charge of your company spend.

Less paperwork, but more control over spend, faster month-end, and more accurate reporting.

4.7 on G2

4.8 on Capterra

Trusted by 3.000+ businesses

Tailored spend workflows.

Real-time tracking of budgets across all spend, with approval and accounting tools tailored to your business and spend-specific flows.

1.

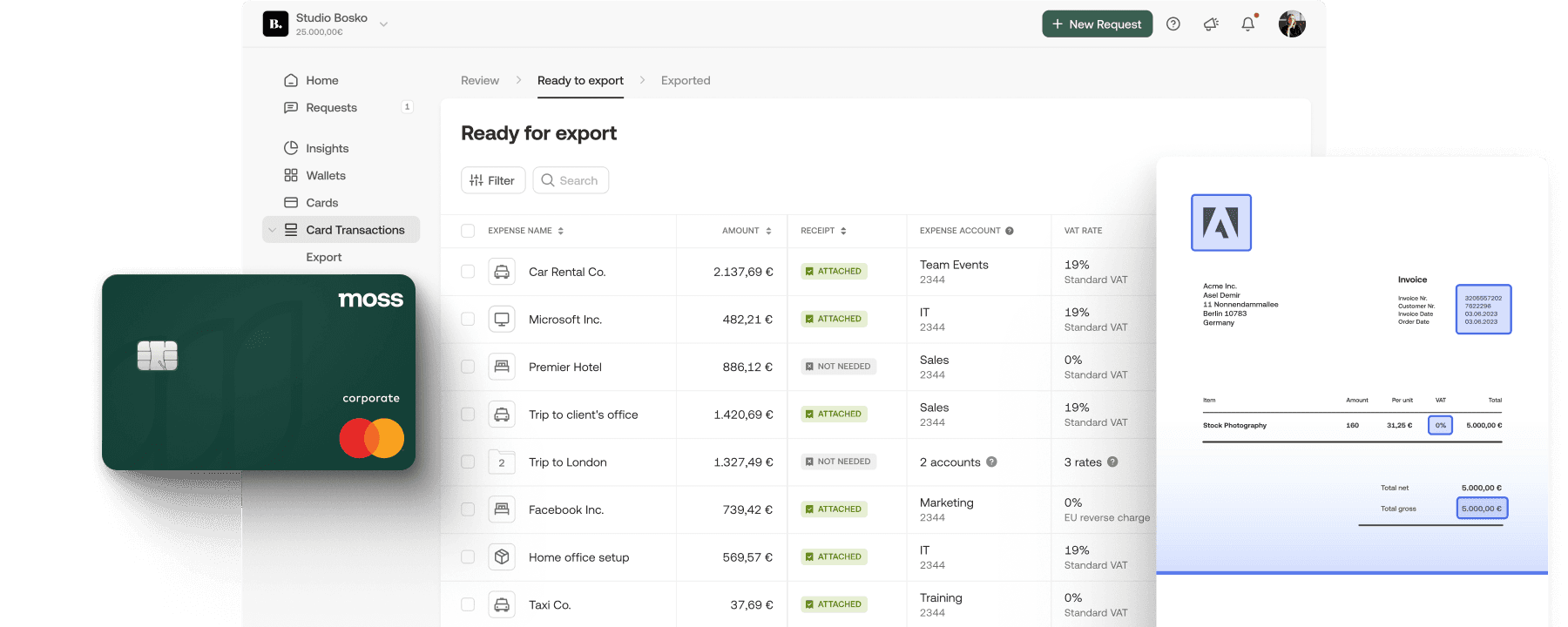

Card spend

Employee cards with complete spend control.

Issue cards with fully adaptable limits to any employee in just a click. Custom approval policies, along with optional reviews of each transaction, guarantee real-time oversight and control over all card spend.

2.

Receipt management

Finally, you can stop worrying about missing receipts.

Spenders can effortlessly capture receipts using our app, or Moss can auto-fetch them through Gmail and Outlook integrations. For finance and admin teams, one-click reminders and optional card blocking features streamline compliance enforcement.

3.

Month-end closing

Close the books on time, every time.

View card spend in real-time, automatically categorised and pre-coded for your review. And rely on our two-way integrations with leading accounting software, keeping your chart of accounts synchronised with Moss and enabling reliable exports.

“Having expenses, cards, and invoices all in one place has made it more efficient instead of using 3-4 different softwares. We’ve had an uptick in receipts actually being uploaded because it’s so easy to use.”

Tori Griffith, Finance Controller

The preferred spend management solution for modern SMB finance teams.

Report

Achieve a 4.5x ROI with Moss.

Our customers see a positive ROI in just 5 months of using Moss, and can reach 4.5x within 3 years by enhancing spend controls, replacing paperwork with time-saving automation, and consolidating all spend on one platform (IDC report).

4/5

expense report errors are auto-corrected.

47%

increase in finance team productivity.

27%

quicker employee reimbursement.

€795

saving per employee annually through improved efficiency.

*Read the full report on the value Moss can deliver for your business here.

Businesses save more with Moss.

Top-tier security without the red tape.

What’s important to you, is important to us. You’ll get unrivalled, end-to-end, hassle-free security for your money and data.

Privacy by design

The protection of personal data is our top priority. Moss processes all personal data in accordance with applicable data protection regulations, in particular the General Data Protection Regulation (GDPR).

Regulated & secure

All our card and e-money products are provided by regulated e-money institutions applying high regulatory standards regarding IT-security, payment execution and safeguarding of customer funds.